The Japanese yen recently collapsed against almost all major currencies, including the Euro. The BOJ interest rate decision this past week ignited an assault on the yen pairs. The EURJPY pair traded above the 141.00 resistance area and registered a new high of 141.38. The yen sellers are not willing to give up and that is the reason why more upside is likely in the EURJPY pair. There are a few risk events lined up during the London session, including the Euro zone manufacturing PMI. Let us see how the outcome shapes and affects the Euro pairs in the near term.

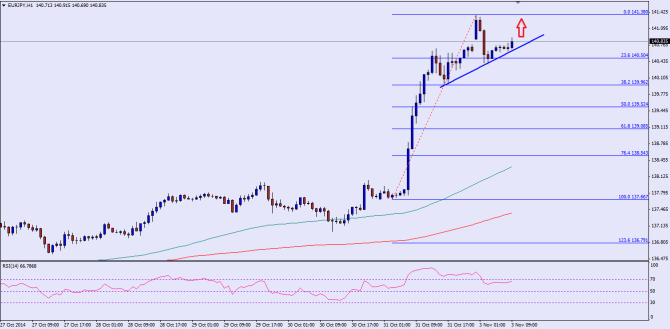

There is an important trend line formed on the hourly chart of the EURJPY pair, which is acting as a support for the pair. The pair after trading as high as 141.38 fell back towards the 23.6% fib retracement level of the last leg from the 137.66 low to 141.38 high. The mentioned fib level also coincided with the bullish trend line, which was the reason the pair bounced. The hourly RSI is moving lower from the extreme levels, which means the pair might correct a bit lower from the current levels. However, the mentioned bullish trend line might continue to support the pair. Only a break below the same would call for more losses in the pair moving ahead.

Alternatively, if the pair continues to move higher, then the last high of 141.38 could be tested again. If the Euro buyers manage to clear the same, then a move towards the 142.00 level might be on the cards.

Overall, one might consider buying dips around the highlighted bullish trend line.

————————————-

Posted By IKOFX Technical Team: Online Forex Broker