The Australian dollar suffered from the inflation report, which showed slow price rises. What’s next?

Here is their view, courtesy of eFXnews:

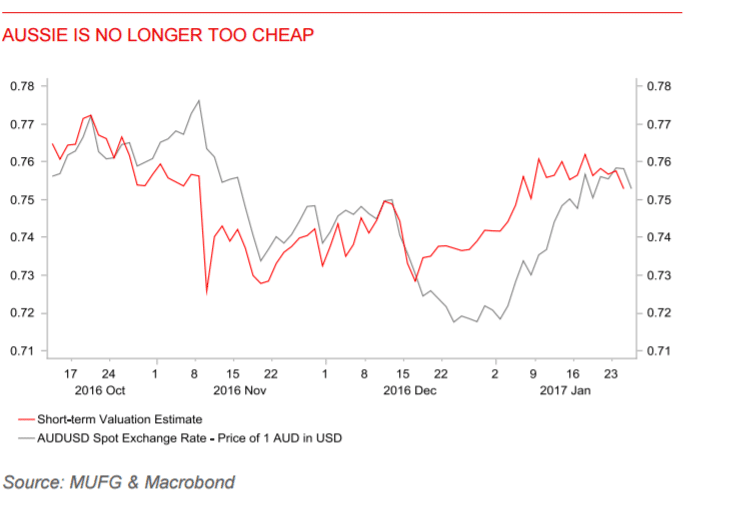

The Australian dollar has been one of the best-performing currencies at the start of this year lifting the AUD/USD rate from around the 0.7200-level at the end of last year back towards the 0.7500-level around where it spent most of last year trading. Aussie weakness at the end of last year was undershooting key short-term fundamental drivers and it has since displayed catch up strength.

Our short-term valuation model is now sending a more neutral signal for the Aussie. The Aussie has benefitted at the start of this year from the pull-back in US yields, ongoing improvement in global risk sentiment, and the strengthening global growth outlook which is supporting higher commodity prices. The strengthening global growth outlook is a positive for Australia’s economy, although the accompanying strengthening of the Aussie is less desirable for the RBA who are currently confronting uncomfortably low inflation.

The release overnight the latest Australian CPI report confirmed that both headline and core inflation remained soft in Q4. The average of RBA’s two core inflation measures has remained at around 1.6% throughout last year. It is broadly in line with the RBA’s forecasts so is unlikely to prompt a change in their policy outlook. The combination of currency strength and continued low inflation will keep the possibility of a further RBA rate cut on the table, although the RBA currently remains comfortable to leave its policy stance unchanged limiting downside risk for the Aussie in the near-term. More likely the RBA will have to tolerate the strength of the Aussie for now.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.