- AUD/USD slides down on Monday, on a silent day.

- The RBA is expected to continue the stimulus program as Covid jitters continue to weigh.

- Technically, the pair may find respite around 0.7400, but chances of slipping further do exist.

The AUD/USD price analysis exhibits bearish bias on the intraday charts. Meanwhile, rising Covid cases also weigh on the Aussie.

At the time of writing, the AUD/USD pair is trading at 0.7431, down 0.24% on Monday.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Following a strong week on risky assets, the Asia-Pacific session opened relatively calmly today. The Reserve Bank of Australia (RBA) will release its interest rate decision for September on Tuesday. Economists disagree on whether the Reserve Bank of Australia will suspend its stimulus reduction plan. This move is likely to be good news for Australian stocks but could pressure the Australian dollar.

New South Wales and Victoria remain under lockdown as the number of Covid cases rises. Every day, new cases of the Delta variant are recorded due to its high transmission capability. There were 1,684 new Covid cases reported in Australia this Sunday, including 1,485 in New South Wales.

Political leaders are getting vaccines as quickly as possible to increase vaccination rates to 70%. Health policy experts agree to lift widespread bans for now. However, the restraints have already wrought significant economic damage on the economy, so some analysts believe we will see a recession in the third quarter.

Otherwise, Japanese stocks may continue to rise. Japan’s Nikkei 225 Index rose 5.38% last week. The announcement of the resignation of Prime Minister Yoshihide Sugi predicted a rise in Japanese stocks. Analysts suggest Suga’s successor will take a more aggressive approach in the fight against the Covid pandemic.

The economic calendar for today is rather sparse since the Australian Ai Group Services Index data for August cross wires. In addition, the Japanese government will release data on household spending in July. In the economic calendar for August, Tuesday and Wednesday will bring trade balance and inflation data from China, respectively. Monday’s US market closure could result in lower liquidity at the APAC meeting today.

–Are you interested to learn more about forex signals? Check our detailed guide-

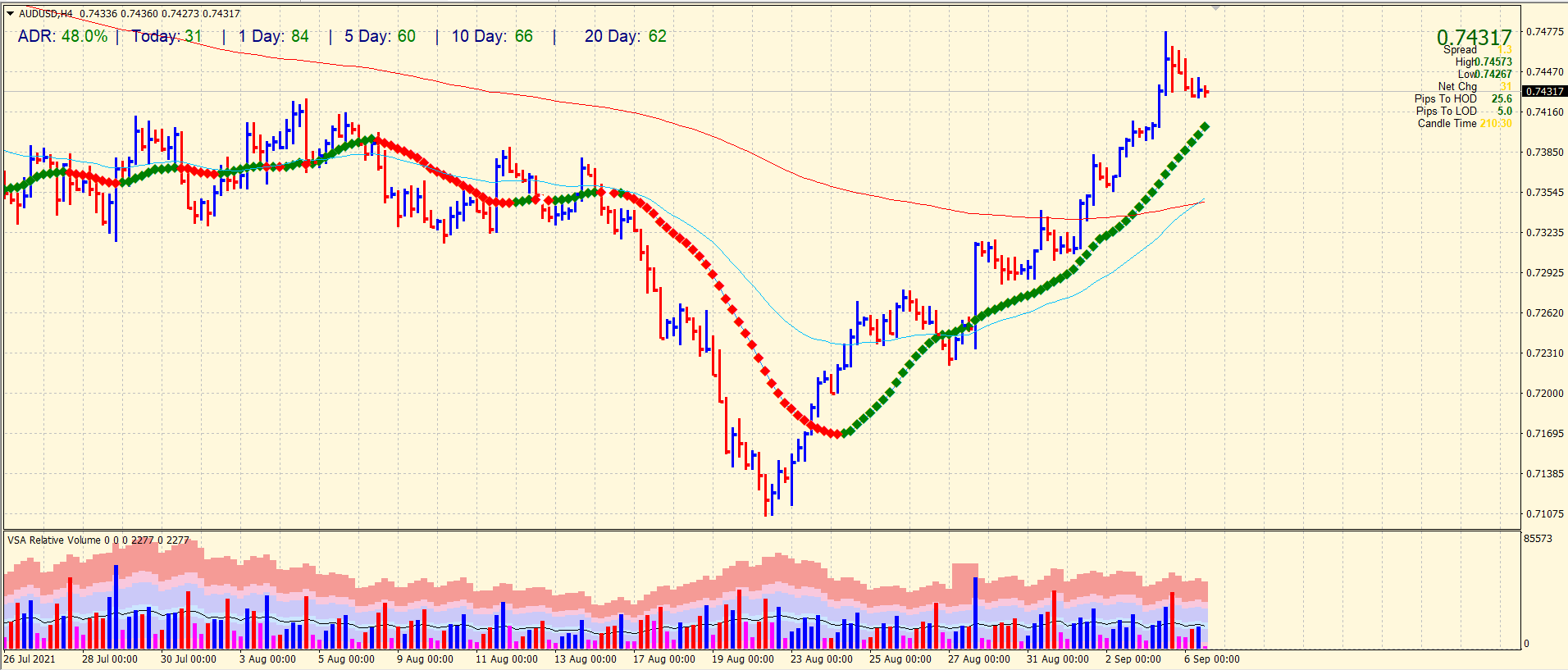

AUD/USD price technical analysis: Slipping towards 20-SMA

The AUD/USD price is slowly declining towards the 20-period SMA on the 4-hour chart. The sluggish Monday and US holiday keep the market activity thin. So far, the pair has covered the 48% average daily range. The price may fall further towards the 0.7400 area ahead of 0.7360 and then 0.7300.

On the upside, the pair may find resistance around 0.7450 ahead of 0.7480.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.