Yellen speaks out and she’s not too dovish. While she acknowledges the disappointing jobs report, she also sees “good reasons to expect further progress towards the Fed’s goals”. The message is generally positive says Yellen, even though recent data has been a miss.

The dollar strengthens a bit , but then slides. It seems like a chopfest.

Yellen

- My message is generally positive but recent data has been mixed.

- Inflation has been lower than our objective, but it should rise

- If data is line with objectives, further gradual increases are appropriate.

- Monetary policy is not a preset course and it depends on the evolution.

- JOLTs were at a record in March. The level of quits stood close to the pre-recession levels.

- All in all the picture is positive, but April and May have been very disappointing when looking at the headline and the fall in participation.

- Despite the concern in this report, we shouldn’t put too much emphasis in one report.

- In Philly, things have improved with national trends.

- The dollar has been broadly unchanged since the beginning of the year.

- GDP growth has been relatively weak, but activity varies from quarter to quarter.

- dot plot could differ from the March ones. Speaking for myself, I expect the balances lean to the upside: employment, inflation and growth looking good.

- Employment is a positive.

- The fall in oil prices has triggered a hit on the sector, but the worst is probably behind us.

- Investment is likely to rebound, but the recent data shows that companies may have chosen to expand investment more slowly.

- We should expect to be surprised with 4 areas of uncertainty:

- resilience of domestic demand (consumer spending)

- Global risks: China, but now it looks more predictable but China faces challenges, investor mood changes

- Outlook for productivity growth: GDP increases have been less impressive. Labor productivity growth has been unusually low. Over time, this is the key in improving living standards. The recession left scars.

- Inflation evolution: The elusive 2%.

- A Brexit could be a problem:

Quotes:

A U.K. vote to exit the European Union could have significant economic repercussions

And:

Although this recent labor market report was, on balance, concerning, let me emphasize that one should never attach too much significance to any single monthly report. Other timely indicators from the labor market have been more positive. For example, the number of people filing new claims for unemployment insurance–which can be a good early indicator of changes in labor market conditions–remains quite low, and the public’s perceptions of the health of the labor market, as reported in various consumer surveys, remain positive. That said, the monthly labor market report is an important economic indicator, and so we will need to watch labor market developments carefully.

Yellen background

Fed Chair Janet Yellen is speaking in Philadelphia and has an opportunity to react to the very poor jobs report. This is her last appearance before the June 15th Fed meeting.

The US dollar was hit hard on Friday and made some recovery attempts in the trading week. It was the worst job gain since September 2010 and the downwards revisions weren’t that encouraging either.

She is usually very dovish and the report provides an opportunity to push back on rate hike expectations. On the other hand, she did express optimism in her previous public appearance that came out one week before the NFP.

Even more FOMC

Yellen is not the first FOMC member to react to the jobs report, but clearly the most important one. Here are other comments:

- Mester: The report doesn’t materially change matters. The Fed Cleveland President was the first to react to the NFP and did not surprise with remaining her dovish self.

- Rosengren: The president of the Boston Fed said the NFP could be a one off. He used to be a dove but in recent months he has been quite upbeat.

- Bullard: Remains with an open mind towards June. While this usually hawkish FOMC member has not committed to anything before the NFP, he doesn’t rule it out either now.. He does say that the chances of June have fallen but that July is still on the cards.

- Lockhart: Still believes in 3 rate hikes and wants to. July is certainly on the cards.

Yellen and Currencies

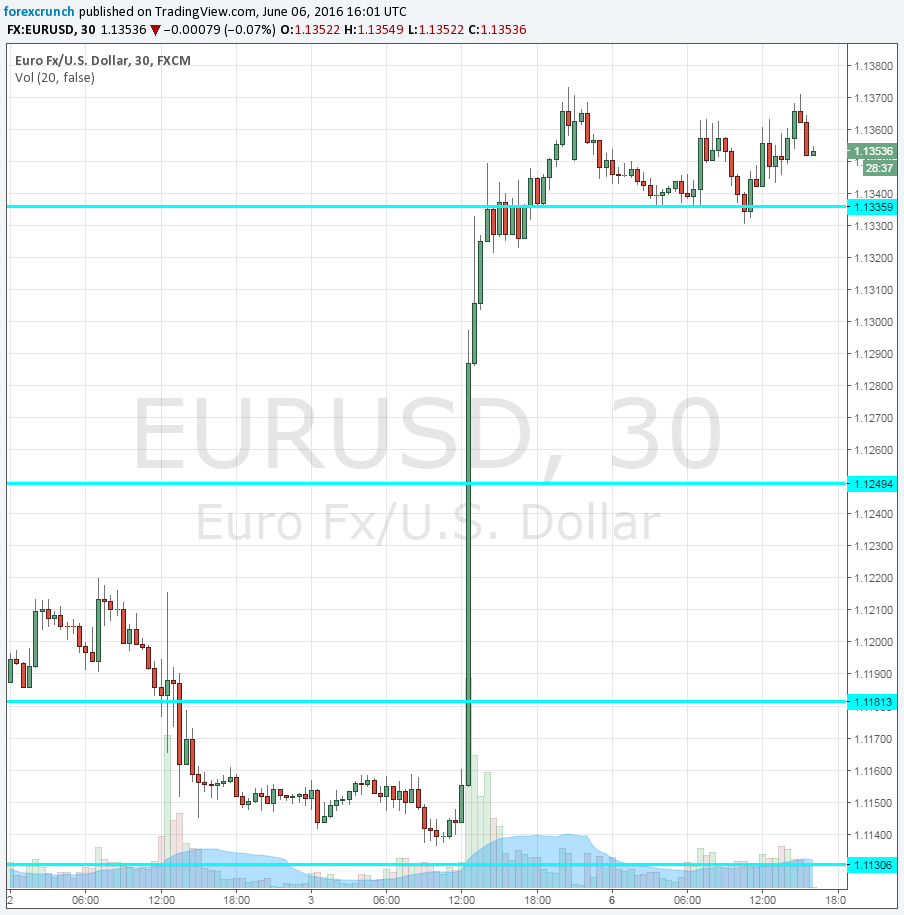

- EUR/USD traded around 1.1350, above support at 1.1335 and under resistance at 1.1410.

- GBP/USD trades around 1.4450, recovering from the Brexit built lows.

- USD/JPY was around 107.30, within the 106.90 to 107.65 range.

- USD/CAD was around 1.2850, falling below the double bottom at 1.2910 and hitting low support at 1.2830.

- AUD/USD was around 0.7360 under resistance at 0.7375. It had a hard time breaking above 0.73.

- NZD/USD traded around 0.6910, under resistance at 0.6950.