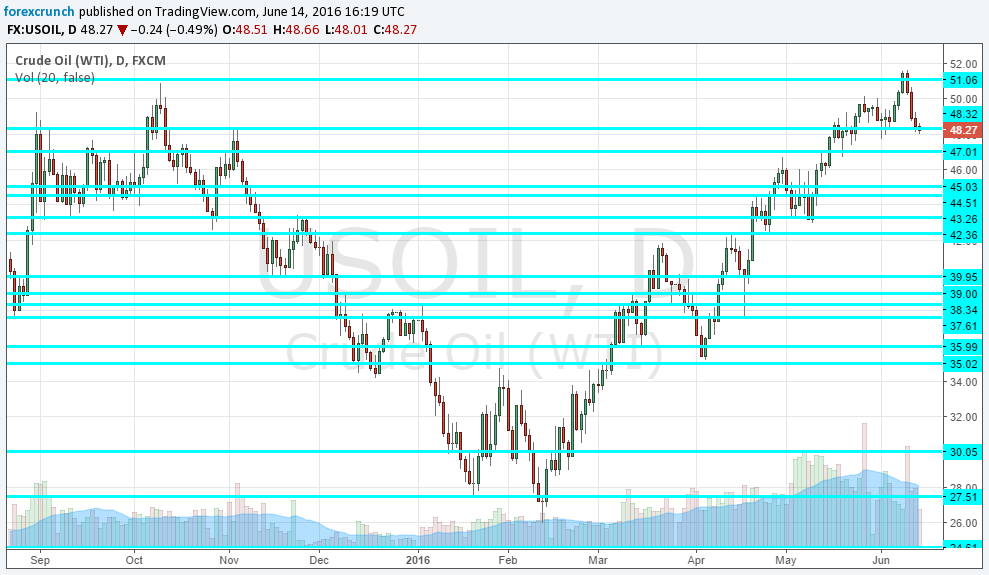

The price of WTI Crude Oil is around $48, under the closely watched $50 level it topped recently, but certainly in the higher ranges of the year and 80% or so above the lows. The situation seems stable, but this could be a calm before the next storm.

However, here are 3 recent reasons why the price of the black gold could fall:

- US production is on the rise: For a long time, we have been talking about the flexibility of the shale oil industry and how it can adapt itself quickly. When the price of oil was falling, production fell, and with the recent rise in prices, we were waiting for output to rise. This did not happen for many long weeks, but now it did, rising from the bottom. This still hasn’t affected the 4-week moving average and could be a one off. Nevertheless, it comes alongside the rise of the prices and could mark the end of them. More production = lower prices.

- Oil rig count rises: The Baker Hughes rig count has tumbled down quite quickly and this was initially seen by some as related to a drop in production. However, the shale oil industry just improved: higher output from less oil wells. This report, published late every Friday, consistently showed a drop in the number of wells and production was unrelated. However, for a change and after a very long time, the count is on the rise. So, are less efficient wells now harnessed for use?

- Risk off: The growing chance of a Brexit has soured the mood in markets. Nothing is fully priced in and any result will rock the pound, the euro, the risk off yen and the slight risk off dollar. Also the price of oil is affected. If we do see a vote to leave the EU, the price of oil could also slide as worries about global growth will take over. Yet even if the Bremain camp wins, the wounds are likely to remain open. All in all, it is hard to see support coming from the wider markets.

What do you think?

This could certainly negatively affect the Canadian dollar. So far, the loonie is looking OK, thanks in part to the better jobs report: a gain of 13.8K was reported last week, better than 3.8K expected. In addition, most of the rise was seen in full time jobs as part time jobs dropped.

Here is the chart of WTI Crude Oil: