- AUD/USD falls as risk sentiment deteriorates amid Fed concerns.

- As global tech stocks continue selling, the US dollar holds its recent rally.

- As it approaches major support, the Aussie ignores the strong Chinese services PMI Caixin.

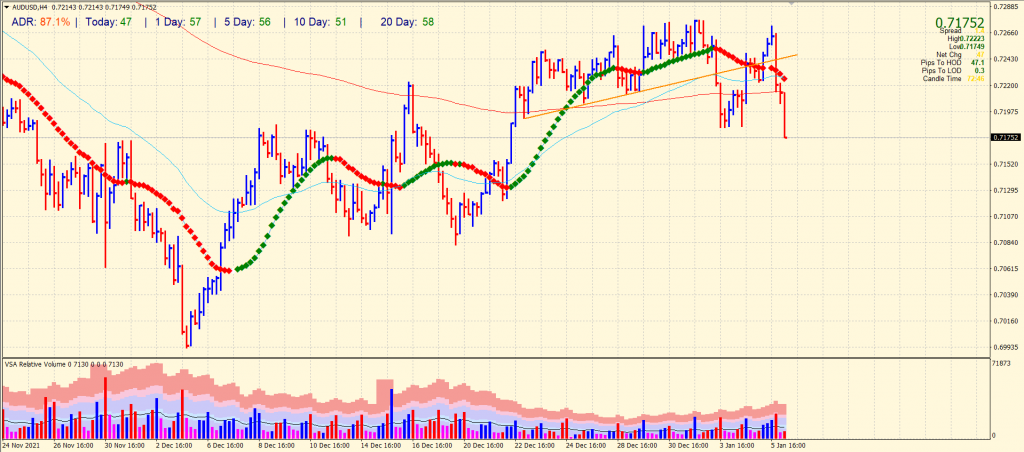

The AUD/USD price forecast is strongly bearish as the Greenback rally weighs heavily on all the major currencies amid risk-off sentiment.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

With the odds of the Fed tightening aggressively increasing, the AUD/USD price fell below 0.7200 in a new sell-off that broke high beta assets.

The Fed’s December meeting minutes showed that the central bank is ready to raise the rate sooner and faster while also reducing its balance sheet.

Stock markets worldwide experienced a massive sell-off of technologies because investors expected an aggressive tightening by the Fed. Instead, the markets have noticed the Fed’s aggressive stance on the economic recovery and the looming threat of the Omicron virus.

As the mood continues to plague, the higher-yielding Australian dollar is unaware of the Chinese Caixin Services PMI spike to 53.1. Furthermore, divergent monetary policies between the Fed and RBA contribute to the Australian dollar’s devaluation.

According to the latest US PMI data from ISM Services, the upcoming Covid updates will add momentum to trading in key markets.

AUD/USD price technical forecast: Bears to hit 0.7100

The AUD/USD price remains negative as the pair has dropped below the key SMAs on the 4-hour chart. Moreover, the price could not hold above the ascending trendline, which was broken previously, and the price is again far below it.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

Looking around the recent consolidation, the up wave was sluggish while the down wave was sharp with fewer bars and more swift price action. The two out of the last three down bars are widespread with a huge volume. This is a strong sign of reversal. We can consider it a top reversal as the price has already plummeted from the several-week highs and finds no technical respite at the moment. The pair is prone to fall further towards 0.7150 ahead of 0.7090.

On the flip side, if USD bulls run out of steam or if we see profit-taking, the AUD/USD pair may rise towards 0.7200 ahead of 0.7260.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.