- AUD/USD bears dominate below 0.7300 level.

- The strong US dollar and gloomy news from China continue to weigh on Aussie.

- Technically, the price may find some upside correction amid profit-taking.

The AUD/USD price analysis suggests a strong bearish action that may lead to test the YTD lows or even further lower. Early Friday, AUD/USD bears re-established their five-week low by holding the 0.7300 level, down 0.10% for the day.

-Are you looking for CFD brokers? Take a look at our detailed guideline to get started-

In response to rising interest rates and the strengthening of the US dollar as the Fed hikes rates during a four-day downtrend, two risk barometers show hesitation in the market. There are also gloomy news items coming out of China, such as Evergrande or power outages, which influenced the quote.

The moderately traded stock futures and the mixed performance of stocks from Asia-Pacific combine to test sellers in the region.

The market is not encouraged by the prospect of China loosening credit restrictions on the real estate sector or comments from former People’s Bank of China advisor Yu Yong that Evergrande is manageable. However, Evergrande’s lender, the Kaisa group, may have updated the situation. This week, Qaisa pleaded with lenders for help as she had the most offshore debt of any Chinese developer after Evergrande. According to Reuters, over $59 million in coupons are due Thursday and Friday, with a 30-day grace period for both.

Other factors will continue to pressure AUD/USD prices, including China’s energy issues, which will shape the GDP in 2021. In addition, China and the US disagree over the Phase 1 deal, Vietnam and Hong Kong.

A recent assessment of Asia-Pacific economies from world ranking giant Moody says: “Most will recover, which will help keep debt stabilization at a higher level than before the pandemic.”

Despite these events, US stock futures posted modest gains, while government bond yields helped the US dollar index (DXY) rebuild its multi-day high.

AUD/USD traders may be entertained by bond traders’ profits after Veterans Day mainly. Furthermore, the Michigan consumer sentiment index for November, forecast at 72.4 versus 71.7, will be equally important.

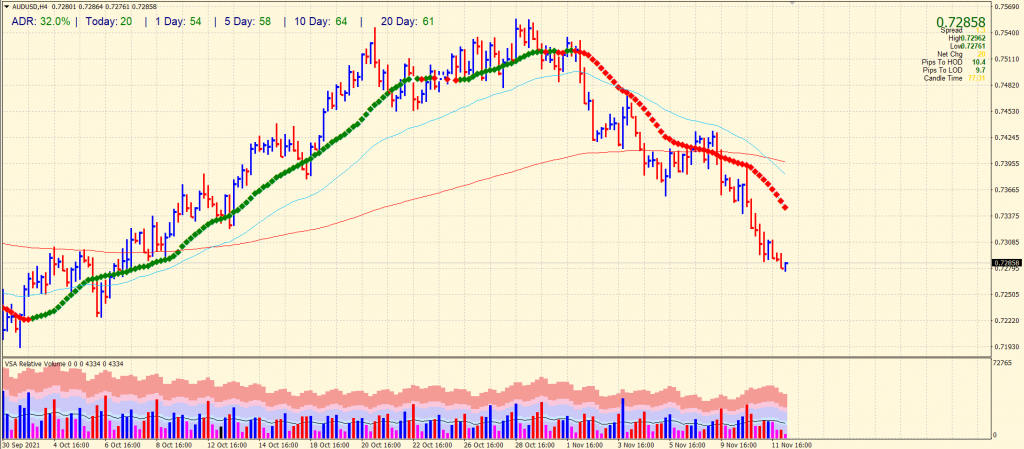

AUD/USD price technical analysis: Bearish pressure keeps mounting

The AUD/USD price is far below the key SMAs on the 4-hour chart. The pair has been ranging around the support area but looks quite vulnerable to falling further. The pair is eying to test the support zones at 0.7250 ahead of 0.7190.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

Alternatively, if the price attempts to break the bearish momentum, it may face strong resistance around 0.7350 ahead of 0.7400. However, the volume is slowly declining, which shows that the bears may be paused and find an upside correction.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.