- AUD/USD pair gathers traction amid positive risk flow.

- US dollar loses strength despite hawkish FOMC and tapering clues.

- Aus manufacturing PMI came better than expected that gave room to the Aussie bulls.

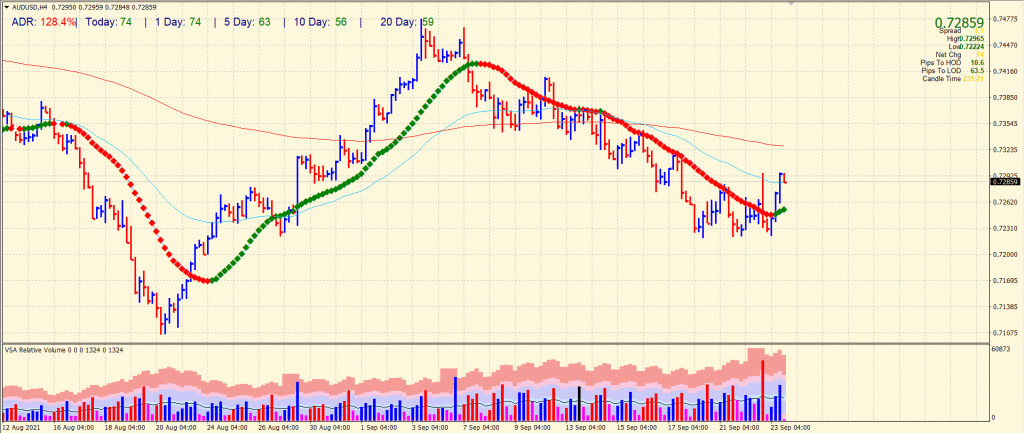

The AUD/USD price forecast broke through a tight range during the Asian session below 0.7250, most recently rising 0.80% to 0.7293 during the day.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Fundamental forecast: Fed tapering, Aus PMI supporting ahead of US data

Thursday’s positive shift in market sentiment appears to have weakened the dollar and allowed the AUD/USD pair to maintain its bullish trend. As a result of aggressive Fed policies, the US dollar index fell 0.25% that day to reach 93.20. Meanwhile, S&P futures gained 0.5%, suggesting major Wall Street indices are likely to open higher.

After a volatile session yesterday, the US dollar gained strength after the FOMC clarified gradual tapering would begin before the end of the year, and new members were added in 2022 on the dot plot. For now, the Fed seems to prefer the US dollar over stocks or bonds as a way of expressing its taper policy. However, after profit-taking, the dollar index fell to 93.37 in Asia after rising by 0.26%.

Later in the afternoon, IHS Markit’s September manufacturing and services preliminary PMI reports will be included in the US economic news.

According to the Commonwealth Bank’s data announced earlier in the day, Australian manufacturing PMI rose to 57.3 in September from 52 in August. Additionally, the service PMI increased from 43.3 to 46 during the same period.

According to the Wall Street Journal, Chinese authorities have instructed local authorities to prepare for the possible collapse of the Evergrande Group. As a result, the AUD/USD pair could be hindered from making further gains if China’s second-largest real estate company goes bankrupt.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

AUD/USD price technical forecast: 0.7300 to be acquired soon

The AUD/USD price overcame the 20-period SMA on the 4-hour chart during the earlier Asian session. While moving through the New York session, the pair cracked the 50-period SMA as well. Now the pair looks promising to move towards the 0.7300 level and above. The pair have done 128% average daily range, which means that the upside potential may be limited to around 0.7300 or slightly above it. On the flip side, the pair may find a correction towards the 0.7250 area.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.