The new trading week brings a more significant change in trends. The US dollar is no longer taking short breathers, but actually making a more significant correction. In the bigger picture, the greenback maintains the vast majority of its post-elections gains, but the correction cannot be called a “dead cat bounce” anymore.

There is no real trigger for this move, other than a much-needed correction. The fall in oil prices, related to doubts about an OPEC deal, should have helped the dollar.

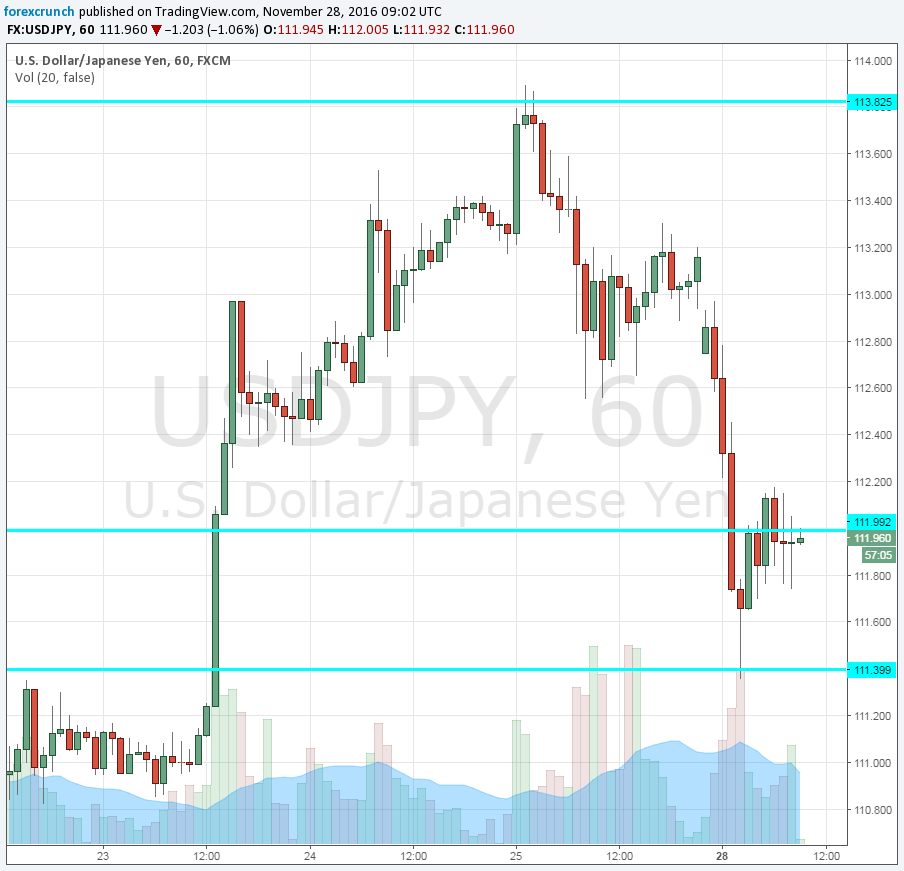

EUR/USD has already reached a high of 1.0685 and now trades at 1.0660, this is already a big gap from the double-bottom of 1.0520. Resistance Support awaits at 1.0570 and resistance is at 1.0710.

More: EUR/USD: Look Out Below As Cyclical Low In Sight – BTMU

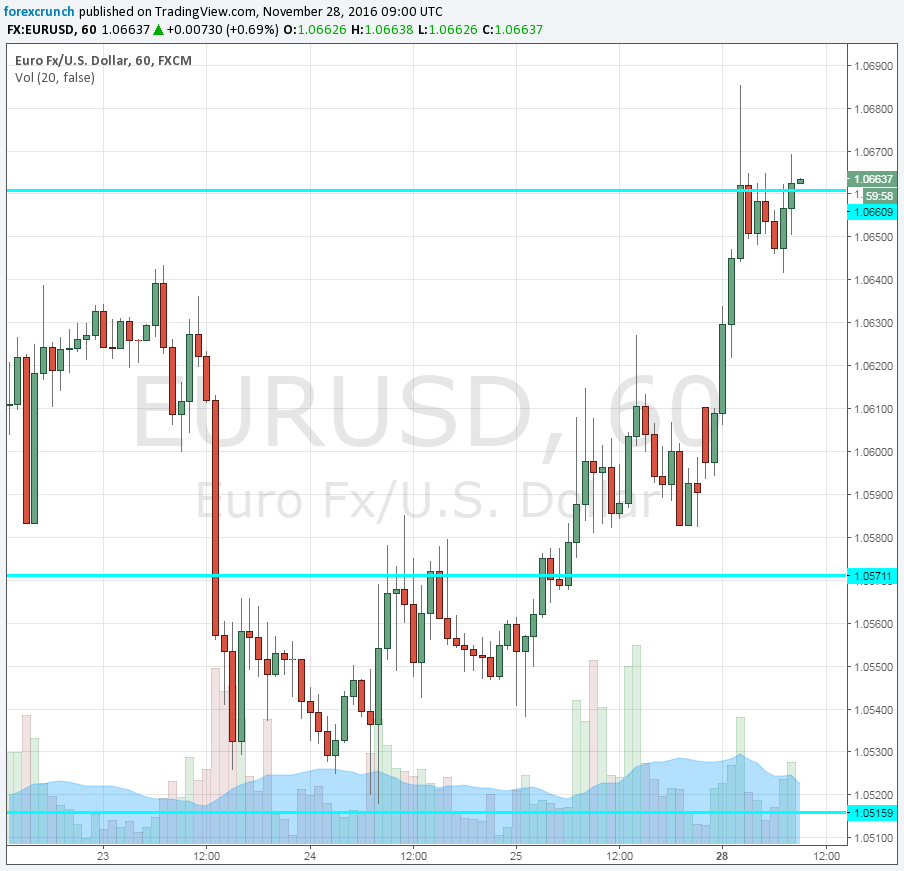

Also, USD/JPY, which seemed unstoppable and only shortly paused after the worrying earthquake in Japan, changed course and fell to lower ground, trading back under 112. It already made an initial dip under 1.1140, but bounced back from there. 111.40 is a significant cushion.

Resistance awaits at 113.80 and the battle for 112 continues.

More: 6 reasons to start unwinding USD/JPY longs into year end.