- Australia’s business conditions barely changed in March.

- Investors have scaled back Fed rate-cut expectations since the March employment report.

- Economists expect a decline in US inflation in March.

The AUD/USD outlook looks up as the Aussie stands its ground following the latest data unveiling steady Australian business conditions in March. Meanwhile, the dollar was weak despite rising Treasury yields as investors cautiously awaited the US inflation report.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Australia’s business conditions barely changed in March as higher interest rates pressured the economy. Moreover, sales and employment held steady. However, companies remained concerned about the economic outlook as the Reserve Bank of Australia is not looking to cut rates soon. At the moment, markets are expecting the first cut around November.

Meanwhile, in the US, investors have scaled back rate-cut expectations since the March employment report revealed a still-hot labor market. Demand in the economy is still high. Therefore, any interest rate cuts by the Fed have to be timed well to avoid a spike in inflation.

Consequently, there is doubt in the market whether the Fed will start cutting interest rates in June. Moreover, markets now only expect 60 basis points of rate cuts in 2024.

The next major economic event in the US is the release of consumer inflation data. Economists expect a decline in inflation in March. However, these figures might also surprise to the upside. In such a case, rate-cut bets would decline further. Furthermore, investors would expect the first cut in July.

AUD/USD key events today

There are no key events from Australia or the US today. As a result, investors will keep speculating ahead of the US inflation report.

AUD/USD technical outlook: Bulls aim for a higher high to confirm recent breakout

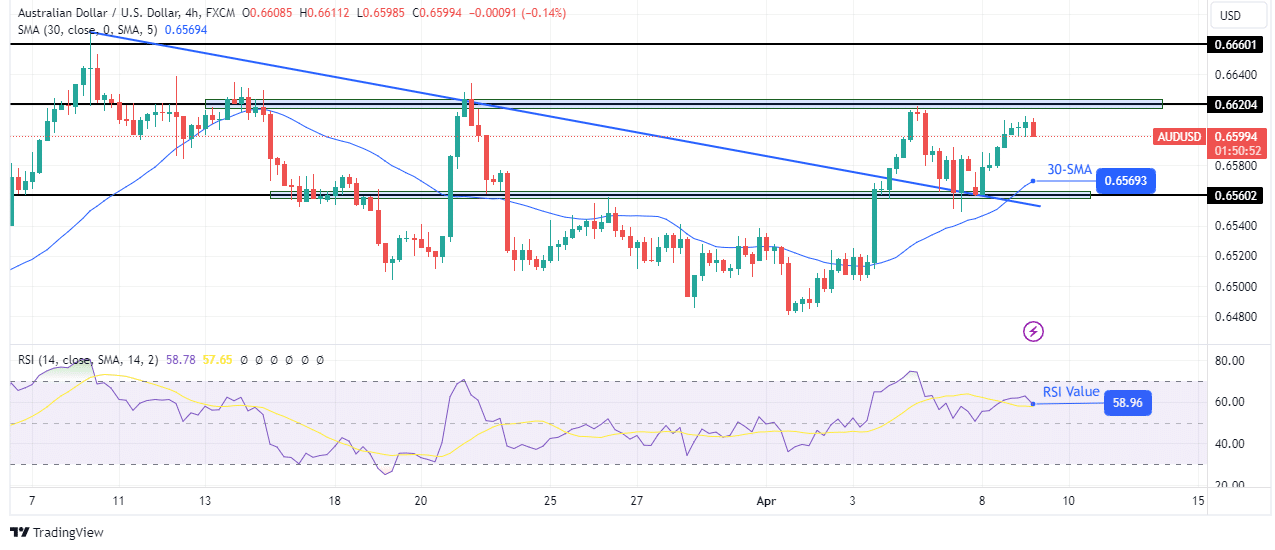

On the technical side, the AUD/USD price is bullish as it trades above a recently broken trendline. The trend recently reversed to bullish when the price broke above a resistance trendline. Moreover, it pulled back to retest the trendline and is now climbing.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Bulls must make a higher high above the 0.6620 critical resistance level to complete confirmation of the breakout. There is a high chance this will happen because the bullish bias is strong. The price sits far above the 30-SMA, and the RSI is in bullish territory above 50. Therefore, bulls might soon retest the 0.6660 key level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.