- AUD/USD gains after RBA but unable to hold and marks fresh daily lows around 0.7400.

- RBA keeps interest rates unchanged and may hold tapering until Feb 2022.

- Risk appetite is declining amid COVID-19 fears.

- China’s macroeconomic data came better than expected that may provide little respite to the pair.

The AUD/USD analysis shows us a bearish scenario as the price could not stay near highs after the RBA-led jump. Markets are getting risk-averse.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The AUD/USD exchange rate rebounded to Friday’s highs near 0.7465 after the Reserve Bank of Australia (RBA) reached market consensus early Tuesday morning. Meanwhile, the price is still under pressure amid the rebound of the US dollar from the daily lows and the rise in government bond yields.

At the same time, the RBA maintains its 0.1% base interest rate, confirming the market consensus. Furthermore, in its interest rate announcement, Australia’s central bank declared that it would purchase government bonds for AUD 4.0 billion per week until mid-February 2022.

The risk appetite of European traders is declining from an initial period of optimism. Despite 2.2 basis points (bps) gains in the 10-year Treasury yield, stocks futures and Asian equities are slowing their progress in the early going. Due to market uncertainty, the US Dollar Index (DXY) finds acceptance around 92.15.

Vaccinations and fears of coronavirus may be behind these moves, as well as actions by the central bank. Australia reports a third consecutive day of cutting daily Covid-19 counts to 1467.

Data reports for August were strong for China earlier in the day. The trade balance increased to $58.34 billion from $56.59 billion in August, up from $ 51.05 billion earlier. Imports increased above market consensus by 26.8% and 28.1% from previous values by 33.1%, while exports increased by 17.1% and 19.3% previously by 25.1%.

The market has responded positively to the RBA announcement. Still, traders will be watching for risk catalysts on a hectic calendar and the return of all markets after the RBA announcement. Nevertheless, optimism about the vaccine during a key European Central Bank (ECB) monetary policy meeting that will take place on Thursday should keep market participants on track for the upcoming ECB meeting.

–Are you interested to learn more about forex signals? Check our detailed guide-

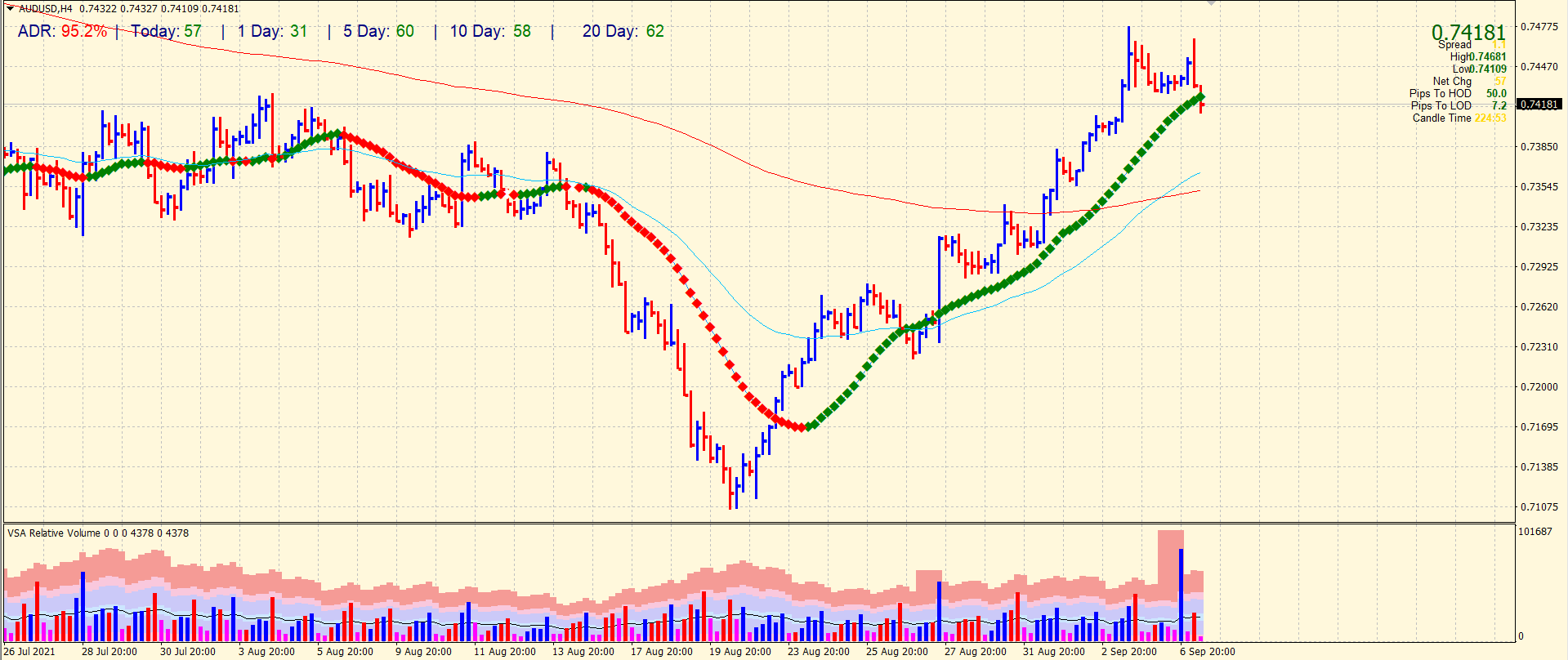

AUD/USD price technical analysis: 0.7400 is the key

The AUD/USD pair found selling pressure near Friday highs and moved sharply lower towards the 0.7400 area. The pair marks 95% average daily range so far amid RBA’s interest rate decision. The pair may find further support around 0.7400 ahead of 0.7360 and then 0.7300. On the upside, Friday’s high at 0.7477 may provide resistance ahead of 0.7500.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.