Introduction: The underlying concept of Inside Bar Breakout Trading Strategy is based on the process of accumulation and distribution which is also known as consolidation at key support and resistance areas respectively by big players and then the breakout thereof.

This article comprehensively deals with the various aspects of trading breakouts of Inside Bars from a daily chart perspective. Hence wherever we mention of an “Inside Bar” in this article, it essentially means an “Inside Day”.

It is one of the simplest but an outstanding strategy if traded with proper guidelines.

Guest post by Anatasius from www.dnbforexpriceaction.com

Meaning

An inside bar is said to have formed when entire bar’s price action range i.e.: Open, Low, high and close takes place within the high and low of the previous bar/day. To put it in more simple words, we say, an inside bar is in place when the highest price is lower than the preceding bar’s high, and the lowest price is higher than the preceding day’s low. The Inside Bar Breakout Strategy gets the distinction mainly due to the simplicity of application and huge reward it offers compared to the amount of risk undertaken.

Anatomy of an Inside Bar

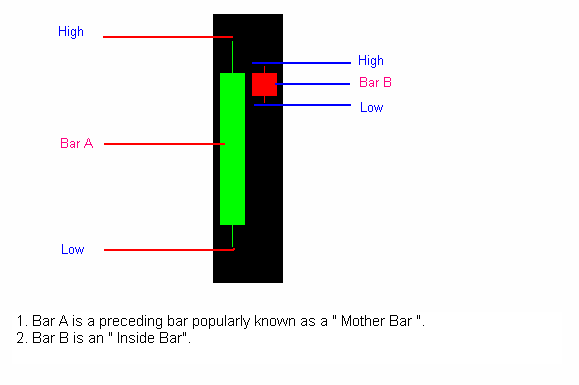

For the better understanding of an Inside Bar, its structure and its precedence, you can see the illustration below.

As we can understand from the illustration below, the high and low of bar B; an “Inside Bar” is contained within the high and low of bar A, a “Preceding Bar”, respectively.

Illustration 1: Anatomy of an Inside Bar

Why Inside bars occur

Inside bars occur in the following circumstances

A. Reversal

Key resistance area: At a point of strong resistance, big time sellers start building short positions and the buyers start covering their longs. This activity of exchange of hands takes place in a small range of price area which leads to a remote activity resulting in an inside bar. Such key resistance or support area can be a big round number, a fib level, a trend line or a confluence area.

In the below illustration as we can notice, after a prolonged up move price goes for a retest at a key resistance area and forms an Inside Day. The breakout downside leads to steep reversal.

Illustration 2: Inside Bar at a key resistance area resulting in strong reversal.

Key support area : It is exactly the vice versa of the above noted activity and in this case at a strong support area big time buyers start building long positions whereas the sellers start covering their shorts. Such an action of exchange of hands in a remote range leads to an inside bar.

As one can notice in the illustration below, An Inside Day occurs at a key support area. Once the high of that Inside Day is taken out price rallies with heavy momentum.

Illustration 3: Inside Bar at a key support area resulting in strong reversal.

Breakout area

An area of key resistance or support gets broken only when there are a large numbers of players willing to bid above or offer below such key areas respectively. Hence, before a strong breakout, there is a period of remote activity or consolidation wherein the sellers/buyers respectively build their positions for an upcoming breakout. It is common to have Inside Days in those consolidation areas before a strong breakout of key resistance or support.

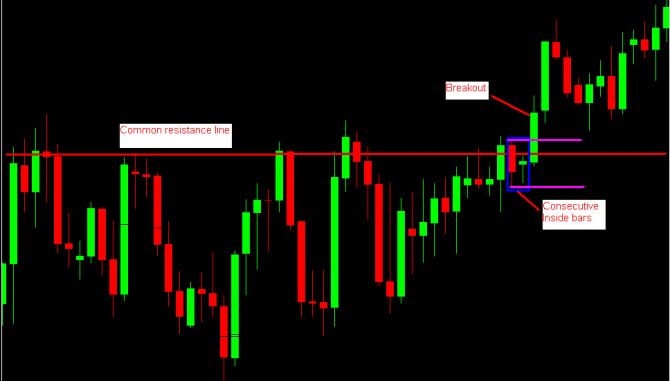

In the illustration below multiple Inside Days show the process of accumulation before the price breaks the key resistance area.

