- AUD/USD is benefitting from a weaker Dollar and better risk tone.

- The pair remains buoyant despite the dismal business confidence data of RBA.

- The technical picture remains on the bull side in the short term.

The AUD/USD price aims to rally above the 0.7372-0.7422 cap after buyers re-emerged near an almost 8-month low of 0.7289.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Earlier in the day, data from Australia, such as the Australian Central Bank’s business confidence, fell from 19 to 17 in the second quarter. This value was not in line with market expectations of 21 but did not result in a significant market reaction.

At the same time, rising market sentiment is helping the Australian Dollar better than its American counterparts. Major European stocks rose 0.3% to 1% on Thursday, with Wall Street opening from another high after a two-day rally.

Later in the session, weekly data from the US Department of Labor on initial claims for unemployment benefits will be considered. In addition, the current June home sales and the National Performance Index of the Central Bank of Chicago will also be included in the US economic briefing.

Australia on Friday will release preliminary reports from Commonwealth Bank on manufacturing and services for July.

–Are you interested to learn about forex robots? Check our detailed guide-

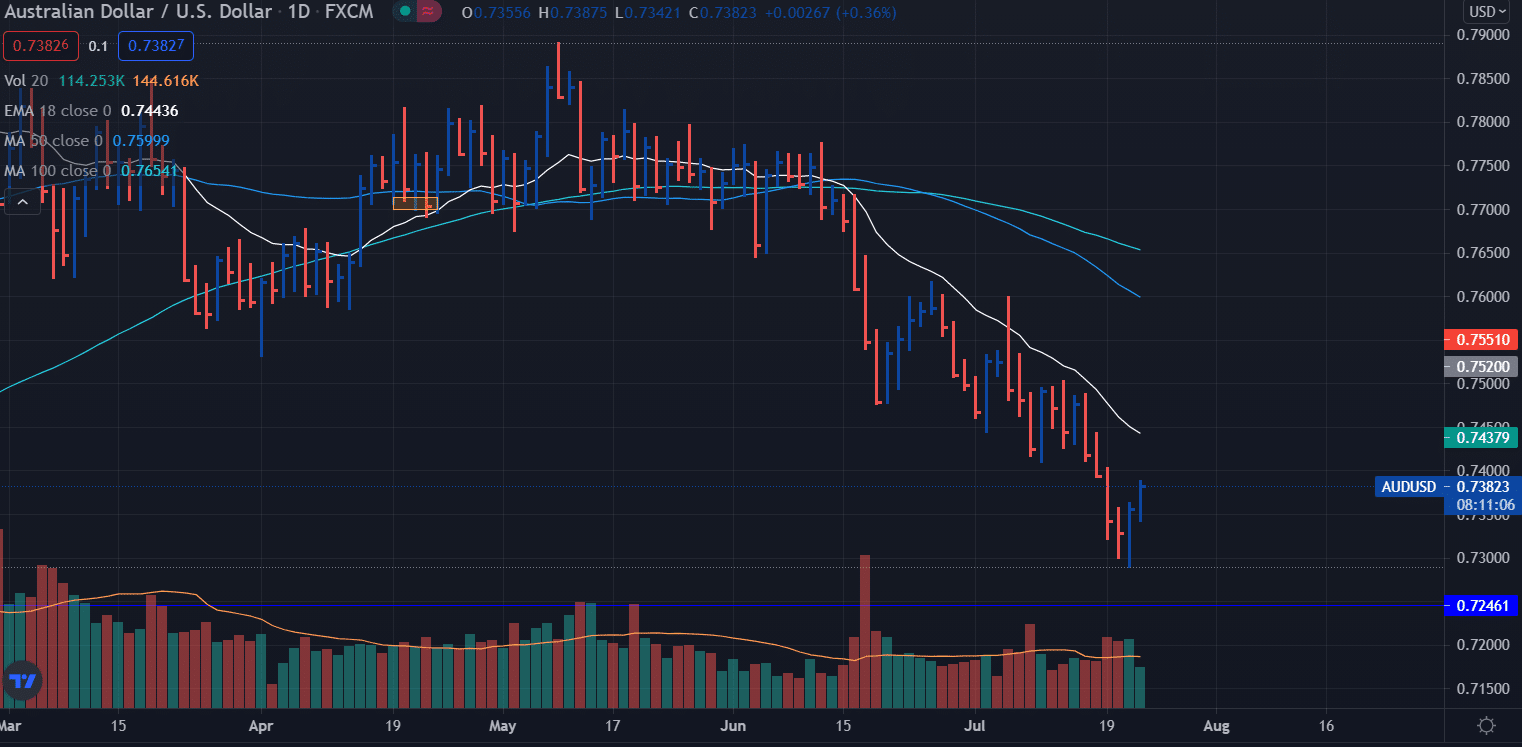

AUD/USD price technical analysis: Key levels to watch

The short-term picture suggests that sellers have gained the upper hand, which can be further confirmed by completing the upcoming bearish 200-day simple moving average (SMA) crossovers with 50-day and 100-day SMA dips.

In a bullish scenario, resistance may come from the 0.7372-0.7422 bounding barrier. If buying interest continues, bulls may face further resistance at 0.7465 and the immediate high at 0.7502. Piloting higher, significant upside constraints could come from the 0.7585-0.7645 resistance zone, strengthened by 50- and 100-day SMAS.

If sellers’ surface and direct the price lower, initial support could emerge from the 0.7289 low and the adjacent 0.7220-0.7253 border. Another leg lower could then test the 0.7157 barriers. Finally, if the pair dips even lower, the 0.6963-0.7020 support base formed between mid-July and late October may try to stem the further decline.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.