AUD/USD reversed directions last week, as the pair lost 80 points. AUD/USD closed the week at 0.7546. This week has nine events on the calendar. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, ISM Non-Manufacturing PMI beat the estimate, and the Fed minutes indicated that an April hike was very unlikely. Australian Retail Sales missed expectations, and the RBA held interest rates at 2.0%.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

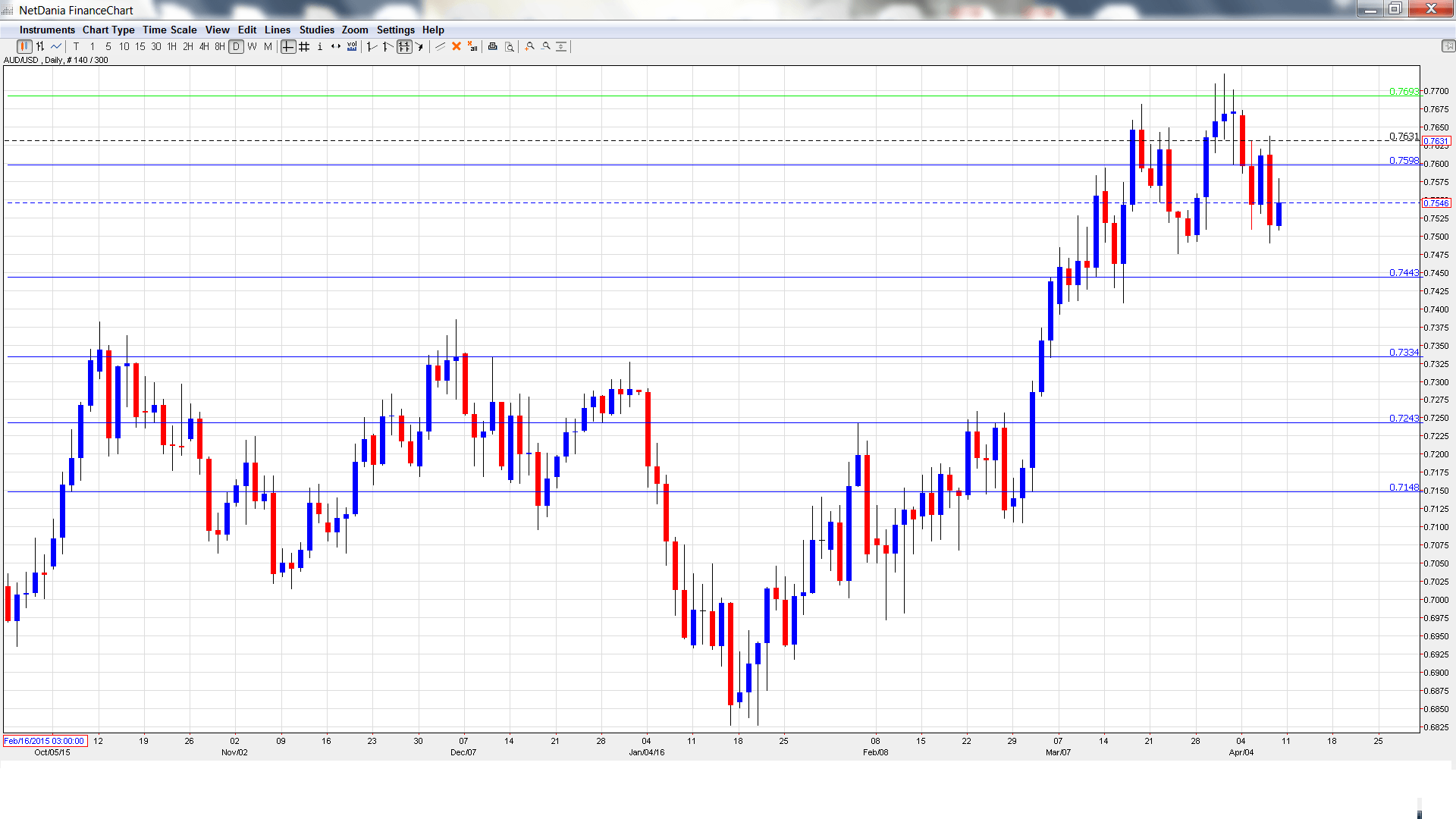

AUD/USD graph with support and resistance lines on it. Click to enlarge:

- Home Loans: Monday, 1:30. This indicator provides a snapshot of the strength of the housing sector. In January, the indicator plunged 3.9%, much weaker than the estimate of -2.7%. The markets are expecting a sharp turnaround in February, with the estimate standing at 2.1%.

- NAB Business Confidence: Tuesday, 1:30. Business Confidence edged up to 3 points in February, up from 2 points a month earlier. Will the upswing continue in March?

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer Confidence closely linked to consumer spending, a key driver of economic activity. The indicator has struggled, posting three declines in the past four releases.

- Chinese Trade Balance: Wednesday, Tentative. Chinese key indicators can have a substantial impact on the movement of AUD/USD, as the Asian giant is Australia’s number one trading partner. The trade surplus dropped sharply in February, with a reading of $210 billion. This was well short of the estimate of $339 billion. The downward trend is expected to continue in the March report, with a forecast of $203 billion.

- MI Inflation Expectations: Thursday, 1:00. This indicator helps analysts predict actual inflation levels. In February, the indicator dipped to 3.4%, marking a 6-month low. Will we see a rebound in the March report?

- Employment Change: Thursday, 1:30. The indicator posted a negligible gain of 0.3 thousand in February, compared to a forecast of 11.6 thousand. The markets are expecting a strong turnaround in the March report, with the estimate standing at 18.6 thousand. The unemployment rate dropped to 5.8% in February, beating the estimate of 6.0%. The estimate for March is 5.9%.

- RBA Financial Stability Review: Friday, 1:30. Kent will deliver remarks at an event in Hobart. A speech which is more hawkish than expected is bullish for the Australian dollar.

- Chinese GDP: Friday, 2:00. The Chinese economy continues to contract, and this trend has had negative repercussions on the global economy. GPD is expected to drop again in the first quarter, with an estimate of 6.7%

- Chinese Industrial Production: Friday, 2:00. This indicator has been dropping, and fell to 5.4%, shy of the forecast of 5.6%. The indicator is expected to jump to 6.0% in March.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7666 and quickly touched a high of 0.7673, as resistance held at 0.7692 (discussed last week). The pair then dropped sharply all the way to 0.7490. AUD/USD closed the week at 0.7546.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We begin with resistance at 0.8163.

0.8025 has held firm since May 2015.

0.7886 is next.

0.7798 was an important resistance line for much of June 2015.

0.7692 held firm in resistance last week.

0.7597 has switched to a resistance role following losses by AUD/USD. It is a weak line.

0.7438 is providing support.

0.7334 was a cap December 2015.

0.7243 has held firm in support since the first week in March.

0.7148 is the final support level for now.

I am bearish on AUD/USD

With the dovish Fed minutes behind us, the markets can put rate hike speculation on the backburner and focus on US fundamentals, which have generally been strong. As well, with an uncertain global economic environment, the safe-haven US dollar remains an attractive asset for many investors.

In our latest podcast we explain why the doves do NOT cry.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast