The Australian dollar showed some strength last week, gaining close to 100 points. AUD/USD closed the week at 0.7918. This week’s major events are NAB Business Confidence and the Annual Budget. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Australian dollar took advantage of a mixed NFP report and briefly rose above the 0.80 level. In Australia, employment numbers were weak and the RBA cut rates, as expected, to a record low of 2.0%.

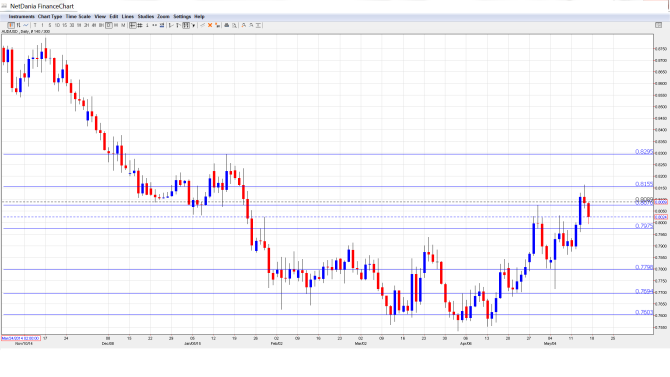

[do action=”autoupdate” tag=”AUD/USDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- NAB Business Confidence: Monday, 1:30. This is the key event of the week. The indicator jumped to 3 points in March, compared to zero points a month earlier.

- Home Loans: Tuesday, 1:30. Home Loans provides a snapshot of the level of activity in the housing sector. The indicator bounced back in February, posting a gain of 1.2%. However, this was well short of the estimate of 3.0%. Little change is expected in the upcoming release, with an estimate of 1.1%.

- Annual Budget Release: Tuesday, 9:30. The markets will be paying close attention to the annual budget, which outlines the government’s anticipated spending, borrowing and income levels. Traders should treat this release as a market-mover.

- Wage Price Index: Wednesday, 1:30. Wage Price Index is an important gauge of consumer inflation. The index has been very steady, posting gains of 0.6% for three consecutive readings. Another reading of 0.6% is expected in the March report.

- Chinese Industrial Production: Wednesday, 5:30. The Aussie is sensitive to key Chinese data such as Industrial Production, as the Asian giant is Australia’s number one trading partner. The indicator was unexpectedly weak in March, with a gain of 5.6%, well short of the forecast of 6.9%. The estimate for the April report stands at 6.1%.

* All times are GMT.

AUD/USD Technical Analysis

AUD/USD started the week at 0.7827 and dropped to a low of 0.7715, as support held at 0.7692 (discussed last week). The pair then climbed to a high of 0.8031, but was unable to consolidate at these levels and closed the week at 0.7918.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.8295, which has remained intact since mid-January.

0.8150 is the next resistance line.

0.8077 was an important resistance line in January.

0.7978 was a cap back in January 2007.

0.7799 has strengthened in support as the pair trades at higher levels.

0.7692 held firm as the pair lost ground before recovering.

0.7601 has remained firm since mid-April.

0.7528 is the final support level for now.

I am neutral on AUD/USD.

With the RBA continuing to slash rates, monetary divergence could weigh on the Aussie. US numbers have been lukewarm, but the markets are expecting the economy to improve in Q2 after a lackluster Q1.

In this week’s podcast, we take tips from Yellen, discuss commodity currencies and preview next week’s events

Subscribe to Market Movers on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZDUSD forecast.