AUD/USD showed little movement during the week, but closed the week almost unchanged, at 0.7654. This week’s key event is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, retail sales and CPI were better than expected and also Yellen sounded upbeat about the US economy. In Australia, Employment Change remained strong, beating the estimate for a third straight month. The US dollar gained ground but gave up these gains late in the week.

Updates:

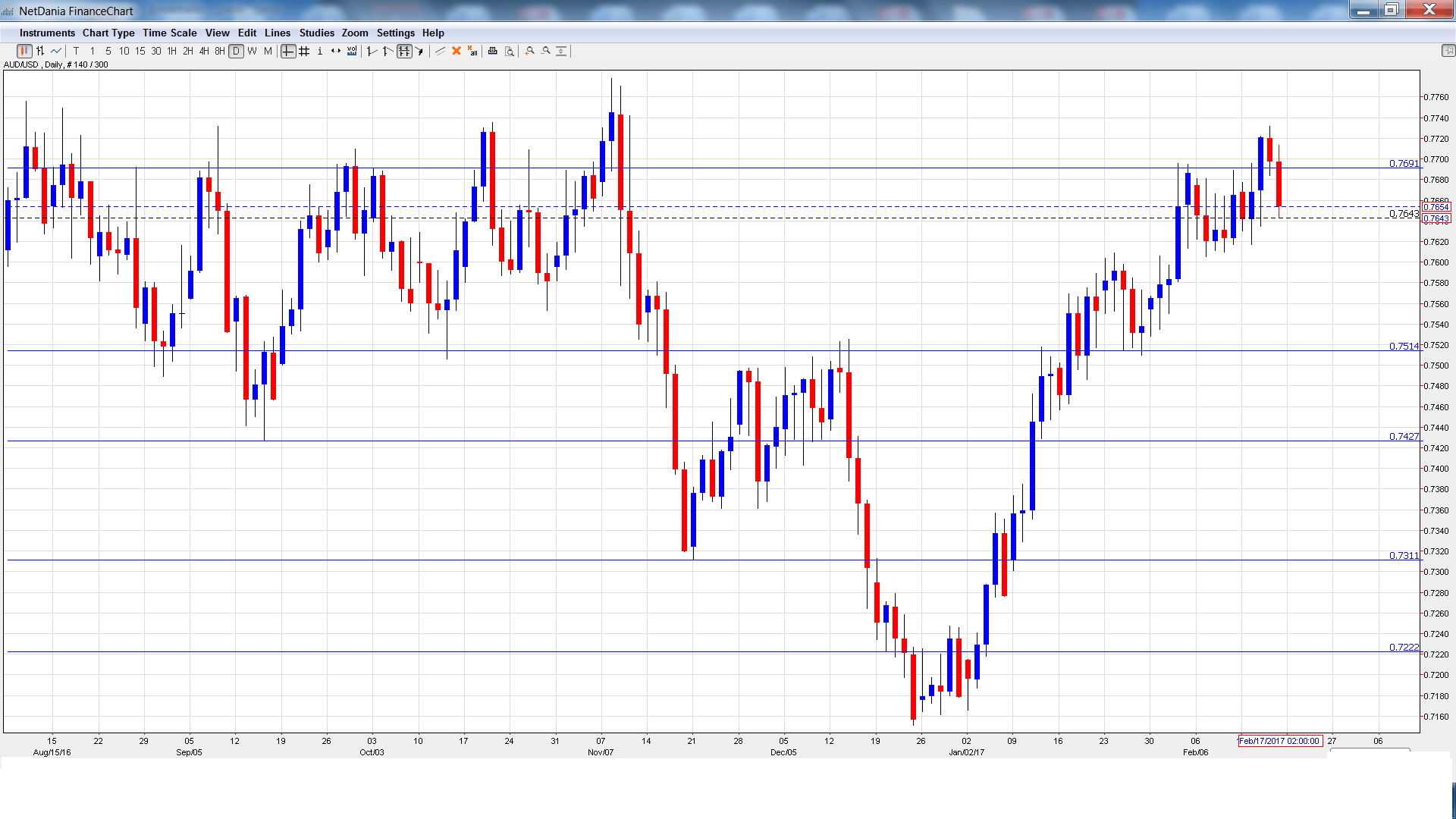

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- RBA Monetary Policy Meeting Minutes: Tuesday, 00:30. The minutes provide details of the February policy meeting, at which the RBA held rates at 1.50%. Analysts will be looking for hints regarding the timing of a rate move.

- CB Leading Index: Tuesday, 15:30. This minor index is based on 7 economic indicators. The index rebounded in November, posting a gain of 0.5%.

- RBA Governor Philip Lowe Speech: Tuesday, 21:30. Lowe will speak at an event in Sydney. A speech that is more hawkish than expected is bullish for the Australian dollar.

- MI Leading Index: Tuesday, 23:30. This index is based on 9 indicators, but most of the data has been previously released. The index improved to 0.4% in January.

- Construction Work Done: Wednesday, 00:30. The indicator continues to record declines, pointing to contraction in the construction sector. The indicator posted a sharp decline of 4.9% in the third quarter, worse than the estimate of -1.5%. The markets are expecting a rebound in Q4, with an estimate of 0.5%.

- Wage Price Index: Wednesday, 00:30. Wage growth has been fairly steady in recent months. The estimate for Q4 stands at 0.5%.

- Private Capital Expenditure: Thursday, 00:30. This is the key event of the week. The indicator has struggled, with only gain since Q4 of 2014. The estimate for Q1 stands at -0.4%.

- RBA Governor Philip Lowe Speech: Thursday, 22:30. Lowe will testify before the House of Representatives Standing Committee on Economics in Sydney. The markets will be looking for clues regarding future monetary policy.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7668 and dropped to a low of 0.7617. Late in the week, the pair climbed to a high of 0.7732, testing resistance at 0.7691 (discussed last week). AUD/USD then retracted and closed at 0.7654.

Live chart of AUD/USD:

Technical lines from top to bottom:

We start with resistance at 0.8066. This line was a low point in May 2010.

0.7938 is next.

0.7835 has held firm since April 2016.

0.7691 was tested in resistance and remains a weak line.

0.7513 is providing support. This line was a cushion in April 2015.

0.7427 is next.

0.7311 marked a low point in November.

0.7223 is the final support level for now.

I am bearish on AUD/USD

The US economy is firing on all cylinders, but Donald Trump’s theatrics and lack of an economic plan have led to uneasiness in the markets. Trump’s protectionist stance could sour investors on risk and hurt the Australian dollar, as Australia is heavily dependent on its export sector.

Our latest podcast is titled Oil upside and euro underperformance

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.