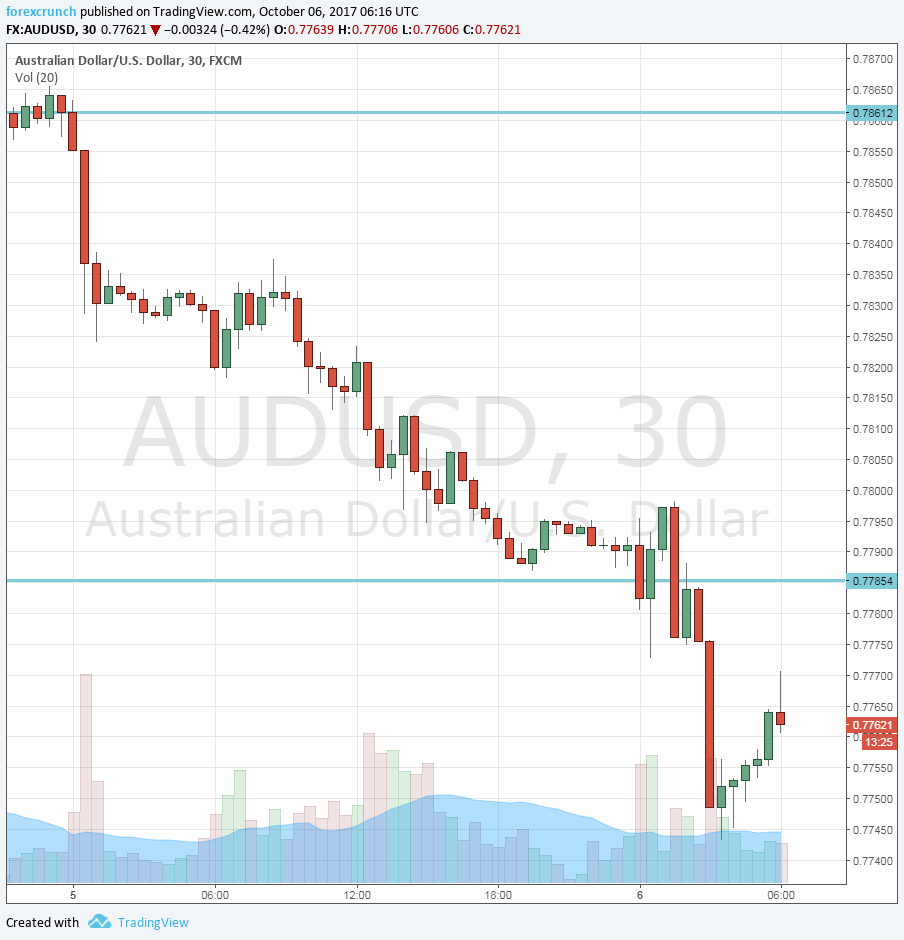

The Australian dollar falls under 0.78 and probably in order to stay there. The pair reached a low of 0.7743 before bouncing to 0.7760, not really an impressive bounce.

The Reserve Bank of Australian already hit the A$ this week. And they are doing it again. The latest trigger has been an interview that the RBA’ Ian Harper gave to the Wall Street Journal. Harper says they “are not ruling out a rate cut”. He expressed concern for low wages and mentioned a “loss of momentum”.

This comes on top of a disappointing read on retail sales yesterday: a big drop of 0.6%, far worse than a rise of 0.3% that was expected.

Morgan Stanley added fuel to the fire by saying that the “Australian consumer faces a credit crunch”. They relate to the drop in retail sales and say that households have reached “crunch time”. The cost of living is re-accelerating according to MS.

The strength of the US dollar also contributes to this move. The greenback enjoyed positive data and faces an interesting NFP read.

AUD/USD is now at the lowest levels since July. The next line of support is the June high of 0.7740. This is followed by 0.7640. Resistance is at 0.7780, but it is weak.