Euro/dollar edged up on the last week of August, anticipating action from the ECB and also enjoying some dollar weakness. As volume and volatility return, the rate decision is the main event in a very busy week. Will Draghi turn strong words into action? A lot depends on Spain as well. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

In the US, Bernanke’s Jackson Hole speech had some dovish points such as calling the employment situation “grave” and justifying past QE. However, QE3 is far from certain and the Fed might opt for other types of monetary easing options on the next meeting. Expectations for a Spanish aid request rose after Catalonia’s aid request, that added pressure on the central government. Without an aid request, the ECB will not buy. However, we may have to wait for the German constitutional court’s decision on September 12th for that to happen. Nevertheless, the busy calendar promises a lot of action before that.

Updates: Spanish Unemployment Change pushed up 38.2 thousand, the first increase in five months. Euro-zone PPI rose 0.4%, above the estimate of 0.3%. The euro moved up after remarks by ECB head Draghi at a closed meeting were leaked, providing some details about the ECB’s bond buying plan, including an option to buy 3 year bonds – 3 years is also the length of the ECB’s LTRO. The euro has retreated, falling under the 1.26 line. EUR/USD was trading at 1.2594. German Services PMI slipped to 48.3 points, down sharply from 50.3 points last month. Spanish Services PMI came in at 44.0 points. Italian Services PMI posted a reading of 44.0 points, beating the forecast of 43.3 points. Euro-zone Final Services PMI disappointed, with a figure of 42.7 points. The market estimate stood at 42.7 points. Euro-zone Retail Sales declined by 0.2%, matching the forecast. It was the first drop for the indicator since June. The German 10-year Bond Auction disappointed, as only 3.61 billion euros were snapped up out of the 5 billion euros up for sale. The yield was unchanged at 1.42%. The euro has recovered and pushed upwards, as EUR/USD was trading at 1.2555. The ECB will announce its key interest rate level on Thursday. As expected by most analysts, the ECB held its key interest rate at 0.75%, and the euro has responded by moving higher. Euro-zone Revised GDP declined by 0.2%, matching the market forecast.The French 10-year Bond Auction posted a yield of 2.21%, down from the previous yield of 2.53%. The markets received a dose of positive news from German Factory Orders,which were up 0.5%, beating the forecast of 0.3%. The markets will be waiting for the release of details of the ECB bond-buying proposal. The ECB will be hosting a press conference later on Thursday, and ECB President Mario Draghi will deliver remarks in Potsdam, Germany. The euro is climbing, as EUR/USD was trading at 1.2642.

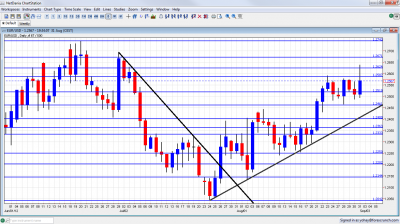

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Mario Draghi talks: Monday, around 13:30. The president of the ECB will have a chance to shed more light on the ECB’s upcoming rate decision in the European Parliament. He will probably find himself discussing the internal disagreement within the ECB. Jens Weidmann of the Bundesbank opposed bond buys, and there were reports that he considered tendering his resignation in protest, as his predecessor did.

- Spanish Manufacturing PMI: Monday, 7:15. Spain is the epicenter of the current crisis, making this forward looking indicator all important. In July, Markit showed a slightly slower contraction in Spanish manufacturing: 42.3 points. This is still depressing: a score under 50 represents economic contraction, and this has been the state since the spring of 2011.

- Italian Manufacturing PMI: Monday, 7:45. Italy has its own debt issues and needs to show improvement after recent GDP and employment data was very worrying. A small rise from the weak figure of 44.3 to 45 points could help.

- Final Manufacturing PMI: Monday, 8:00. Thanks to improvement in sentiment among German purchasing managers, the initial figure for the whole euro-zone stood on 45.3 points. This will likely be confirmed now.

- PPI: Tuesday, 9:00. Producer prices surprised to the downside in the past 4 months, with prices falling in the recent two months. More falls in prices will make it easier for ECB to cut rates. However, a correction with a rise of 0.3% is predicted now. It’s important to note that the ECB has a single mandate of price stability.

- Spanish 5 Year Bond Auction: Wednesday. Spain will test market sentiment with a bond auction which is not at the short end of the curve (where Draghi aims to buy bonds) and not at the benchmark 10 year bonds, but in the middle. The last auction resulted in a yield of 6.456%, and a lower yield will ease the pressure now, especially after Catalonia asked for aid, and saw its rating downgraded to junk.

- Italian 10 year bond auction: Wednesday, tentative. Italy saw an improvement in the latest 10 year bond auction. A yield under 6% will be considered OK, while a higher level will be worrying.

