- Although the RBA announced a rate hike of 0.50%, the AUD/USD accepts offers to update intraday lows.

- Combined with bearish Treasury yields, US-China trade deal hopes are cautiously optimistic.

- June manufacturing orders are driving the US dollar weakness this week.

- The week’s key events are the US NFP and the Federal Reserve’s meeting minutes.

After the Reserve Bank of Australia (RBA) announced a rate hike, the AUD/USD price fell nearly 30 points to 0.6850. Prices are mainly affected by the news, which may be the reason.

-Are you interested to find high leverage brokers? Check our detailed guide-

Share prices may also have been affected by the RBA’s recent statement that “inflation in Australia is high but not as high as in many other countries.”

In other comments, Chinese Vice Premier Liu He mentioned improved US-China trade relations, at least for now, which helped improve market sentiment. In a macroeconomic release, Chinese Minister Liu He and US Treasury Secretary Janet Yellen agreed that communication and macroeconomic policy coordination between China and the United States needed to be strengthened.

AUDUSD was also supported by expectations surrounding the Australian-Chinese Foreign Ministers’ meeting in Indonesia and a bullish Caixin Services PMI ahead of the RBA meeting.

In June, China’s Caixin Services PMI surpassed market expectations and previous data to reach 54.5 compared with 47.3 and 41.4.

S&P 500 futures are up 0.40%, extending the previous two-day uptrend to 3850 at press time, reflecting market sentiment. The 10-year Treasury yield is nearing 3.0%, up 1.70% on the day at press time.

AUD/USD key events to watch

The much-anticipated 0.50% rate hike by the RBA appears to have little effect on AUD/USD traders. Due to this, intraday moves are determined by US manufacturing orders for May, which are expected to rise 0.5% versus 0.3% ahead of the release of the FOMC minutes and US jobs report.

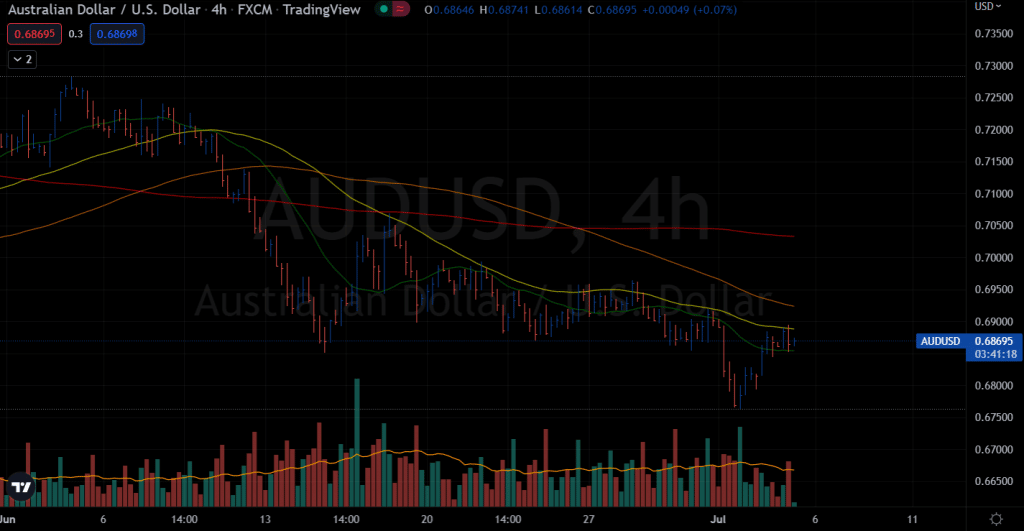

AUD/USD price technical analysis: Locked between 20 and 50 SMAs

The AUD/USD price remains locked between the 20-period and 500-period SMAs on the 4-hour chart. Although the pair found some support after falling to 0.6750 on Friday, the upside looks shallow and may continue the downside later.

-Looking for high probability free forex signals? Let’s check out-

Traders should look for a clear range breakout to find a decent trading opportunity. On the upside, 0.6900 will be the immediate hurdle for the bulls.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money