I see that the markets have gone crazy last week, with EURUSD turning up almost 600 pips. Some traders can be making good bucks in this environment, but I am afraid that those with small accounts are losing it, so make sure to trade micro lots if your account is small. You need to protect your money with risk management!

You are probably wondering what those reversals mean; “Are bears on EURUSD done and we go impulsively up, Or, is this just another big corrective rally?” Well, put it this way; the big trend is down, the rally from the low is not impulsive, and also what are the chances to be correct with calling a multi-year low? I guess chances for that are very small, so I suspect that the rally on EURUSD is just corrective move as part of a downtrend. Please make sure to check our latest daily charts.

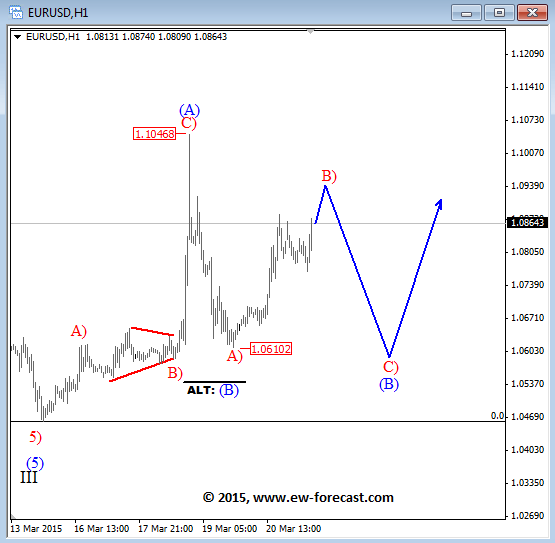

With that said, I am looking at EURUSD as an incomplete corrective bounce from the lows. I will be tracking a three wave rally with subwave (B) now underway, so I suspect the pair will move through 1.1050 with a “failure” breakout before turning down. I am pretty sure that a lot of traders loaded new shorts after the spike was visible, so would not be surprised to see those levels hit once more before we go down again.