- AUD/USD posted intraday highs just under 0.7500 area amid improved risk sentiment.

- Positive news about China’s Evergrande and virtual meeting of US and Chinese presidents has escalated the risk mode.

- Removal of restrictions in Melbourne despite a surge in daily cases has provided little support to the Aussie.

The AUD/USD price surged to an intraday high near 0.7490 and consolidated a rebound over the day, with its biggest daily decline occurring early Friday in October. The price of the Aussie dropped the previous day because of inflation-related headlines, but risk sentiment has recently helped the pair.

-If you are interested in high leveraged brokers, check our detailed guide-

As a result of rushing injections and ignoring a recent surge in infections by the country, the Melbourne city block has been unblocked after 262 days despite Coronavirus-led activity control. ABC News reports 2,547 daily cases this week, up from 2,643 on Thursday.

Moreover, President Biden’s speech at CNN City Hall led to optimism about the infrastructure deal because he spoke of coming to an agreement on infrastructure and social spending after weeks of intra-party disputes between his Democrats.

Speculation about a virtual meeting between US President Biden and his Chinese counterpart Xi Jinping has also fueled risk-taking. In preparation for a virtual meeting between President Joe Biden and Chinese Leader Xi Jinping, White House officials hope to show the world that Washington can effectively manage relations between rival superpowers, said familiar sources.

A few positive results were also reported for China’s Evergrande after several days of dimmer market sentiment. Besides paying a coupon on its $ 83.5 million bonds, the ailing real estate company also hoped to sell its assets to Hopson. However, according to South China Morning Post, rival China Evergrande Hopson Development Holdings Limited, which wanted to acquire half of the developer’s property management business, still views the purchase agreement as legally binding despite Evergrande terminating the deal on October 12.

US Treasury bond yields continue to rise by 1.70%, a key mark that historically fuels US dollar strength. US policymakers continue to highlight inflation concerns. The President of the New York Federal Reserve (FRS), John Williams, recently noted the difficulties of reflation following Fed Governor Christopher Waller.

Stock futures rally amid these events, and the US Dollar Index (DXY) weakens after bouncing off its three-week high on the previous day. However, a more important point to keep in mind will be the preliminary US PMI data for October. PMI for October from the Commonwealth Bank of Australia was mixed, with manufacturing PMI being weaker than expected.

-If you are interested in MT5 brokers, check our detailed guide-

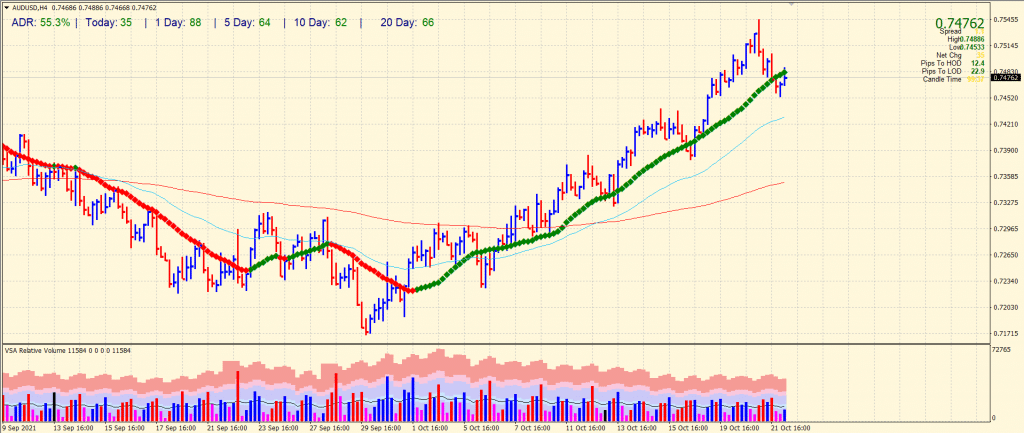

AUD/USD price technical analysis: Pressured below 20-SMA

The AUD/USD price has come under selling pressure near the 0.7470 territory. The price is struggling below the 20-period SMA on the 4-hour chart. The pair can further slip towards the 50-period SMA around 0.7430 ahead of round number 0.7400. On the upside, 0.7500 remains a tough nut to crack ahead of the multi-week top at 0.7540 area. The volume data is in favor of bears while the bearish stance is not yet confirmed.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.