Euro dollar falls and tests levels last seen in 2010 as fear moves from Italy and Spain to Germany and France. Each country has specific issues, but they are all related to the inability to rebuild trust. Today we have 3 major indicators for the Non-Farm Payrolls on Friday.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

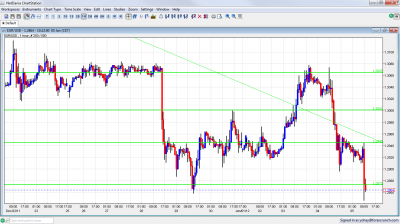

- Asian session: Quiet session saw consolidation losses under the 1.2945. The European session saw a temporary drop under the 2011 low of 1.2858.

- Current range: 1.2873 to 1.2945.

- Further levels in both directions: Below 1.2873 , 1.2720, 1.2650, 1.2580 and 1.24.

- Above: 1.2945, 1.30, .13060, 1.3145, 1.3212 and 1.3280.

- 1.2945 makes the full turnaround to resistance.

- The first move break under 1.2873 proved false but it could succeed this time.

Euro/Dollar losing New Year gains- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Retail Sales. Exp. +0.2%. Actual 0.9%. The first German problem.

- 10:00 Euro-zone Industrial New Orders. Exp. +2.4%.

- 10:00 Euro-zone PPI. Exp. +0.1%.

- 10:10 French bond auction results. Update: Results are OK – France covered the projected amount, bid to cover was OK, and yields were similar to last time. This doesn’t stop the fall.

- 12:30 US Challenger Job Cuts. Only a minor hint.

- 13:15 US ADP Non-Farm Payrolls. Exp. 176K. First hint.

- 13:30 US Unemployment Claims. Exp. 375K. Second hint.

- 15:00 US ISM Non-Manufacturing PMI. Third hint, important after the positive manufacturing figure.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Deutsche Bank at risk: After Germany’s second largest bank, Commerzbank, saw rumors of nationalization, there are now rumors about No 1. The core of the core cannot fully avoid the debt crisis, and its banks are no different. Germany had a mediocre bond auction yesterday.

- France auctioning bonds before the downgrade: France will try to raise money in long term bond auctions. A credit rating downgrade for the euro-zone’s No. 2 economy could come any day now. It could be the last chance to raise money at AAA. France might lose two notches.

- Spain might need help for banks: After acknowledging that the deficit for 2011 is closer to 8% than 6%, there are reports that the new government might ask for help from the IMF or the EU to help its banks. Spanish banks are thought to overvalue real estate property values.

- Italy doesn’t want help: The technocrat PM Mario Monti said that approaching the IMF would be bad for the euro-zone’s third largest country. The echoes from a bad bond auction in which Italy paid high prices once again are still heard. 10 year yields are under 7%.

- Another summit: The leaders of Germany and France plan to meet on January 9th and take new steps to fight the debt crisis. A wider summit is planned for January 30th. Merkel and Sarkozy have new steps in mind.

- Iran challenges the US: The Islamic Republic warned the US that passing an aircraft carrier through the Straights of Hormuz might trigger action. This supports oil prices and this weighs on the US dollar.

- US Manufacturing provides optimism for NFP: The ISM figure not only exceeded expectations but boasted strong growth in employment. This provides hope for a strong Non-Farm Payrolls result on Friday, although the services sector is more important. We will get this data, together with ADP and jobless claims (which have been on the fall) today. Note that after the drop in the unemployment rate to 8.6%, also this figure will be important tomorrow.