- The AUD/USD held as unemployment data comes in as expected.

- The possible beginning of the end of the dollar rise.

- The reopening of China favors AUDUSD.

The AUD/USD forecast is slightly positive as the US dollar has been correcting lower; as a result, lending support to the Aussie.

–Are you interested in learning more about forex robots? Check our detailed guide-

The change in the number of people employed in Australia came out much lower than yesterday. This is an important indicator of consumer spending and is bearish for the AUD/USD. The unemployment rate came in at 3.9%, as expected by investors, leading the pair to hold its ground. As in other countries, inflation is relatively high in Australia, and the RBA is expected to keep raising interest rates.

On the other hand, investors expect the dollar to experience its first losing streak in a long time as investors rushed for the safety of treasury bonds overnight. Despite global stocks collapsing and growth concerns due to the tight monetary policy, the dollar’s safe-haven status changed overnight.

It is becoming painfully clear that the Fed and other central banks have fallen behind in fighting to contain inflation. They will need to be more aggressive in this fight. However, the economy will be a victim as higher interest rates do not favor growth.

On Friday, Australia’s currency was down, losing 0.35% to 0.7023 after surging 1.33% in the previous session. The pair has benefitted from the news of the reopening of China, which is Australia’s biggest trading partner. Joseph Capurso, a strategist at Commonwealth Bank of Australia, said that the China news favored the pair, so the move down on Friday could be an unwind of that and some positioning by investors.

AUD/USD technical forecast: Market looking for a catalyst

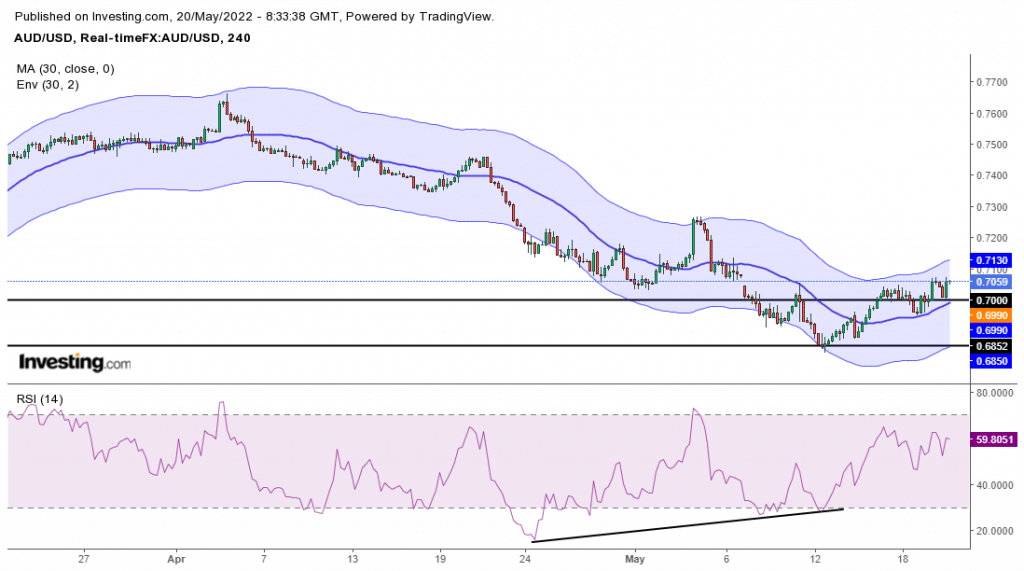

The 4-hour chart shows a possible change in the direction of the pair. Price is currently trading above the 30-SMA and is making higher highs and higher lows. However, this might be a pullback, and the price may continue trading below 0.7000. Prices tried to break below the 0.7000 critical psychological level but could not sustain the move, making lows at around 0.6850. The possible reversal is supported by the bullish divergence in the RSI, which points to weaker bearish momentum.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

The price needs to confirm this move by getting to the overbought RSI level above 70. The bulls need to show they are strong enough to get prices overbought. This would inspire more buyers to join and possibly get AUD/USD trading above 0.7300. If the bears are stronger, on the other hand, we might see prices breaking back below 0.7000 and seeking lower lows. Sitting on your hands and waiting for the market to pick a winner is not an easy task. It is, however, what must be done now as the price consolidates around 0.7000.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money