- AUD/USD is vulnerable to breaking the monthly lows.

- A better Australian jobs report may help the bulls a little.

- Market participants are eying at US CPI data for further fresh stimulus.

After failing to gain traction above the 200-day SMA (0.7550), the AUD/USD price appears to have reversed. Still, new data from Australia could dampen the recent depreciation of the currency as job growth is expected to bounce in October.

-Are you looking for CFD brokers? Take a look at our detailed guideline to get started-

The AUD/USD pair is forming a bearish outer candle holder as it has been following the uptrend since the start of the week. Nevertheless, the exchange rate may continue its rise from the October low (0.7190) as it appears near a breakout. The course begins in November.

However, AUD/USD could try to hold on to its 1-month low (0.7360) after the Australian employment report predicted an economic expansion of 50,000 jobs in October and a rise in the unemployment rate from 4.6% to 4% over the same period.

However, it remains to be seen if the Reserve Bank of Australia (RBA) is better prepared for higher rates after adopting restrictive forward guidance as it increases its YCC program. The decision to deviate from profitability targets reflects an improving economy and earlier than expected progress toward inflation.

A weaker-than-expected employment report could lead to a weaker Australian dollar, prompting the RBA to act on the next rate decision on March 7th, the latest dip in retail sentiment this year.

On the other hand, Greenback remains strong during the week amid risk-off sentiment. The traders are now eying at US CPI data releases due in the New York session.

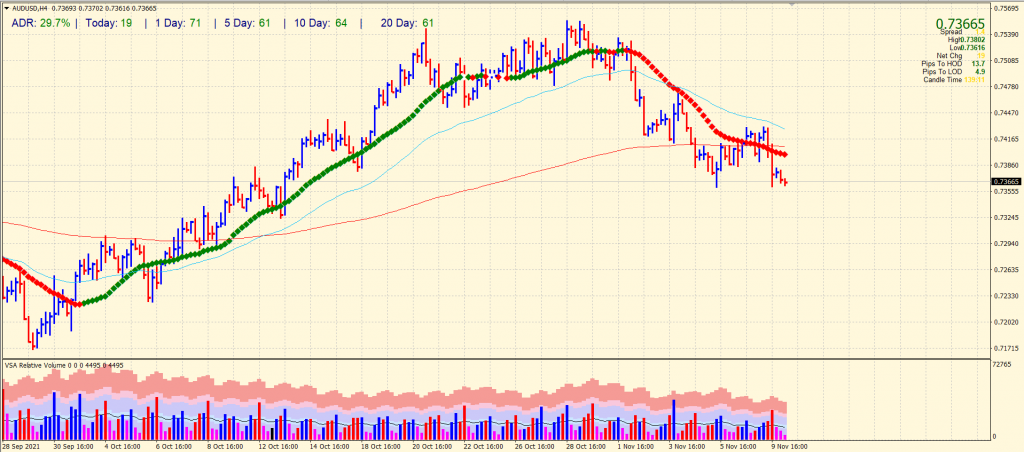

AUD/USD price technical analysis: Bears to pounce monthly lows

The AUD/USD price remains vulnerable around the monthly lows at 0.7365 area. The price stays well below the key moving averages like 200-period and 20-period on the 4-hour chart. For bears, it is important to break the monthly low of 0.7365 and sustain below it. The recent volume data is not clearly in favor of bulls. Hence, we can expect an upside correction here. The average daily range is 29% so far, indicating low volatility for the day.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

Any upside correction will face resistance around 0.7395 to 0.7425 area, which confluence of important moving averages. On the downside, we may see support around 0.7325 ahead of 0.7290.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.