Illustration 4: Inside Bars forming at a breakout area and then the price breaking the Key resistance with momentum.

C. Consolidation after a strong move in a single direction:

When the price makes a substantial move in a single direction, it halts and starts consolidating to facilitate the below noted parties, before it makes next round of movement in the same direction.

- The parties who are in the right direction and want to cover their positions with profit

- The parties who are in the wrong direction and want to cover their loss.

- The parties who want to add to their profitable positions.

- The parties who have missed the initial move and now want to open fresh positions.

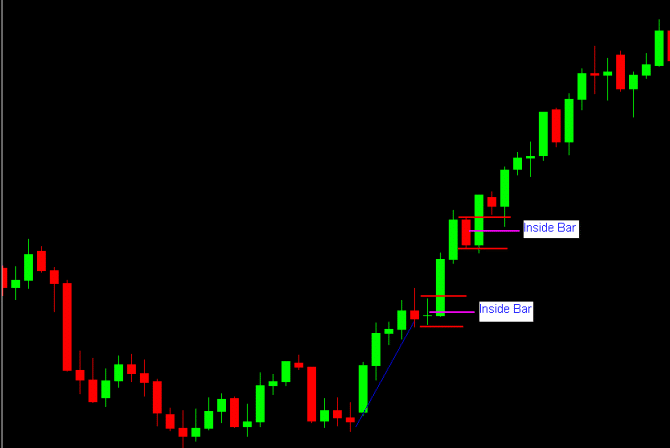

When so many parties get involved in exchange of hands at a key price level, it naturally leads to a huge consolidation represented by Inside Days. More than quite often, you will notice an Inside day after a strong initial rally or decline in the price. This type of Inside day will fall under this category.

Illustration 5: After initial rally, price starts consolidating and forms an Inside bar. Again the price makes second round of rally and forms an Inside bar indicating accumulation before next leg of up move.

D. Ranging markets

When the big time players take no interest in the market, the liquidity dries up and the price stops making any substantial moves leaving the market in a small range. We call this as a “period of indecision” as both the buyers and the sellers with large orders refuses to particitipate in the marketplace. Whenever the institutional traders stay away from market activity, price has nowhere to go but to trade in a narrow range. This period of indecision may last for long depending on various factors. As a consequence, price is reflected through multiple Inside Bars.

Illustration 6. Market goes in to a range and we get multiple Inside Bars within very short span of time. A trader needs to exercise enough caution against such Inside Bars

Finding Reliable Inside Bar

The success, efficiency and the effectiveness of trading the Inside Bars largely depends on spotting the highly reliable Inside Bars. It is important to note that all Inside Bars cannot be traded profitably.

To ensure that we trade only reliable Inside Bars, following guidelines are of utmost importance.

a. Time frame :

Rule: Trade Inside Bars only on a daily Time frame

Trading the daily time frame has its own distinctions as noted below.

- Reliable

- Affordable risk

- Optimal frequency of formation of Inside bars

- Helps to avoid overtrading

- Needs less trade monitoring and screen time.

b. Trend:

Rule: Trade Inside bars only in the direction of the trend

We are aware that big money is always with the trend. Hence as a thumb rule, we avoid trading Inside Bars against an ongoing trend. To mitigate the risk to the possible extent as well as to magnify our gains, we always trade in the direction of the trend. For example if the major daily trend is long, we trade Inside Bars only on the long side and avoid opening shorts. It is a proven fact that most of the large drawdown in trading accounts are due to counter trend trades. It is pertinent to note that all profitable traders are always in sync with the thought process of big players in the market. Trend always signifies the opted direction of institutional traders.

Period:

Rule: Always ignore the Inside Bars formed during low liquidity period

Inside bar formed during a low liquidity period must be ignored. Examples are Christmas holidays, all US Bank holidays and other holidays when big ticket players remain absent from the market. During these periods, due to non presence of big time players, the range shrinks and the chart will start printing Inside Bars. Since these Inside Bars are formed as a result of low liquidity and not due to a process of accumulation and distribution i.e.: exchange of hands between big time players, one should abstain from trading such Inside Bars.

