The Australian dollar has no respite. Since Australian GDP disappointed, economists are lining up to predict the timing of a rate cut, which is now on the cards for some time in 2015.

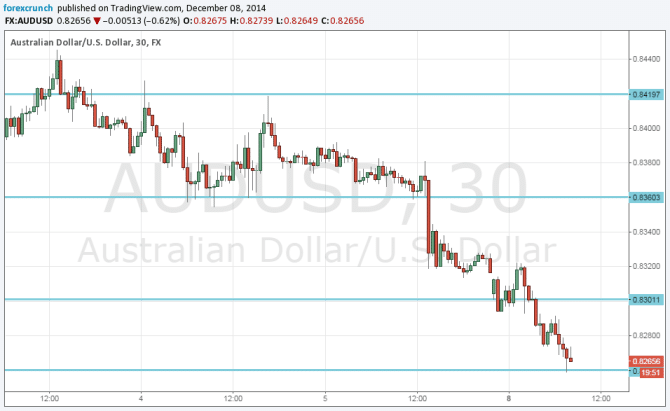

And now, the Aussie receives a blow from its No. 1 trade partner: China. This sends the pair lower, and it is now more comfortable under 0.83, a line that seemed far away not too long ago.

China reported a surplus of 54.5 billion dollars, which is a record and higher than 44.4 billion expected. But, the details give no reasons to be cheerful: imports dropped by 6.7%, contrary to an advance of 3.8% predicted. China imports commodities from Australia.

Also exports fell short of predictions with only +4.7% instead of +8% that was forecast. The slowdown in China, that may reach a growth rate of 7% or below in 2015, adds to the weight on the Aussie.

Opinion: Sell AUD/USD – Barclays’ Trade Of The Week

Here is the chart, that shows some recovery from the new low of 0.8259, but is far from being a threat on 0.83: