2015 is nearing its end and it’s time to look at closing levels.

The team at Nomura makes its assessment:

Here is their view, courtesy of eFXnews:

In a note to clients today, Nomura discusses its outlook for EUR/USD heading into year-end outlining its targets, and trading strategy.

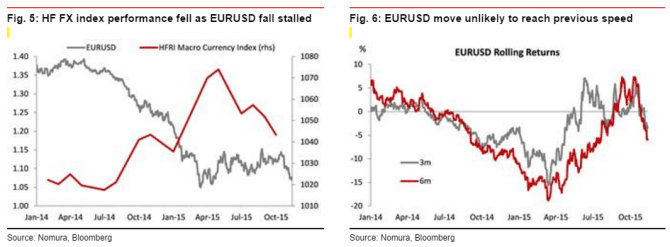

“EURUSD moved from 1.40 to 1.05 in about 10 months (from May 2014 to March 2015). Since then, we have traded in a 1.05-1.15 range for about eight months.

Going forward, we think 1.05 could be tested relatively soon (before year-end), and a break may generate some technical acceleration to the downside,” Nomura projects.

However, Nomura doesn’t anticipate a prolonged trending move with a steep slope, a la early 2015 in light of the following 2 reasons.

“First, investors have been burned on overly bearish EUR views in recent quarters. FX hedge fund performance is a good example.

Second, the extreme fixed income outflows from the Eurozone (which peaked in H2 2014) may be hard to repeat, especially given that both US credit markets and EM assets more generally are trading in a way that it is hardly bullish and conducive to broad-based inflows. Even the US equity market, is not attracting any clear waves of foreign inflows, although FDI into the US is strong,” Nomura clarifies.

“All these factors point to a more grinding Euro move, although that may also speak to a more durable trend. Trading strategies should be constructed with this in mind,” Nomura argues.

Bottom line for the short term: “All told, this means that we can test 1.05 in EURUSD on or before the date of Fed liftoff (i.e., December 16). The ECB meeting may not deliver a huge additional impulse compared with its October meeting (as QE extension and a lowering of the deposit rate of at least 10bp is already priced),” Nomura projects.

Trading strategy:

“We have been short EURUSD since 20 September, in the form of 1.13-1.10 put spreads, which are expiring on 18 December. This position has low delta at this point, but it benefits from positive decay, and we are inclined to keep it, to maximize the payout.

We would also look to enter fresh spot exposure (short EURUSD) on any spikes toward the 1.08-1.0850 level,” Nomura advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.