- AUD/USD is expected to update its intraday high and continue the corrective rollback from the two-year low.

- The market shows signs of risk-on with soft yields and moderately positive equity futures.

- China and Fedspeak support bids despite bearish NAB data out of Australia.

- US/China inflation, Fedspeak data, and Aussie Westpac Consumer Confidence will be key to setting clear directions.

An improvement in market sentiment supports the AUD/USD price, recovering from a two-year low previously set in Asia. Before Tuesday’s European session, the pair hit an intraday high of about 0.6985.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Although Shanghai closes the last two metro lines due to a Coronavirus outbreak, the market sentiment improves as Russia and China no longer provide negative feedback. Moreover, the US Treasury yields had continued to pull back from their highs of the day before, which occurred at the end of 2018, supporting risk sentiment.

The vice-premier of China, Liu He, reaffirmed the country’s dynamic response to the virus and offered much-needed relief to US stock futures close to a yearly low.

After hitting a multi-day high, the 10-year US Treasury bonds fell three basis points from 3.20% to 3.05% at press time.

In response to Rafael Bostic’s 50 basis point rate hikes, yields may have declined due to mixed remarks from Fed officials.

In addition to the recent decline in US inflation expectations, the AUD/USD rally is also driven by the St. Louis Federal Reserve’s 10-year breakeven inflation rate. On Monday, the inflation indicator fell to the lowest level in 10 months.

What’s next to watch?

The AUD/USD pair will be guided intraday by speeches by US President Joe Biden and Treasury Secretary Janet Yellen, along with the Federal Reserve. However, the main focus will be on Wednesday’s US consumer price index before food and energy, which is expected to be 6.0% y/y vs 6.5% earlier, China’s April inflation data and the Australian Western Pacific Consumer Confidence for May.

–Are you interested in learning more about making money with forex? Check our detailed guide-

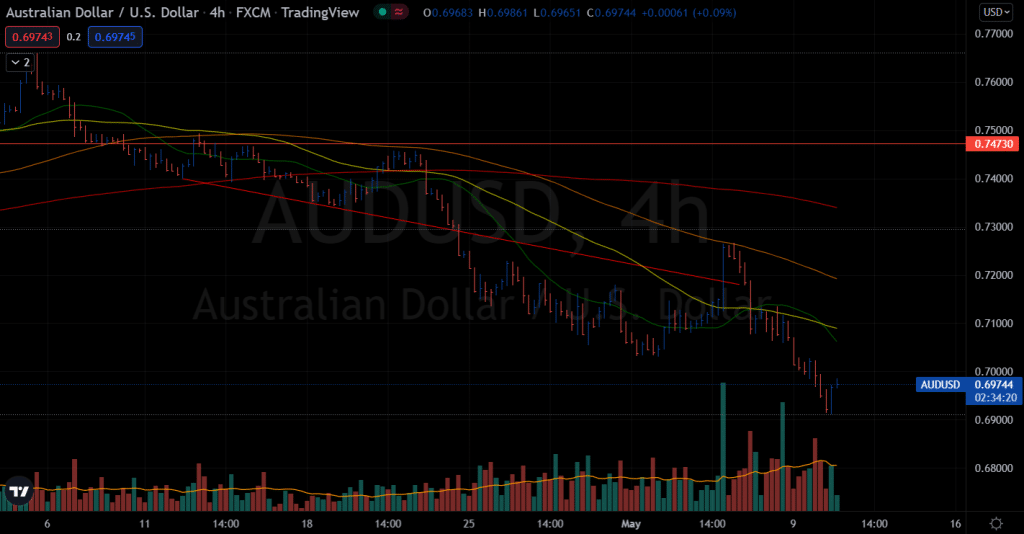

AUD/USD price technical analysis: Volume favoring buyers

The 4-hour chart shows a bearish crossover of 20 and 50 SMAs. However, it seems like the crossover has already done its part. The recent widespread up bar indicates a high volume, though below the average. It shows a mild sign of reversal. More interestingly, the previous down bars had a declining volume. The 0.7030 area will remain a key resistance to watch.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money