Election day is today and everything is ready. Here is our full guide, video guide, and all the updates. And here is the view from Deutsche Bank, seeing 4 scenarios and looking into USD/JPY:

Here is their view, courtesy of eFXnews:

Japan will be the first major market to see the results of the US elections.

We would posit at least the following four post-election scenarios in terms of fiscal policy expectations, depending on the combination of president and Congress.

(1) Clinton victory + Republican House and Senate: Risk of continued political turmoil. Dead-locked fiscal policies.

(2) Clinton victory + Republican House + Democratic Senate: Somewhat reduced uncertainty. Concern about political situation and fiscal administration.

(3) Trump victory + Republican House and Senate: Heightened expectations for US fiscal policy. Increased global political uncertainty.

(4) Trump victory + Republican House + Democratic Senate: Brake on more aggressive US fiscal policy. Increased global political uncertainty.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

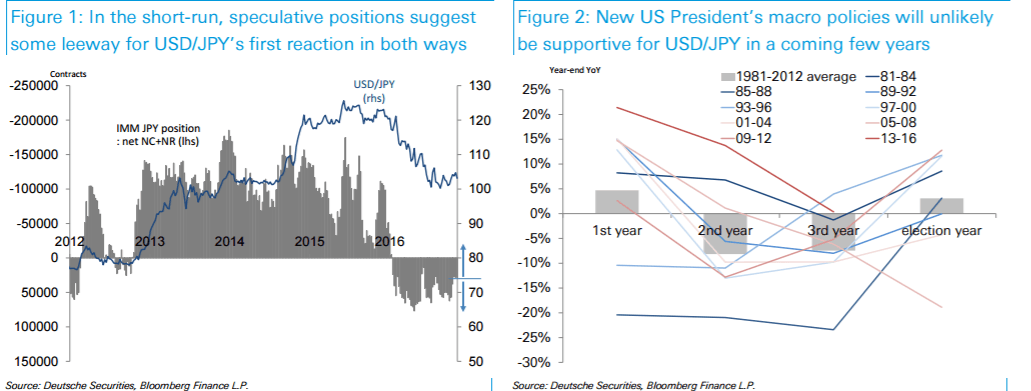

Scenarios (1) and (2) would cast doubt on the sustainability of USD/JPY’s uptrend and ultimately result in reversion to a fundamentals-driven market. Today’s news, favorable for Clinton, that the FBI said no evidence against her on the e-mail issue, has already made USD/JPY rebound, which could make the further upside leeway limited. We would recommend selling if USD/JPY rose to around 105 or higher.

In scenarios (3) and (4), we would first focus on whether USD/JPY’s initial reaction to risk-off shock from Trump’s victory could make it drop to 100 or lower. A deep decline could result in a greater sales order to cap around the 100 mark. Then, however, USD/JPY could show some steadiness, watching rise in US bond yields and some recovery in stocks to bolder fiscal package expectations. However, from a medium-term perspective, we also see the possibility of USD/JPY falling below 100 before the impact of a Trump administration’s fiscal policies would begin to feed through in a few years later. Our tactical approach to USD/JPY would be to sell on Trump-favorable news about the election process, buy back on confirmation of the results of his victory, then gauge the timing to build short positions.