- The AUD/USD pair slipped to a fresh weekly low on yesterday’s heavy losses.

- The Fed’s hawkish outlook and softer risk stance supported the US dollar.

- The decline in US bond yields limited the upside for the US dollar and helped limit further losses.

In the first half of the European session, the AUD/USD price maintained the suggested tone and was last seen near a weekly low of 0.7475.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Following a second straight day of selling, the pair slid further this week from its highs near the 0.7660 area reached in June 2021. Furthermore, a hawkish Fed outlook on Wednesday led to a rise in the US dollar near a two-year high, which, in turn, put downward pressure on the AUD/USD pair.

Hawkish FOMC minutes

As the FOMC meeting minutes from 15-16 June showed, this is the case. The Federal Reserve announced in March that it was poised to raise interest rates by 50 basis points amid rising inflation concerns. Additionally, according to the minutes, there was general agreement about the need to trim the huge central bank’s balance sheet by a maximum of $95 billion a month to tighten financial conditions.

Ukraine crisis

Investor sentiment was dampened by aggressive Fed plans and fading hopes of a diplomatic solution to end the war in Ukraine. The fall in stock markets illustrated this by strengthening the safe-haven dollar and driving capital out of the perceived riskier Australian dollar. However, the decline in US Treasury yields limited the upside potential of the US dollar.

Commodities prices and hawkish RBA

Furthermore, the RBA’s hawkish comments and rising commodity prices have limited further losses for the resource-dependent Aussie, at least for now. Earlier this year, the RBA backtracked from its promise to be patient while tightening policy, noting that domestic demand remains strong and spending rises after the Omicron slump.

What’s next to watch for AUD/USD price?

However, acceptance below the psychological 0.7500 indicates that the AUD/USD pair has peaked in the near term and indicates that the corrective decline will continue. Now, traders are eagerly awaiting the weekly US Initial Jobless Claims report, which, along with US bond yields, will move the US Dollar and add some momentum to the AUD/USD pair.

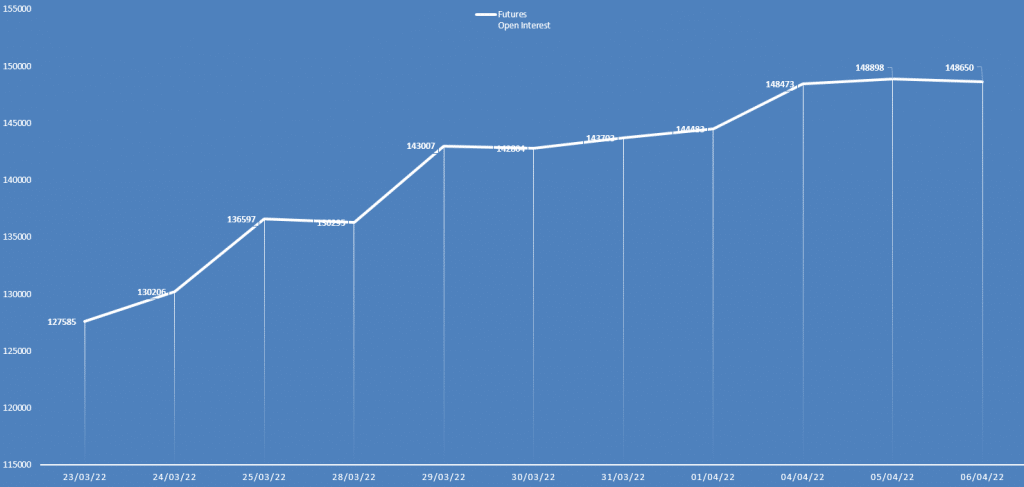

AUD/USD daily open interest

The AUD/USD price fell sharply on Wednesday. Meanwhile, the daily open interest did not show any significant change. Hence, the bias is not yet clear.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

AUD/USD price technical analysis: 100-SMA remains the key

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money