The Australian dollar struggled amid various pressure, mostly from the RBA. The upcoming features more talk from the central bank as well as some Chinese data. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Reserve Bank of Australia seemed to escalate its rhetoric regarding the strength of the Australian dollar. It has a bigger impact when the Aussie is already struggling. The language in the rate statement was joined by some dovish talk later in the week. Weak retail sales did not help either. In the US, the data was mostly positive.The US dollar emerged as a winner from the messy NFP (blame the hurricanes)

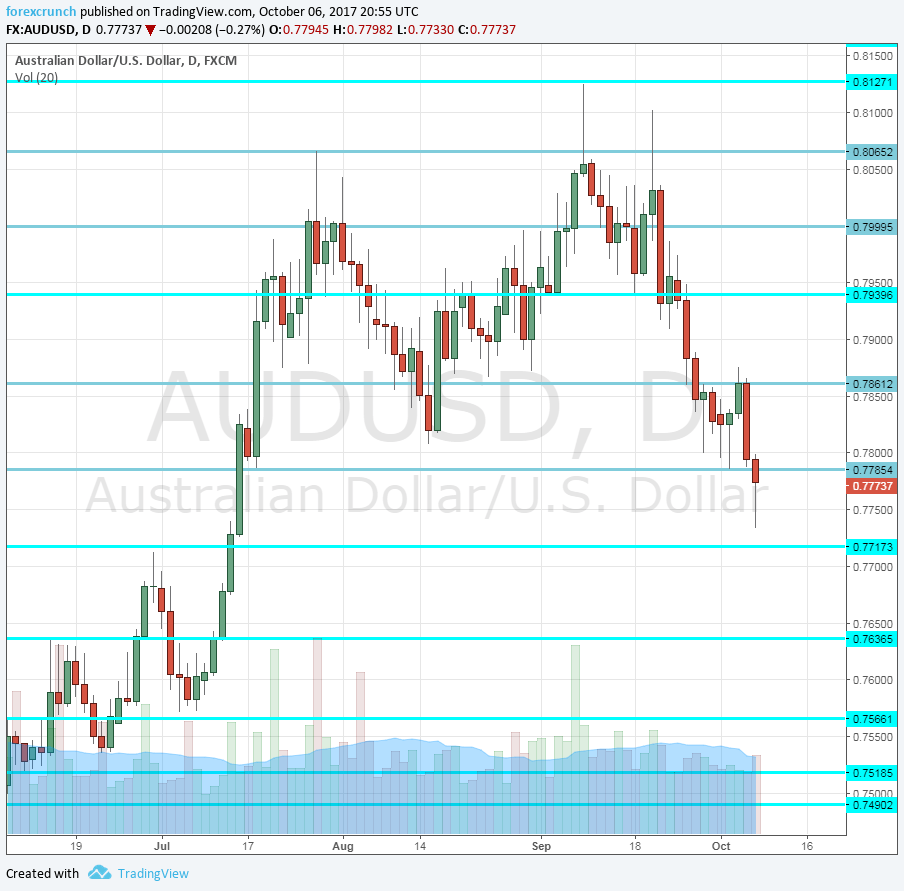

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- NAB Business Confidence: Tuesday, 00:30. This indicator by National Australia Bank has been relatively volatile and dropped to 5 points in August. We now get the figure for September.

- Guy Debelle talks: Tuesday, 3:30. The RBA Assistant Governor talks about the forex code of conduct and may talk about the currency as well. It will be interesting to hear if he also opens the door to cutting the interest rate.

- Westpac Consumer Sentiment: Tuesday, 23:30. This survey of around 1200 consumers is a see-saw: rising one month and falling the next. It jumped by 2.5% in September and the fresh figure for October could see a drop.

- MI Inflation Expectations: Thursday, 00:00. The Melbourne Institute fills in the gap that the government leaves by publishing inflation figures only once per quarter. In August, they reported inflation expectations at an annual rate of 3.8%. A similar figure could be seen now.

- Home Loans: Thursday, 00:30. Home loans beat expectations in July by advancing at a robust rate of 2.9%. A more modest increase is forecast now: 0.6%.

- RBA Financial Stability Review: Friday, 00:30. While this report is published only per quarter, its wide scope allows for hints about future monetary policy. In the past, it was used to guide markets.

- Chinese trade balance: Friday, 2:00. Australia’s No. 1 trade partner enjoyed a trade surplus of 42 billion USD, in line with recent months. A smaller surplus of 38.1 is on the cards now. Note that China’s imports matter more to Australia than the balance.

AUD/USD Technical Analysis

The Australian dollar traded in a downtrend, flirting with the 0.7740 level mentioned last week.

Technical lines from top to bottom:

The high of 2017 at 0.8125 is the top level. 0.8065 is the previous 2017 high.

It is followed by the psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping-stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I am bearish on AUD/USD

The RBA took a victory lap on the pair, and can continue doing so, pushing it lower for another week in a row.

Our latest podcast is titled Good, bad and ugly NFP, Catalan crisis update

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!