The greenback suffered a massive sell-off. Nevertheless, we have already noted some dollar bulls.

And here are more. The team at Bank of America Merrill Lynch explains:

Here is their view, courtesy of eFXnews:

Despite its recent sideways price action, Bank of America Merrill Lynch remains bullish and long USD/JPY.

“Evidence says that the bull trend of the past 4+ months is drawing to a conclusion and the long-term uptrend is set to resume for 124.59, ahead of 128.45,” BofA argues.

“Below 118.33 invalidates this view and points to continued range-trading, while those awaiting additional price confirmation need a break of 120.86 (the Apr-13 high),” BofA adds.

In line with this view, BofA maintains a long USD/JPY position with a stop at 118.32, and a target at 124.59.

Turning to EUR/USD, BofA notes that since mid-March, the pair has been caught in an increasingly well defined contracting range and while this range can persist for another week or two, it is nearing its conclusion.

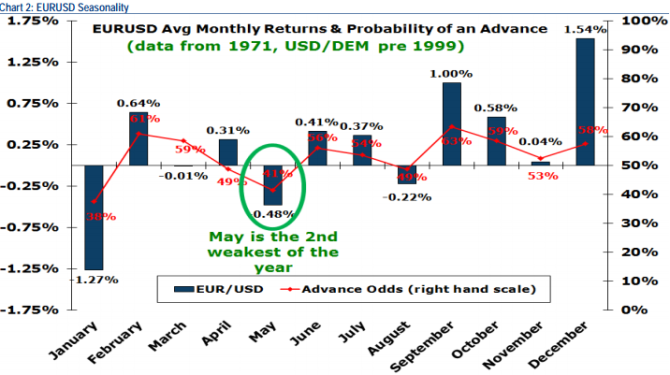

“Indeed price should not exceed 1.1000 and can’t exceed the Mar-26 high at 1.1053. With seasonality about to turn bearish (May is the second weakest month of the year for EUR/USD), its almost time to get short again,” BofA projects.

“GET READY. Downside targets are seen to 1.0283 ahead of parity. Below 1.0550/1.0521 (Triangle support & Apr-13 low) says the downtrend has resumed,” BofA advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.