Trading the Inside Bars

Before trading any strategy, we need to answer the following questions.

1.Where do we get in to the trade?

2. Where do we get out of the trade in case it does not workout? And

3. What is the risk associated with the entry in comparison to the potential return?

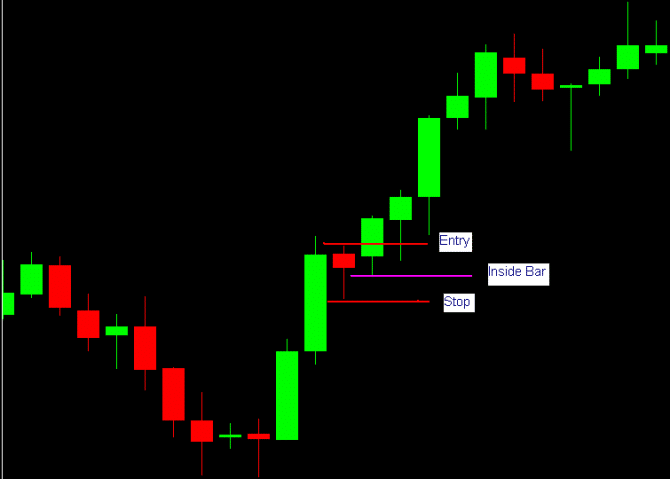

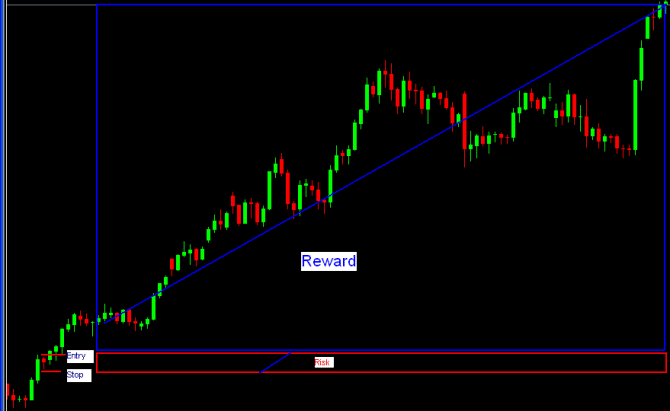

a. Entry: We make entry on the breakout of an Inside bar, in the direction of trend baring cases of reversals. Just to understand, In case the overall trend is up, we go long with the breakout on the upper side.

In this context, it is very important to note that we make the entry with the momentum as most of the breakouts without momentum end up with false breakouts. Momentum here refers to a strong/sharp and steep move in the direction of the breakout. For ascertaining the momentum, one can scale down to next lower timeframes like 4 hour, 2 hour or 1 hour charts respectively.

b. Stop: We place the stops in a sensible way so as to make it neither too big nor too small. Under this strategy we always place the stops on either side of the Inside Bar depending on which side of the market we are trading. I.e.: When we go long, we place the stops just below the bottom of the Inside Bar and vice Versa for short entries. The biggest distinction of the Inside Bar Breakout strategy remains the “Stop”. Since this strategy offers smallest logical/sensible stops one could imagine, it is not exaggerating if we say it is one of the simplest yet greatest strategies found in the market.

c. Risk-Reward: Barring other ancillary objectives, every trader’s basic objective remains reducing the risk and increasing the gains to the maximum possible extent. Inside Bar Breakout Strategy offers very low risk (Almost nil!) entries and extraordinary returns on trades. A Risk is to Return of 1:5 and 1:10 are quite common under this strategy. Just to give you an idea, because of the incredible risk reward ratio this strategy has to offer, one can wipe out 10 consecutive losses in a single trade. That says all about the power of trading this strategy.

Illustration 7: After initial rally in the price an Inside Day is formed. When the price breaks high of the Inside day the long entry is taken placing the stop just below the low of the Inside Day.

Illustration 7A: A reward of 2000 pips for a risk of 70 pips comes to Risk reward ratio of almost 1:30!

