- The AUD/USD pair breaks a four-day high but remains near an intraday low.

- RBA keeps interest rates unchanged and again refuses to raise them.

- DXY tracks yield growth as Russian-Ukrainian standoff challenges bulls.

- Biden’s SOTU will be followed closely by the US ISM Manufacturing PMI and geopolitical headlines.

After falling to intraday lows on Tuesday, the AUD/USD price remains sluggish near 0.7270 ahead of the European session. The Australian pair was higher for the past two days before sober comments from the Reserve Bank of Australia (RBA).

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

The Reserve Bank of Australia kept interest rates unchanged at 0.1%, in line with market expectations. A recent move in the AUD/USD pair appears to be influenced by the Reserve Bank of Australia remarks dismissing the need for a rate hike. In a statement released by Reuters, the RBA said it would not raise interest rates until inflation is maintained within the 2%-3% target range.

A pause in risk aversion was a positive factor for AUD/USD bulls earlier in the day as upbeat activity data from Australia and China were released. It may have something to do with the negotiations between Ukraine and Russia, which ended a day ago without progress but remained open for discussion. However, Russian criticism of Western sanctions and an aggressive military invasion of Kyiv suggest geopolitical risks are far from abating, which puts some risk barometers to the test.

In addition, the call for AUD/USD prices has led to higher yields for the US Dollar and US Treasuries. Yesterday, the 10-year US Treasury yield fell the most since early December 2021, rising two basis points (bps) to 1.86%. An optimistic outlook for US inflation could explain the recent rebound in Treasury yields. However, the St. Louis Federal Reserve (FRED) 10-year breakeven inflation rate does not match the Fed’s recent dovish comments. It jumped 2.62% to its highest level since November 23 at the close of the North American session on Monday. A few days earlier, the CME FedWatch tool predicted a more than 50% chance of a Fed hike in March, down from nearly 5.0% today. Rafael Bostic, the Atlanta Fed’s chairman, was quoted as saying, “Today, I am for a 25 basis point hike at the March meeting.”

S&P 500 futures halted a three-day uptrend at press time, down 0.08%, while Asia-Pacific stocks have underperformed Wall Street lately.

Therefore, today’s US Manufacturing PMI for February and US President Joe Biden’s speech on his position in the country (SOTU) provide a new impetus for AUD/USD buyers as market sentiment and a stronger royal dollar test their resolve.

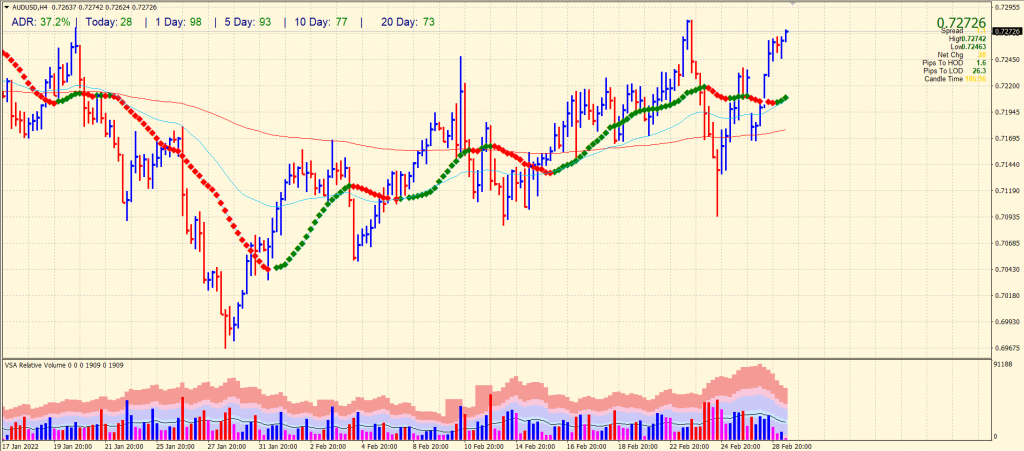

AUD/USD price technical analysis: Bulls weakening

The AUD/USD price is heading towards the double top and the swing high around 0.7285. The price remains above the key SMAs on the 4-hour chart. However, the volume is declining for the recent upside move. Moreover, the average daily range is only 31%. It shows that the pair is reluctant to rise further and may see some weakness.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

In that case, 0.7200 remains the key level to protect bulls ahead of 0.7150 and 0.7100. However, the downside path remains loaded with obstacles. Hence, bears are in no position to dominate for now.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money