Euro/dollar made impressive gains as the prospects for a Spanish solution rose once again. Can we expect a surge now? Or will optimism prevail? A major German survey and an important Italian bond auction among other events will close the month, as eyes remain on Spain and also on Greece. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Optimism began with a report about potential details of ECB bond buys and significantly strengthened as one German ECB member, Asmussen, backed the ECB’s bond buying ideas. As he is close to Merkel, this is practically a German approval. The result was a surge in the euro. Adding reports about negotiations between Spain and its euro peers regarding a solution and the new hopes of QE3 in the US, and you get a huge rally that woke markets.

Updates: The euro got a boost from a positive GfK German Consumer Climate release. The key indicator posted a reading of 5.9 points, beating the market forecast of 5.8 points. Euro-zone M3 Money Supply looked sharp, climbing 3.8%, as it easily exceeded the estimate of 3.3%. Euro-zone Private Loans were up 0.1%, above the forecast of a 0.1% decline. EUR/USD was trading at 1.2547. German Preliminary CPI will be released throughout Wednesday. Italian Retail Sales surprised the markets, posting a modest gain of +0.4%. The market estimate stood at -0.1%. ECB head Mario Draghi is a surprise no-show for the Jackson Hole meeting of central bankers, citing a “heavy work schedule“. EUR/USD is trading in a narrow range, as the pair was trading at 1.2558. German Unemployment Change disappointed, as the unemployment rolls swelled by an additional 9,000 people. The markets had forecast a gain of 7K. Euro-zone Retail PMI dropped, posting a reading of 44.4 points. The markets cheered the Italian 10-year Bond Auction, which saw yields drop to 5.82%, down from July’s 5.96%. The markets are eagerly awaiting remarks from Fed Chair Bernanke in Jackson Hole on Friday, as speculation about QE continues. The euro continues to be rangebound against the dollar, as EUR/USD was trading at 1.2546.

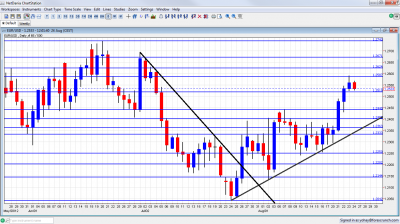

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Import Prices: Publication time unknown at the moment. Prices of imported good eventually impact consumers. Germany’s levels of inflation have a strong influence on the ECB’s rate decisions and the euro. Prices fell for the past three months, with a sharp drop of 1.5% last month. A small rise is likely now.

- German Ifo Business Climate: Monday, 8:00. Germany’s No. 1 Think-tank showed declines in confidence in the past 3 months. From the score of 103.3, another drop is predicted. This survey of 7000 businesses and the accompanying statement from IFO’s chief Hans-Werner Sinn have a strong impact on the euro.

- GfK German Consumer Climate: Tuesday, 6:00. This survey of consumers has been showing a rather stable picture of late, with a small rise from 5.8 to 5.9 points last time. A similar number is expected now in this 2000 strong survey.

- M3 Money Supply: Tuesday, 8:00. The amount of money in circulation is growing at a faster rate than at the turn of the year: 3.2% year-over-year according to last month’s data. This is partially the result of the massive LTRO’s. A small deceleration is predicted now. A big rise would limit the ECB’s potential QE blitz.

- German CPI: Wednesday. Germany’s states release their initial inflation estimates during the day. Last month saw a rise of 0.4% after two months of drops in prices. No big change is expected now.

- Italian 10 year bond auction: Thursday. Italy had two bond auctions that resulted in a yield of under 6% recently, but at 5.96% last time, Italy’s fund raising abilities are still questionable. 10 year bonds are considered the benchmark. A result of over 6% will prompt speculation that Italy will be forced to seek aid.

- German Unemployment Change: Thursday, 7:55. After many months of drops in unemployment, Germany saw a streak of 3 consecutive months of rises. A small drop, similar to last month’s 7K rise, is likely now.

