The Chinese economy grew at an annualized rate of 6.8% in Q4 2016, better than 6.7% that had been projected. Good news? Not so fast. Year on year growth came out at 6.7% as predicted. Other figures were slightly disappointing.

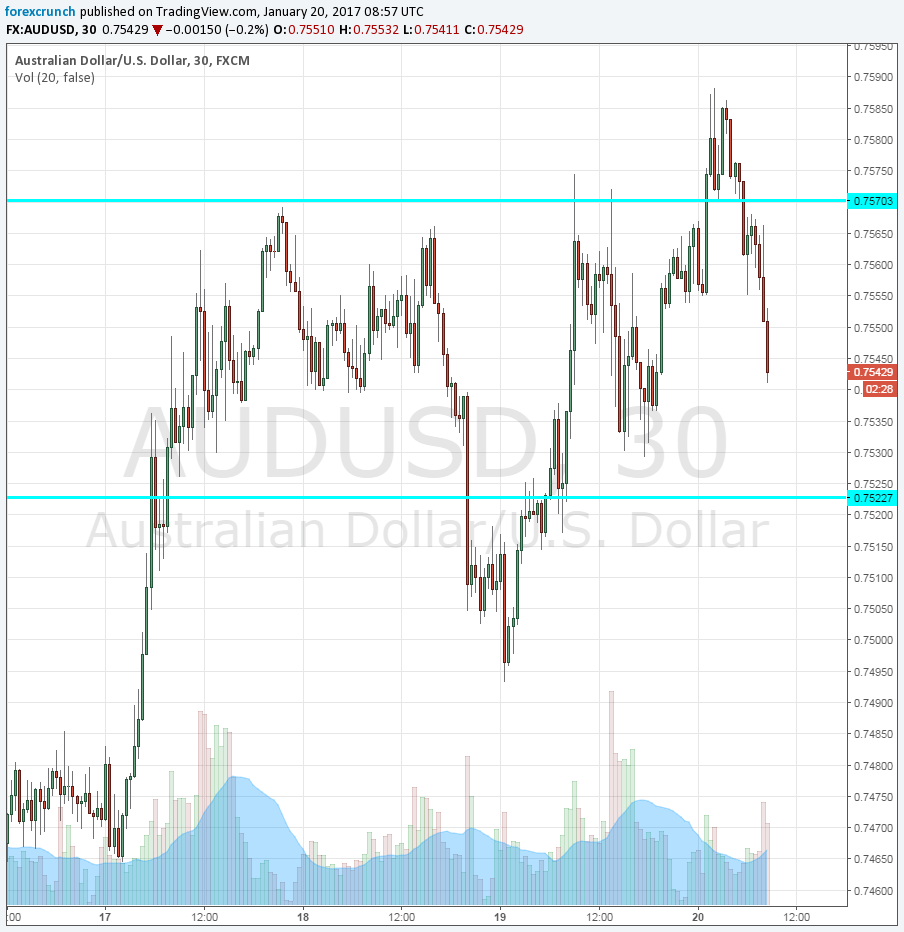

AUD/USD managed to advance and reached 0.7588, above the previous weekly highs of 0.7570, but the move was short-lived, and the pair fell back to its previous range, trading around 0.7540.

Other figures were also more or less in line with early estimations. Chinese industrial output growth slowed to 6%, lower than 6.1% expected and 6.2% seen last time. Fixed Asset Investment decelerated with a growth rate of 8.1% against 8.3% forecast. A positive surprise came from retail sales, that grew by 10.9% instead of 10.7% expected.

For Australia, China’s industrial manufacturing is more important than consumption. Earlier this week, Australia printed a mixed jobs report, with gains in part-time jobs rather than full-time ones.

The focus now shifts to the inauguration of Donald Trump as the President of the USA. Trading could become more volatile.

More: AUD/USD: Upward Correction Targeting 0.7700/20 Against 0.7150/00 – NAB

Here is how recent moves look on 30-minute AUD/USD chart: