After outstanding gains in the month of May, the British pound reversed sharply last week, losing about 250 points. The pair closed at 1.5472. This week’s highlight is Second Estimate GDP. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

UK inflation fell below 0%, to 0.1%. Also other inflation measures fell short of expectations. On the other hand retail sales jumped by 1.2%, better than predicted. Yet all in all, sterling had a bad week, One of the reasons was the recovery of the greenback, fueled by elevated rate hike expectations. What’s next for cable?

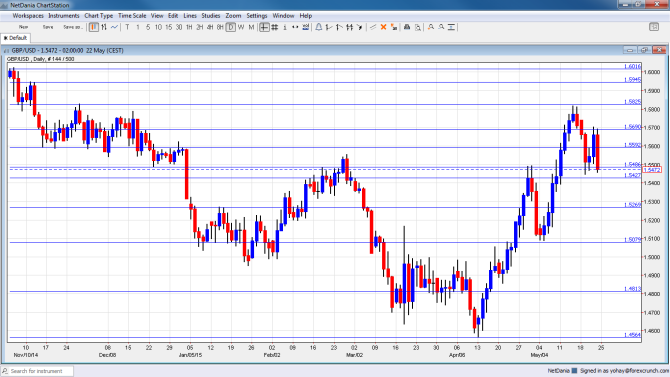

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CBI Realized Sales: Tuesday, 10:00. This index, based on retailers and wholesalers, has shown significant volatility in 2015. The indicator dropped to 12 points in April, down from 18 points a month earlier. This figure was well off the estimate of 26 points. The markets are expecting a strong turnaround in the May report, with an estimate of 21 points.

- Second Estimate GDP: Thursday, 8:30. Preliminary GDP for Q1 came in at 0.3%, shy of the forecast of 0.5%. Little change is expected in the Second Estimate GDP for Q1, with a forecast of 0.4%. An unexpected reading to this key indicator could have an strong impact on the direction of GDP/USD.

- Preliminary Business Estimate: Thursday, 8:30. After a streak of four consecutive gains, the indicator has sagged, reeling off two straight declines. The Q4 reading showed a decline of 1.4%, well of the estimate of a 2.0% gain. The markets are expecting a strong turnaround, with the estimate standing of 1.1%.

- GfK Consumer Confidence: Thursday, 23:05. Consumer Confidence is an important indicator, as stronger consumer confidence usually translates into increased consumer spending, which is critical for economic growth. The indicator has been steady, posting two straight readings of 4 points. The same reading is expected in the May report.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5738, which was also the high of the week. The pound plunged all the way down to 1.5445, testing support at 1.5459 (discussed last week). The pair closed the week at 1.5492.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

1.60 is a round line and also played an important line in the past. 1.5945 capped the pair on a recovery attempt in late 2014.

1.5825 stopped the pair at the same time and also in its recent surge in May. Below, 1.5690 provided support to the pair and then turned into resistance in the turn of the year.

1.5590 worked as support late in 2014 and is a pivotal line in the current range. 1.5485 worked as support and later switched to resistance in April. It is closely followed by 1.5425 which had a role in the past.

1.5350 worked as resistance in January and was a stepping stone on the way up later on. 1.5270 capped the pair early in the year.

Below, 1.5080 served as support in May and is the last level before the round 1.50 level.

I am neutral on GBP/USD.

With the pound posting tremendous gains in the month of May, we could be in for a downward correction. Sentiment over the US economy remains strong, as Q2 is expected to be much stronger than Q1. Still, the British election results are good news for the pound, as the new majority government will have the political muscle to take steps to boost the UK economy.

In our latest podcast, we discuss commodity currencies, oil hedging and preview next week’s events.

Subscribe to Market Movers on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZDUSD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar.