So, the Chinese crisis hurt the US dollar as the Fed is unlikely to hike in September. But the ECB could act as well.

So, is the EUR-rally over? The team at UOB have their say:

Here is their view, courtesy of eFXnews:

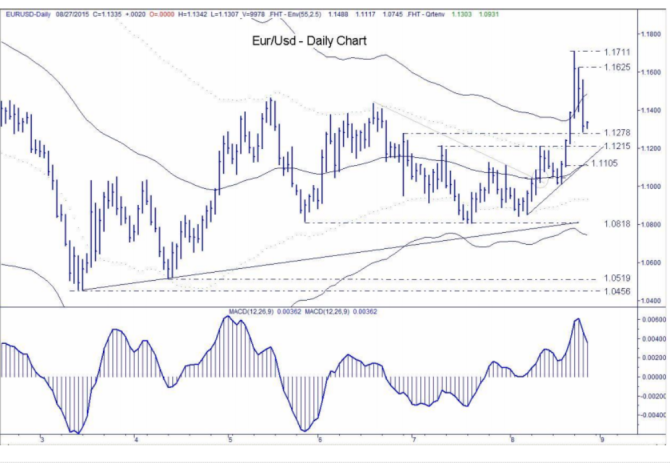

The bullish EUR phase that started last Friday has likely ended with the break below 1.1360 yesterday, argues UOB Group.

“The spike to the high of 1.1710/15 is likely a ‘blow-off’ and as we highlighted in our update yesterday, the odds for move to reclaim 1.1710/15 is rather low,” UOB adds.

“From here, we believe the current weakness is a corrective pull-back but in view of the large moves recently, the down-move could extend lower to test the major support at 1.1215 with an outside chance for a deeper drop to 1.1105. On the upside, strong resistance is at 1.1560 ahead of the now very strong resistance at 1.1625,” UOB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.