- AUD/USD remains on the backfoot near 0.7300 handle amid the Dollar rise.

- The rise in bonds yields has provided additional strength to the Greenback.

- China’s sluggish growth and fall in demand for commodities are also weighing on the Aussie.

The AUD/USD price forecast is bearish. As the US dollar appreciates, the AUD/USD exchange rate remains at the lower end of the negotiation spectrum. As a result, despite opening higher, the pair failed to maintain its momentum.

AUD/USD is trading at 0.7329 at the time of writing, down 0.05% from yesterday.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

A record number of US job vacancies rose to a record 10.1 million in June from a revised 9.5 million the previous month, raising the yield on 10-year US Treasury bonds to 1.32%, up 0.39%.

Investing in bonds surged along with the US Dollar Index (DXY), which tracks the dollar against six main competitors.

According to Boston Fed President Eric Rosengren, the central bank should discuss rate cuts early as September. As far as the Atlanta Fed president is concerned, inflation has already reached the critical threshold that will lead the Fed to discuss a reduction in bond-buying.

A bipartisan infrastructure bill worth $1 trillion will be adopted by the US Senate on Tuesday. The strength of the US dollar weighs on riskier assets like the Australian dollar.

A lower commodity price and the extended quarantine also have weighed on the Australian dollar.

Reuters reported that iron ore prices are down more than 5% as supply improves and demand is falling in China.

A note of interest is that S&P futures stood at 4,425, down 0.01% from the previous day.

As of now, traders are waiting for new data on home sales in Australia, productivity in the non-farm sector of the US, and unit labor costs for trading to drive investment decisions.

Moreover, Goldman Sachs has cut its growth estimation for China. According to bank analysts, the Covid regulations and social distancing measures hinder consumer spending and consumption.

–Are you interested to learn more about forex signals? Check our detailed guide-

Last month, the People’s Bank of China (PBOC) unexpectedly lowered reserve requirements for banks. However, Beijing may raise interest rates further if the recovery in GDP slows, especially if the Covid restrictions persist.

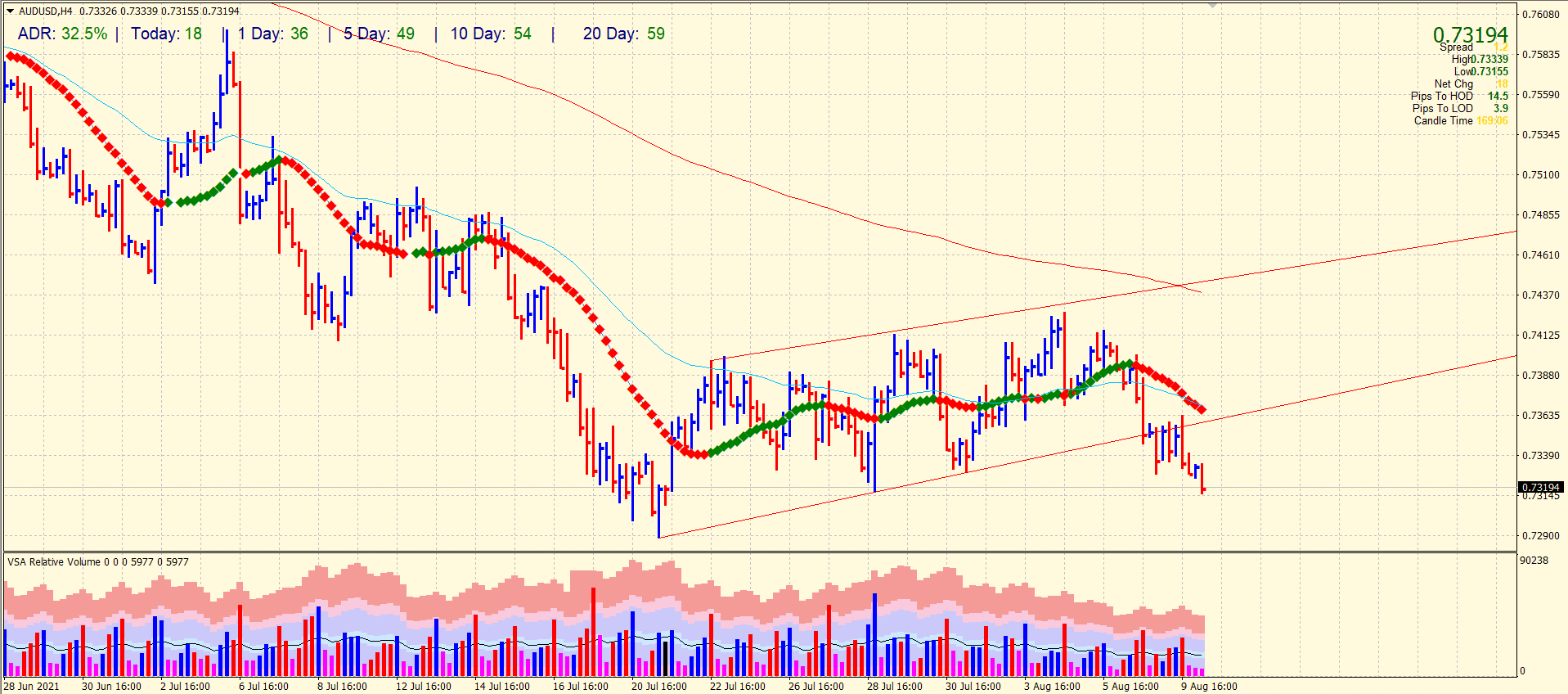

AUD/USD technical forecast: 0.7290 is the key

Technically, the uptrend channel holding price for quite a long time got broken on Friday. The price is heading south, well below the key SMAs. The price can aim for 0.7290 which is a swing low of July 21. The volume on retest and bounce back from the broken channel is ultra-high, indicating that the price is in strong dominance of the bears. There is no further support near the 0.7290. So, if the level is broken, we can expect a deeper retracement towards 0.7200-20 area.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.