- GDP data shows Australia’s economy performed better than investors expected.

- A rising dollar is keeping the AUD/USD below 0.7200.

- Australia’s retail sales could move the pair later in the day.

The AUD/USD outlook is bearish as the pair pulls back on Wednesday morning after a rally supported by positive GDP data from Australia. The morning losses can be attributed to the rise in the dollar across the board amid new recession fears sparked by rising inflation. However, AUD/USD bulls are holding on to the news that the Australian economy did better than investors expected in the first quarter.

-Are you interested in learning about forex indicators? Click here for details-

Data from the Australian Bureau of Statistics released a GDP reading of 0.8%, higher than the expected 0.5%.

“It supports our view that the economy will hold up better with rising interest rates and falling real incomes than most anticipate,” said Marcel Thieliant, a senior economist at Capital Economics.

The first quarter saw 0.8% growth mainly from household consumption, while government spending and inventories contributed. Imports covered some of the demand, reducing GDP by 1.5%. The GDP report also pointed to rising inflation, with the primary price index rising 2.9% for Q1, the most significant increase since 1988.

This inflation is set to drive rate hikes, and markets are priced for a move of 0.6% at the RBA’s June policy meeting. These rates could reach 2.5% by the end of the year due to rising inflation.

AUD/USD key events today

Investors will be paying attention to retail sales from Australia, which will give a clear guide on consumer spending and economic activity in the country. Data from the US could also move the pair today, including ISM manufacturing PMI for May and JOLTs job openings for April.

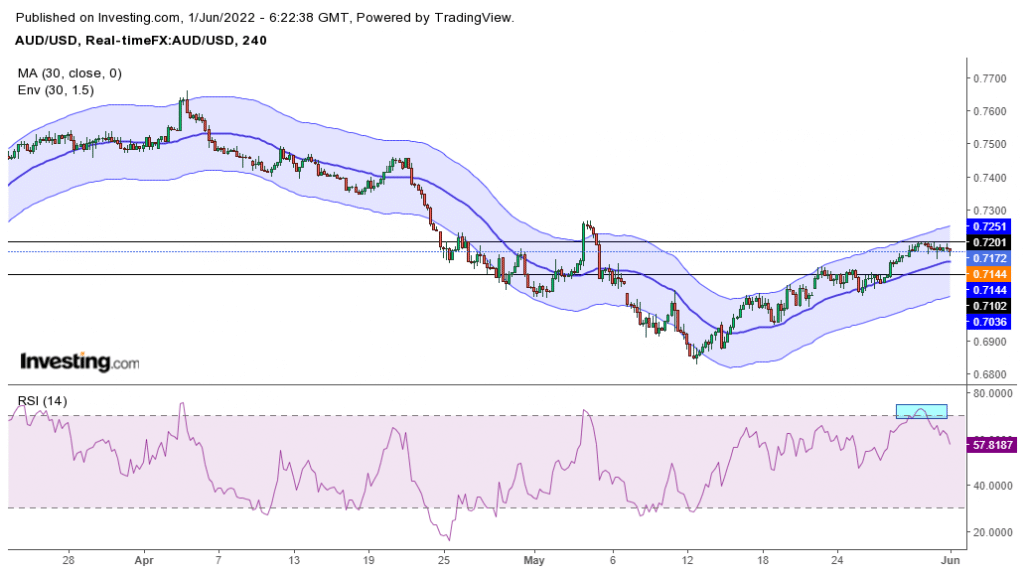

AUD/USD technical outlook: Bulls capped by 0.7200

The 4-hour chart shows a solid bullish trend in the market. This price trades above the 30-SMA, and the RSI hit the overbought region with the most recent high. The price is trading below 0.7200, where it has experienced resistance.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The price is coming close to the 30-SMA, where it might bounce off to higher prices or break below and start a downtrend. An oversold RSI reading will only confirm a new downtrend. The bias here remains bullish.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money