The euro often seems to be living in its own world, but risks are certainly out there.

The team at Goldman Sachs explains the potential misfortune for the pair:

Here is their view, courtesy of eFXnews:

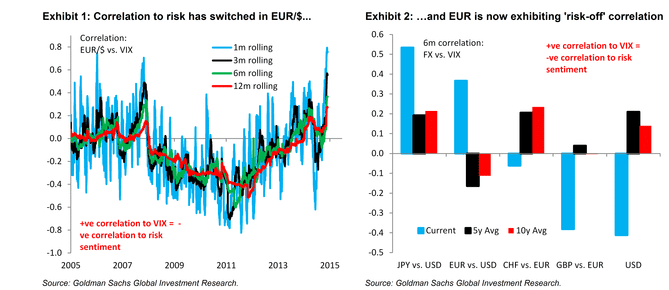

Since the beginning of the year, EUR/USD has exhibited an increasingly negative correlation to risk sentiment: in particular, when risk sentiment deteriorates in ‘risk-off’ periods, the EUR rallies, notes Goldman Sachs.

This, according to GS, has been an important feature of the recent behaviour of the EUR, and has made the path of the EUR volatile since its sharp decline in the early part of the year.

In a note to clients, GS discusses the causes of this correlation, evaluating its potential persistence and where does leave the path and targets of EUR/USD over the coming months.

EUR/USD & Risk Correlation: What’s Going On?

1- “There has been much speculation about the cause of this correlation, for example: liquidation of short EUR positions as overall risk is reduced, a reversal of short EUR vs EM FX carry trades, or an unwinding of EUR hedges by investors in European equities,” GS notes.

2- “Although each may play a part, back in April we described how a currency can exhibit negative risk correlations when under the influence of very easy monetary policy – in particular low rates, forward guidance and quantitative easing. This was a feature of the behaviour of the USD between 2010 and 2013, and may go some of the way to explain the behaviour in EUR/$ over the summer,” GS adds.

3- “The flipside of this is that the USD – at least vs the EUR – has become more of a ‘risk-on’ currency. Given the focus on Fed policy and the data dependency of monetary policy, this is also intuitive, as better data support both risk sentiment and the USD through expectations of tighter policy, and vice versa,” GS notes.

4- “While the EUR may be exhibiting a negative correlation to risk sentiment, in our view it falls short of being a safe-haven currency. We do not see strong evidence that the EUR has benefited from genuine ‘safe-haven’ flows into fixed income,” GS argues.

EUR/USD & Risk Correlation: What’s Next?

5- “Finally, while the EUR may continue to exhibit this negative risk correlation over short periods, we do not see this as an impediment to our negative EUR/$ view – renewed ECB easing and Fed tightening should be the guide to the next move in EUR/$,” GS adds

6- “Even as day-to-day and short-term risk-off correlations in the EUR persist, there should be no obstacle for renewed ECB easing to push down further on EUR/$. We expect any additional ECB easing, first by increasing the length of the sovereign bond purchase program in coming months, to help drive the EUR to 0.95 vs the USD over the next 12 months,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.