- AUD/USD jumps above 0.7200 as the risk sentiment improves further.

- The coronavirus cases have slowed down while a higher vaccination rate has been achieved.

- Eased activities around the world can reiterate Fed to avoid tapering.

- DXY and US 10-yr bond yields are at lows.

The AUD/USD price analysis clearly shows an upside bias as the Dollar correction continues because of better risk sentiment.

As of writing, the AUD/USD pair is at 0.7217, up 0.17% on the day.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

AUD/USD holds the start of the week in Asia early Tuesday morning from a year low of around 0.7220. After posting its strongest daily gains since April, the Australian pair fell the heaviest in just 11 months last week. Although the Coronavirus issues can be seen as a major downside, recent stock and gold rallies, fueled by a weak US dollar, are favored by buyers.

The daily Coronavirus cases in Australia are still close to an all-time high, but PMI news and vaccine news favor the AUD/USD pair. Even so, Australia announced another 900+ cases on Monday, but the state with the highest infection rate, New South Wales, boasts one of the highest vaccination rates in the world.

Similarly, the US Food and Drug Administration (FDA) approved Moderna-BioNTech Covid as a vaccine for use in adults 16 and over, which has become another weapon against the pandemic.

Furthermore, preliminary data show a slight easing in August in the US, Europe, the UK, and Australia, although this decline is tame. These factors are also helping the US Federal Reserve System (FRS) and its monetary policy allies to avoid challenges.

Due to risk appetite, Wall Street was propelled by these catalysts, while gold also bounced back to $1,800. After Monday’s trading session, the US dollar index (DXY) and the yield on 10-year US Treasuries were lower.

The lack of key events may force traders to rely on qualitative catalysts to take action right away. In particular, we’ll be watching for news about the Coronavirus, vaccines, and central banks.

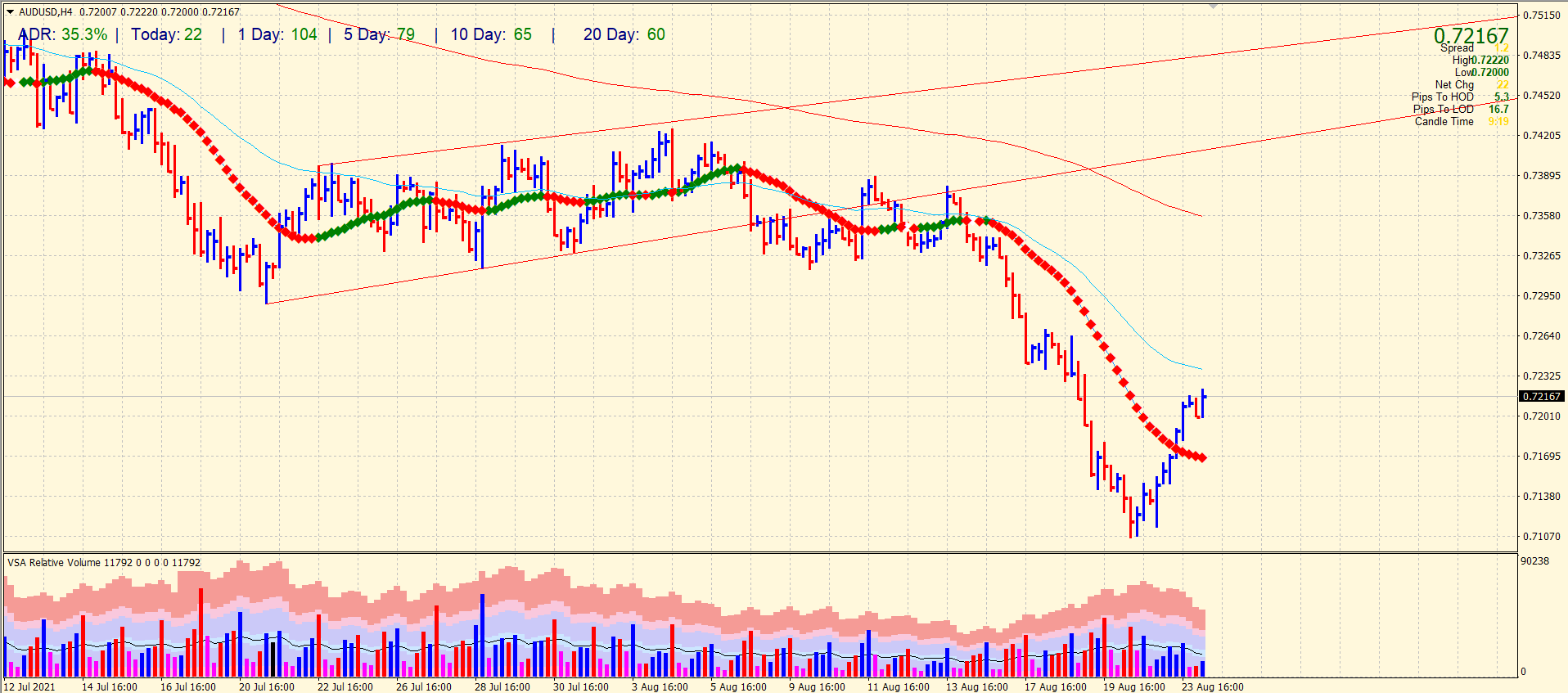

AUD/USD price technical analysis: 20-SMA lending decent support

The 4-hour chart of the AUD/USD pair shows a rising volume with rising prices. The Aussie has settled well above the 20-period SMA. However, the price is still below the 50-period SMA that can provide immediate resistance. The next upside hurdles could be 0.7260 followed by 0.7290.

–Are you interested to learn more about forex signals? Check our detailed guide-

On the downside, 0.7200 will act as immediate support, followed by 20-period SMA at 0.7170. However, the path of least resistance is on the upside for now. Hence, any weakness or pullback can be considered a buying opportunity.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.