EUR/USD has been on a roll, reaching almost 1.1450 before consolidating its gains. What’s next for the world’s most popular currency pair?

Kit Juckes from SocGen explains:

Here is their view, courtesy of eFXnews:

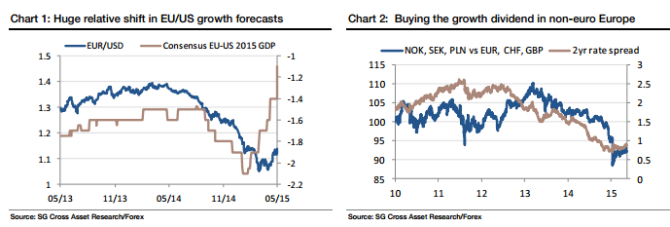

“Soft US data and the rise of the 10yr Bund yield above 70bp are undermining the dollar and supporting the euro. EUR/USD models based on rate differentials and peripheral spreads still point to an uptrend, and we are loathe to fight them. Oversold positions in commodities and the euro as well as overbought positions in bonds and the dollar are still being unwound.

…We prefer looking to benefit from the dramatic narrowing in the consensus forecasts for 2016 GDP growth by shorting the euro against European currencies that may gain more traction from the improving growth outlook. Short EUR versus NOK, SEK, PLN appeals, but we recommend a more balanced basket that is long those three against the EUR, CHF and GBP.

The performance of the basket is shown in Chart 2 along with the relative rate differential (2-years). This is a basket that works in a ‘risk-on’ world but might perform best of all in a ‘risk-on’ world where the euro is being weakened by ECB policy and investors are looking for more yield.”

Kit Juckes – SocGen

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.