- Retail PMI:Thursday, 8:00. This survey of purchasing managers in the euro-zone’s largest economies, Germany, France and Italy, is another way of measuring how consumers are acting. The indicator has been in contraction zone (under 50 points) for the past 9 months. No change is likely now, and the figure could even drop from last month’s 46.4 points.

- Italian unemployment rate: Friday, 8:00. The situation in Italy’s labor market has deteriorated rapidly in the past year: from an unemployment rate of 8.1% last June to 10.8% this year. Another rise in the unemployment rate is expected in the euro-zone’s third largest economy. The rise in unemployment is going hand in hand with Italy’s fast contraction. Italy will also publish the quarterly unemployment level, which will leap from the 9.8% rate seen in Q1.

- CPI Flash Estimate: Friday, 9:00. Inflation in the euro-zone stood on 2.4% in the past three months, just above the ECB’s 2% target. Expectations for a slide later on the year have allowed the central bank to cut the rate. A small slide in inflation is predicted now.

- Unemployment Rate: Friday, 9:00. After reaching 10% at the beginning of 2010, euro-zone unemployment stayed around this figure until late 2011. Since then, it deteriorated and rose steadily, reaching 11.2% last month. Another depressing rise in unemployment is expected now, as the situation is now worsening in many countries.

- Mario Draghi talks: Saturday, 16:25. This event happens on a Saturday, but it’s certainly worth mentioning. Draghi will speak at Jackson Hole following a speech from Bernanke on the previous day. Draghi will have the chance to lay out more details about the upcoming bond buying blitz after internal committees worked on it. Also Spain’s conditions could be mentioned somehow. In general, markets want to hear that Draghi will act at the ECB meeting on September 6th.

* All times are GMT

EUR/USD Technical Analysis

€/$ started the week with capped under the 1.2360 line (mentioned last week), before bouncing off uptrend support and making big gains. It first settled under 1.2440 before surging higher. 1.2587 provided a strong cap.

Technical lines from top to bottom:

The very round 1.30 line is a very important line in case of huge rally. In addition to being a round number, it also served as strong support. 1.29 is also notable on the upside, followed by 1.2814.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is now of higher importance. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

1.2623 is the previous 2012 low and remains important despite recent battles over this line. Below, 1.2587 is a clear bottom on the weekly charts but is only a minor line now.

1.2520 had an important role in holding the pair during June, in more than one case, but it’s much weaker now. 1.2440 provided support for the pair at the same time. and worked as double bottom.

It is closely followed by 1.24 that provided some resistance in June 2010 and switched to resistance in July. It is now of higher importance after capping a recovery attempt at the end of July and also at the beginning of August. 1.2360 was temporary support in July 2012 but quickly switched to resistance. It is minor now.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. It’s stronger after working as strong support. It should be closely watched if the pair falls. 1.2250 proved to be significant support for the pair in August 2012 and is key support now.

1.22 is now a more serious support line, after serving as such in June 2010. 1.2144 is already a very strong line on the downside: it was a clear separator two years ago, when Greece received its first bailout. Also in July and August 2012, it worked as a separator.

The new 2012 low of 1.2043 is the next line, although it may prove to be weak on a downfall. Next we have the 1.20 line, which is a round psychological figure.

Uptrend Support Proved its Strength

An uptrend support line can be seen on the graph. Another slide towards this line provided an excellent test. The pair is now far from this line, but it could be tested on a new fall.

I turn bullish to neutral on EUR/USD

After the big gains, there is some room for correction, especially as worries about Greece (which doesn’t rule out selling islands) weigh on the euro. On the other hand, optimism about Spain will likely prevail and a formal Spanish request could trigger a rally.

In the US, expectations are higher for QE3, but there are many reasons to doubt that this will be the outcome for September’s meeting. Just before markets close on Friday, Ben Bernanke could pour a lot of cold water on these expectations and strengthen the greenback, balancing ans Spanish optimism.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast