Euro dollar is sliding in range, after recovering from a new year-to-date low. Last minute adjustments are made before another long weekend. The echoes of the weak Italian bond auction will likely be heard also in 2012.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

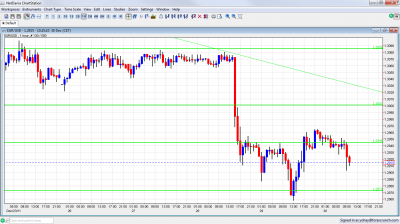

EUR/USD Technicals

- Asian session: Quiet session after the recovery from the new year-to-date lows. The slide began in the European session.

- Current range: 1.2873 – 1.2945.

- Further levels in both directions: Below 1.2873 , 1.2720, 1.2650 and 1.2580.

- Above: 1.2945, 1.30, .13060, 1.3145, 1.3212, 1.3280, 1.3380

- 1.2945 now switches to strong resistance, and the next big one is 1.3060.

- The break under 1.2873 proved fake. The new YTD low of 1.2858 was just a swing.

Euro/Dollar closing the year- click on the graph to enlarge.

EUR/USD Fundamentals – No Events for 2011 anymore

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Italy’s worrying auction: The euro-zone’s third largest country couldn’t raise the maximum amount of money and paid high prices once again. Yields didn’t rise, but at these levels, recycling debt will place Italy in a debt trap.

- Volume falling: While .all financial centers are open for business, trading volume is very low. January 3rd and January 4th are when the markets will return to full speed.

- Tensions rise around Iran: A recent law moving through the US congress aggravates Iran, which repeats its threat to close the Straights of Hormuz. These tensions send the price of oil up, and this weighs on the US dollar. Note that Mid-East violence could erupt in Syria, Lebanon and Israel rather than the Persian Gulf.

- US – more positive than negative: The last figures for the year were OK. Jobless claims ticked up, but the moving average continues falling. Pending home sales leaped for a second month in a row, creating hopes for a bottom in the housing sector.

- Despite optimism, Greek talks stuck: Greece’s bondholders are struggling to reach an agreement about the “voluntary” debt restructuring. Greek politicians are optimistic, but there’s no evidence of progress in the PSI deal. The pace of withdrawals from Greek banks intensified recently, as the chances of leaving the euro-zone rose. This Greek bank run could bring down the system.

- The day after the euro: Some financial institutions are already working on contingency plans for the day after the euro. Symbols such as ITL (Italian Lira), ESP (Spanish Peseta) and GRD (Greek Drachma) are revived in computer software systems, but there is no confirmation about printing the old money. There was one rumor about the Irish mints working on printing the Irish punt (IEP), but this was never confirmed.