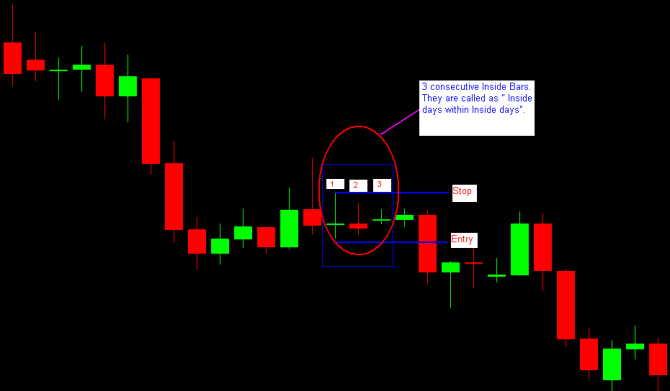

Multiple Inside Bars

As we know, at a place of key resistance and support areas, big time players start an activity of accumulation or distribution respectively. From a daily chart perspective, Some times this activity lasts for multiple days and the price keeps on making lower range every following day. This phenomenon is popularly called as “Multiple Inside Days”.

As we are aware, longer the consolidation, longer will be the movement after the breakout. Hence Multiple Inside Days offer a great trading opportunity as the breakout from the range leads to heavy movement in the price after the breakout in a particular direction.

Sometimes trading Multiple Inside Days can be tricky as the probabilities are more in this scenario compared to a single Inside Bar breakout. If we understand the underlying psychology under the formation and breakout of Multiple Inside Days, we can trade the same with high degree of success. The most authentic and reliable way of trading Multiple Inside Bars is to trade the breakout of the initial Inside Bar (The first Inside Day in the series). Of course with momentum! As far as stops are concerned, we place it on the opposite side, either just below or above the first Inside day, depending on the direction of the trade.

Illustration 8: In an ongoing downtrend, price consolidates for more than a week and then forms 3 consecutive inside days. Bar No 1, 2 and 3 respectively are consecutive Inside days. As per our rule, we always trade with the trend and a short order is placed just below the low of the first Inside day being bar no.1 in this case. It is pertinent to note that the breakout downside takes place with momentum.

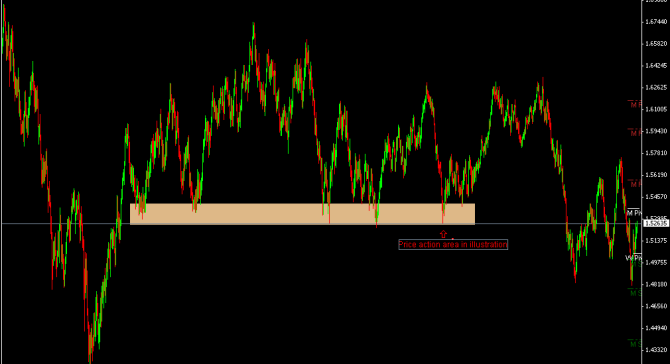

Breakout Traps

Understanding the breakout traps becomes highly essential to trade this strategy effectively. A breakout trap essentially means, the price breaks out in one direction and lot of traders jump in to the trade in the direction of the breakout. Then the price comes back and breaks out in the other direction with momentum and continues its move in the same direction. In this case all the traders who entered their positions on the first breakout are trapped in the bad trade. To overcome such kind of traps we follow certain rules and they are.

- We do not trade against the trend.

- We avoid trading longs in a strong resistance area and shorts in a strong resistance area.

- We avoid trading the breakouts against the trend as such breakouts are prone to trap. Alternatively we wait for the retest of the breakout of key areas to ensure that we are not stuck in the bad trade.

Illustration 9: The chart depicts a key support area.

Illustration 9A: The chart shows a process of breakout trap.

So as you can see the Inside bar breakout strategy can be very powerful when used in the correct context. Inside bars form all the time, but by following some simple rules we can really start to filter out those high risk trades and avoid being caught in breakout traps.

I live and breathe price action every day, and the Inside bar breakout is just scratching the surface when it comes to indicator free trading. This is just one of the price action trading techniques I use in the markets.

I hope this article has been an eye opening on how simple price action based strategies like the Inside bar can actually be molded into powerful trading systems. It’s all about waiting for the better setup and not trying to trade every single inside bar that forms and with such high risk/reward potential of these breakouts, you can afford to lose a few trades and remain ahead in the long run.

Cheers to your trading future.

Guest post by Anatasius from The Forex Guy