AUD/USD reversed directions last week and gained 110 points. The pair closed at 0.7683. This week’s key indicators are Retail Sales and the RBA rate statement. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

There were no major Australian events last week. In the US, Final GDP in Q1 was revised upwards to 1.4%, above the estimate of 1.2%. In the US, the Fed sounded more skeptical about inflation picking up. Is the Fed having second thoughts about a third rate hike in 2017?

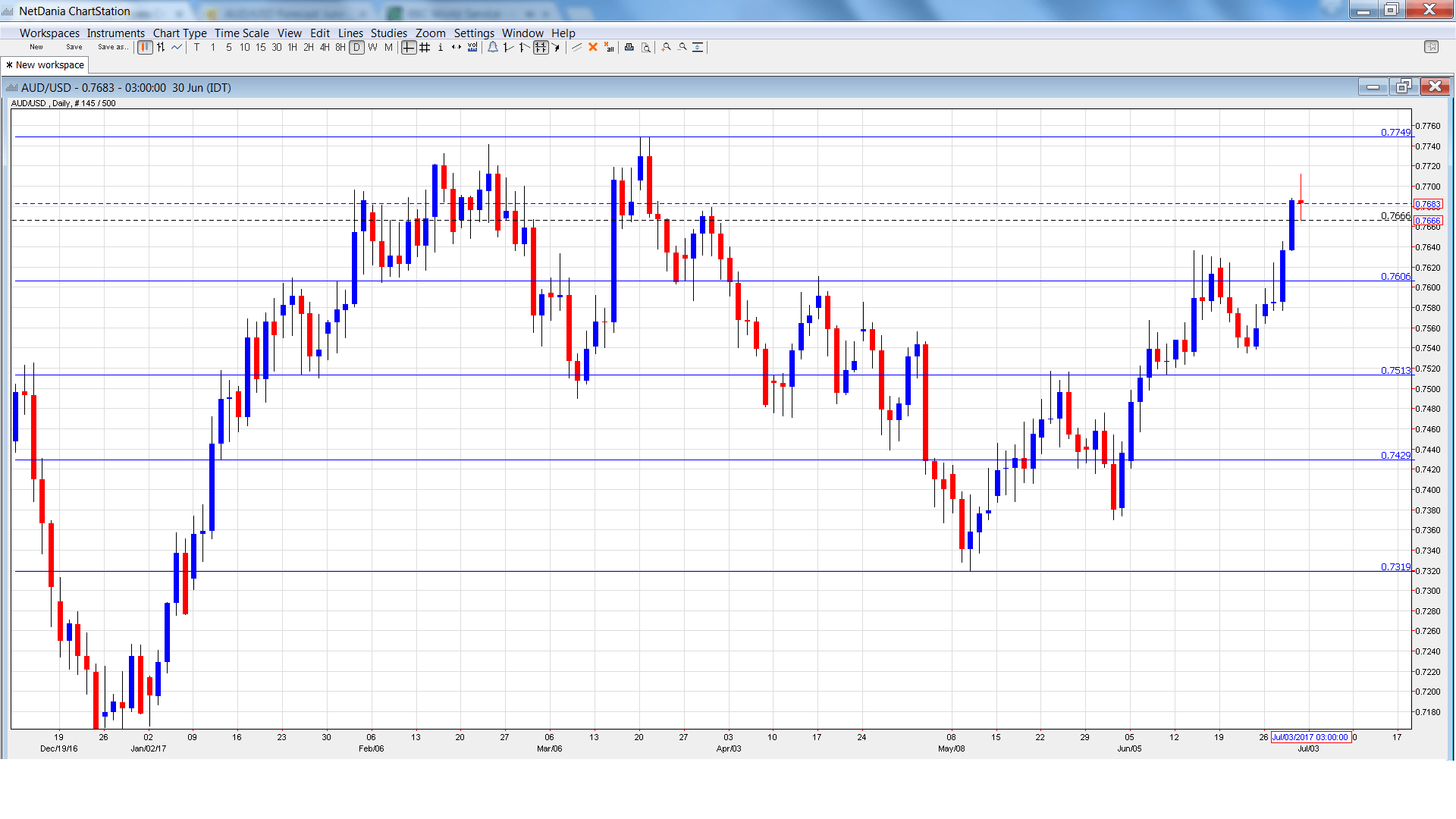

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Manufacturing Index: Sunday, 19:30. The index continues to point to expansion in the manufacturing sector, although it dropped to 54.8 in May. This marked a 4-month low.

- MI Inflation Gauge: Sunday, 21:00. The indicator provides analysts with a monthly look at inflation, as CPI is released each quarter. In May, the indicator softened to 0.0%, down from 0.5% a month earlier.

- Building Approvals: Sunday, 21:30. Building Approvals tends to show sharp fluctuations, which means that actual readings are often well off the estimates. In April, the indicator bounced back with gain of 4.4%, above the forecast of 3.2%. The forecast for the June report is -1.2%.

- Chinese Caixin Manufacturing PMI: Sunday, 21:45. Chinese indicators are closely watched, as they can have a strong impact on the Australian dollar. In May, the index dropped to 49.6, pointing to slight contraction in the manufacturing sector. The estimate for June stands at 49.9.

- Commodity Prices: Monday, 2:30. Commodity prices have been showing smaller gains, with a reading of 32.6% in May.

- Retail Sales: Monday, 21:30. This key event should be treated as a market-mover. In April, the indicator rebounded with a gain of 1.0%, well above the estimate of 0.3%. This reading broke a streak of two declines. The estimate for the May report stands at 0.3%.

- RBA Rate Statement: Tuesday, 00:30. The RBA is expected to maintain the benchmark rate at 1.50%, where rates have been pegged since July 2016. Analysts will be monitoring the rate statement for the bank’s assessment of the health of the Australian economy.

- Trade Balance: Wednesday, 21:30. Australia’s trade surplus narrowed to A$0.56 billion in April, much smaller than the estimate of A$1.9 billion. The surplus is expected to increase to A$1.11 billion in the May report.

- AIG Construction Index: Thursday, 19:30. The index improved to 56.7 in May, up from 51.9 in the April report. This points to expansion in the construction sector.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7571 and quickly touched a low of 0.7564. The pair then reversed directions and climbed to a high of 0.7712 late in the week, as resistance held firm at 0.7749 (discussed last week). The pair closed the week at 0.7683.

We start with resistance at 0.8075.

0.7938 is the next line of resistance.

0.7835 was the high point in April 2016.

0.7749 has been a resistance line since March.

0.7605 has switched to support after strong gains by AUD/USD last week.

0.7513 has provided support since early June.

0.7429 is the next line of support.

0.7319 is the final support line for now.

I am bullish on AUD/USD

The US dollar continues to lose ground, as the US economy has slowed gears and the Trump administration continues to struggle with advancing its legislative agenda. Australia’s economy has been boosted by a renewed global economy, which is hungry for Australia’s raw resources.

Our latest podcast is titled Markets are finally moving – will it last?

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.