- AUD/USD struggles to stay in a positive territory near 0.7400 after the Chinese macro data missed expectations.

- Torrential rains and delta variant continue to weigh on the Chinese economy.

- The rise in commodity prices may lend some support to the Aussie.

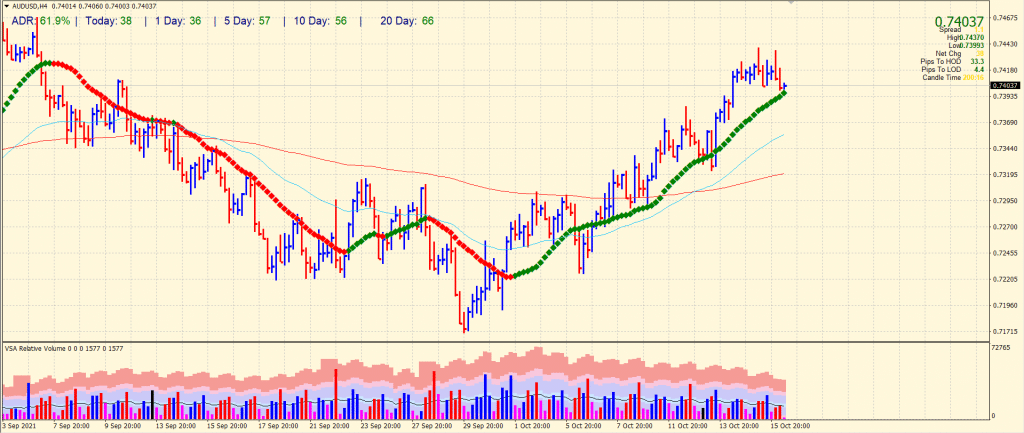

The AUD/USD price forecast shows the emergence of a bearish trend after finding a peak at 0.7340 on Friday. US dollar still remains a guiding factor. After the data dump from China, the AUD/USD pair continued to move sideways and remained limited by a tight trading band around 0.7400.

-If you are interested in forex demo accounts, check our detailed guide-

The pair struggled to capitalize on its early rally, which reached a more than month high on Friday and saw a modest pullback from the 0.7435 level on Monday. With the US dollar moving at a sluggish pace, the cautious sentiment in the equity markets was seen as a key headwind for the riskier Aussie.

In addition, China’s macroeconomic releases were weaker than expected, which restricted the Chinese proxy currency’s upside potential. As reported by the National Bureau of Statistics of China, economic growth in the world’s second-largest economy has slowed to 0.2% and 4.9% y/y in the third quarter, compared to 1.3% and 7.9% a year ago.

Moreover, China’s industrial production increased by 3.1% y/y rather than 5.3% in September, falling short of market expectations. Those factors more than offset September’s higher-than-expected monthly retail sales rise of 4.4%. Stagflation fears and concerns about inflation growth overshot September’s 4.4% increase.

The PBOC Governor Yi Gang recently stated that the Evergrande saga could have been prevented. According to local Chinese media, several major Chinese developers have also urged an easing of a crackdown on the real estate sector.

China has suffered torrential rains caused by the typhoon season, resulting in the temporary closure of some coal mines. Increasing energy demand should push up energy prices as winter approaches. There are also numerous problems with supply around the world.

China’s economy continues to be hindered by the delta variant. In addition, shipments are experiencing significant increases in shipping costs due to port closures and reopenings.

Although the market’s reaction so far has been limited, aggressive traders should take caution until the reaction becomes more widespread. Recent commodity price increases continue to provide some support to Australia’s resource-dependent economy. Consequently, it is prudent to wait until strong follow-up selling occurs before concluding that the AUD/USD pair has peaked soon.

AUD/USD price technical forecast: Bears taking back control

The AUD/USD price finds some support around the 0.7400 handle and the 20-period SMA (4-hour chart). However, the bearish momentum may emerge and lead the price towards 0.7355 (50-period SMA) ahead of testing the 200-period SMA at 0.7320.

-If you are interested in Islamic forex brokers, check our detailed guide-

The average daily range is 61% so far, indicating further potential in the market. If the price finds some buyers here, the upside may test the monthly highs around 0.7440 ahead of Sep 07 swing high around 0.7470.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.