- With the AUD/USD pair, traders accept suggestions to refresh the intraday low and reverse the recovery moves earlier this week.

- Concerns over US trade sanctions on China and Russian-Ukrainian skirmishes, along with the new high in US Treasury yields, have put a damper on the market.

- The US CPI is the key risk catalyst for the market participants.

As risk aversion gains momentum ahead of Tuesday’s European session, the AUD/USD price hit new intraday lows near 0.7100, down 0.15% on the day.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

Market participants seek clues to the Australian pair’s recent weakness by looking at rising US Treasury yields. However, the yield on the 10-year US Treasury note rose three basis points to 1.95%, while the yield on the five-year copy rose four basis points to reach 1.8050%.

Due to Australia’s close trade ties with Beijing, gloomy concerns about US-China relations could also pressure the AUD/USD exchange rate. According to Reuters, China’s blue-chip index fell to a 19-month low on Tuesday, led by new energy vehicles stocks, as investors fretted about the prospect that the US government would add more Chinese companies to its export control list.

Meanwhile, hawkish fears over the March rally weigh against US-Japan trade optimism. A coronavirus outbreak in Hong Kong and Tokyo complicates matters and supports the demand for the US dollar.

US equities’ futures show modest losses no later than 4470, and Asian shares are drifting lower.

In the weeks to come, US trade balances for goods and services are forecast to drop by 83 billion versus 80 billion in December, which will lead to intraday moves.

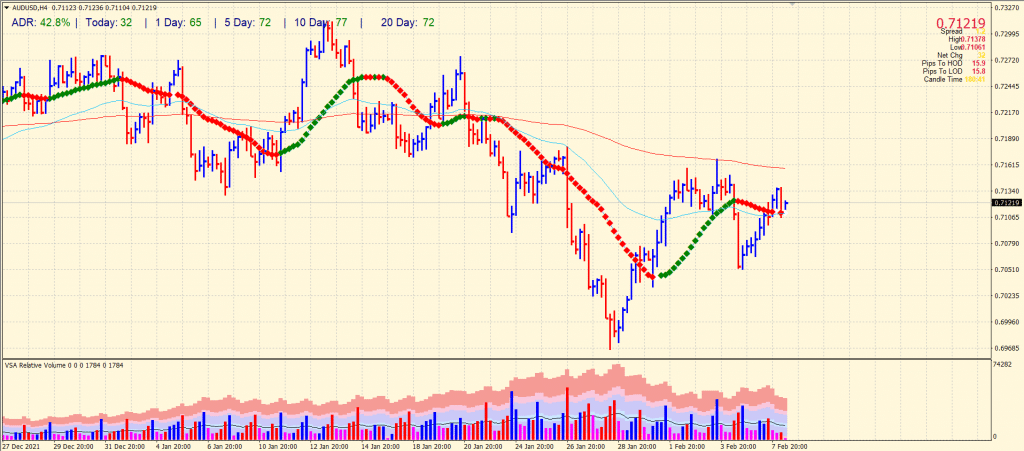

AUD/USD price technical analysis: Bears to break 0.7100

The AUD/USD price is wobbling above the confluence of 20-period and 50-period SMAs. The price seems to find support by the psychological level of 0.7100. Meanwhile, the price is well below the 200-period SMA, indicating a downside pressure.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

If the price breaks 0.7100, we may see a plunge towards 0.7000 area. Alternatively, if the price sustains above the 0.7100 mark, we may see a drift higher towards the 0.7200 area. However, the path of least resistance lies on the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money