- Final Services PMI: Wednesday, 8:00. The services sector PMI slid to 47.5 points according to the initial figure. This will likely be confirmed now. Note that as with the manufacturing sector, PMIs will first be released in Italy and Spain, but these are less important after manufacturing data has already been published.

- Retail Sales: Wednesday, 9:00. While released after German data is already available, this figure is still of high importance. Germany disappointed with an unexpected drop in the volume of sales. After rising 0.2% last month, a drop of the same scale is expected now.

- Revised GDP: Thursday, 9:00. According to the initial estimation, the euro-zone contracted by 0.2% in Q2 after 0% in Q1. This will likely be confirmed now, after Germany confirmed its 0.3% growth rate.

- German Factory Orders: Thursday, 10:00. This gauge of the euro-zone’s locomotive is somewhat volatile, but still has a strong effect on markets. The volume of orders fell by 1.7% in June and could rise now by 0.3%.

- Rate decision: Thursday, 11:45, press conference at 12:30. The ECB will likely provide more details about the new bond buying scheme initially announced in August One interesting part is the seniority issue that was problematic in the Greek bond swap. Another is the question of sterilization: if the ECB drains out the money or not. The ECB isn’t expected to act immediately in the markets after the decision, as Spain isn’t in a hurry to submit an aid request. Another reason for the ECB to wait is the September 12th decision by the German constitutional court on the ESM. On this background of no action expected on the bond buying front, there are growing chances that the ECB will cut the interest rate from 0.75% to 0.50%, to help the struggling economies. This is far from certain though, so there’s more room for market action after the rate decision, in addition to the action around the press conference.

- Rajoy meets Merkel: Thursday. Spain’s prime minister Mariano Rajoy will host the German Chancellor Angela Merkel in Madrid on the same day when Draghi announces his decision. Will Rajoy use this opportunity to announce an aid request? Merkel can stand by him and give support. A month has passed since Spain stopped rejecting this option, but negotiations haven’t been fruitful since then.

- German Trade Balance: Friday, 6:00. Germany enjoys a wide trade balance that more than compensates for the deficit of the rest. This surplus grew to 16.2 billion euros in June to 16.2 and has likely squeezed a bit in July.

- French Trade Balance: Europe’s second largest economy had a deficit of 6 billion euros in July and likely saw a squeeze in this deficit now.

- German Industrial Production: Friday, 10:00. Similar to the factory orders figure, industrial output is also quite volatile. After a rise of 1.7%, production fell by 0.9% last month. A small gain is likely now.

* All times are GMT

EUR/USD Technical Analysis

€/$ traded in a relatively narrow range throughout most of the week, falling short of the 1.2587 line it challenged last time, and at times held above the 1.2520 line (mentioned last week). Later on, the pair fell a bit lower only to make a sharp rise and challenge the 1.2624 line before retreating.

Technical lines from top to bottom:

The very round 1.30 line is a very important line in case of huge rally. In addition to being a round number, it also served as strong support. 1.29 is also notable on the upside, followed by 1.2814.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is now of higher importance. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

1.2624 is the previous 2012 low and remains important as also seen at the end of August, when it served as resistance. Below, 1.2587 is a clear bottom on the weekly charts but after holding the pair down for a while, it was eventually run through.

1.2520 had an important role in holding the pair during June, in more than one case, and it became stronger in August. 1.2460 is the next minor line of support after providing a cushion for the pair in August.

It is closely followed by 1.24 that provided some resistance in June 2010 and switched to resistance in July. It is now of higher importance after capping a recovery attempt at the end of July and also at the beginning of August. 1.2360 was temporary support in July 2012 but quickly switched to resistance. It is minor now.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. It’s stronger after working as strong support. It should be closely watched if the pair falls. 1.2250 proved to be significant support for the pair in August 2012 and is key support now.

1.22 is now a more serious support line, after serving as such in June 2010. 1.2144 is already a very strong line on the downside: it was a clear separator two years ago, when Greece received its first bailout. Also in July and August 2012, it worked as a separator.

The new 2012 low of 1.2043 is the next line, although it may prove to be weak on a downfall. Next we have the 1.20 line, which is a round psychological figure.

Uptrend Support Getting Closer Again

An uptrend support line can be seen on the chart. After bouncing off the line last time, the line slowly got closer to the pair that remained stable in range.

I turn from neutral to bearish on EUR/USD

With tensions rising within the ECB, we might get more details from Draghi but action, including a Spanish request, will probably all wait for after the German constitutional court approves the ESM bailout fund. Data from Europe remains generally weak.

In the US, we could get more positive signs from the job market, lowering expectations for QE3. Without a threat of recession, it’s hard to see more QE. The picture might all change in the following week, but for now, there’s more on the downside in a week packed with many moving parts.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast