The Australian dollar showed some volatility last week, and gained 100 points. AUD/USD closed the week at 0.8024, its first weekly closing above the 0.80 level since mid-January. There are 9 events this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Australian dollar took advantage of strong Australian data last week, as NAB Business Confidence and Home Loans beat expectations. It was a disappointing week for US releases, highlighted by soft US retail sales.

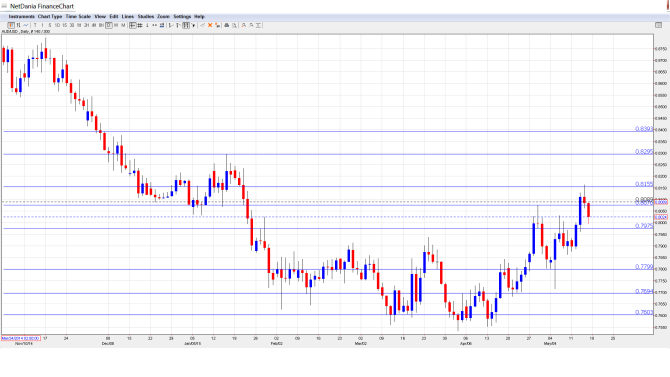

[do action=”autoupdate” tag=”AUD/USDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- RBA Deputy Governor Philip Lowe Speaks: Sunday, 23:30. Lowe will speak at event in Sydney. A speech which is more hawkish than expected is bullish for the Australian dollar.

- New Motor Vehicle Sales: Monday, 1:30. New Motor Vehicle Sales is an important gauge of consumer confidence, as an increase in demand for expensive durable goods points to a consumer who is optimistic about the economy. The indicator slipped to 0.5% in March. Will the indicator bounce back with a stronger reading in the April report?

- CB Leading Index: Tuesday, 00:00. This indicator is based on 7 economic indicators, but is considered a minor event since most of the data has already been released. The indicator has been steady in recent readings, and came in at 0.5% in the February release.

- Monetary Policy Meeting Minutes: Tuesday, 1:30. The minutes will provide details of the RBA policy statement, which was released earlier in the month. The markets will be looking for hints from the RBA over interest rate policy, and whether the Bank is contemplating further rate cuts.

- RBA Deputy Governor Philip Lowe Speaks: Tuesday, 23:15. Lowe will speak at an event in Sydney. The markets will be listening closely for clues regarding the RBA’s future interest rate policy.

- Westpac Consumer Sentiment: Wednesday, 00:30. This important indicator has been struggling lately, posting two consecutive declines. Will the indicator bounce back in the May report?

- RBA Assistant Governor Malcolm Edey Speaks: Sunday, 23:30. Edey will speak at an event in Melbourne. A speech which is more hawkish than expected is bullish for the Australian dollar.

- MI Inflation Expectations: Thursday, 1:00. Analysts rely on this indicator to track inflation, as consumer’s expectations often translate into actual inflation. The index improved in March, posting a gain of 3.4%.

- Chinese HSBC Flash Manufacturing PMI: Thursday, 1:45. The Australian dollar is sensitive to key Chinese data such as Flash Manufacturing PMI, as the Asian giant is Australia’s number one trading partner. The index continues to trade close to the 50-point line, which separates contraction from expansion. The April reading stands at 49.5 points.

* All times are GMT.

AUD/USD Technical Analysis

AUD/USD started the week at 0.7924 and dropped to a low of 0.7876. The pair then reversed directions, and shot up to a high of 0.8163, breaking above resistance at 0.8150 (discussed last week). However, the pair was unable to consolidate at these levels and closed the week at 0.8024.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.8393, which has held firm since December 2014.

0.8295 has remained intact since mid-January.

0.8150 was tested as the pair showed some strength late in the week before retracting.

0.8077 was an important resistance line in January.

0.7978 was a cap back in January 2007.

0.7799 has strengthened in support as the pair trades at higher levels.

0.7692 is the next support level.

0.7601 has remained firm since mid-April.

0.7528 is the final support level for now.

I am neutral on AUD/USD.

Despite the greenback’s losses to the Aussie last week, market sentiment remains positive about the US economy, with the Fed expected to tighten rates later in the year. The sharp monetary divergence between the US and Australia will likely continue to weigh on the Australian dollar.

In our latest podcast, we ask: USD: Glass half full or half empty? And also discuss other topics:

Subscribe to Market Movers on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZDUSD forecast.