Euro dollar fell to the lower end of the range after worries about global growth came from China: manufacturing returned to contraction zone. In addition, there are complications in the breakup of Dexia – the first European bank to fall due to the debt crisis. European bond yields remain at scary levels. A very busy day awaits us: European PMIs are followed by a big bulk of US figures just before Thanksgiving. French services PMI was better than expected, but don’t cheer up the euro. Will EUR/USD recover, or break lower?

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

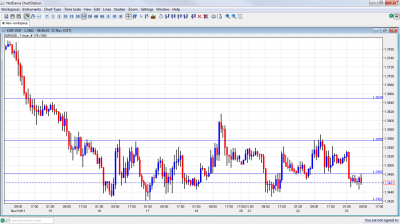

- Asian session: A very active session saw the pair drop to the lower part of the range.

- Current range: 1.3420 – 1.3480.

- Further levels in both directions: Below 1.3420, 1.3360, 1.3250, 1.3145 and 1.30.

- Above: 1.3480, 1.3550, 1.3650, 1.3725, 1.38, 1.3838.

- Stronger resistance is now found at 1.3550 as the pair is lower.

- 1.3480 is a pivotal line within the range – important support is at 1.3420. Will it break lower?

Euro/Dollar falls to lower end- click on the graph to enlarge.

EUR/USD Fundamentals

- 8:00 French Flash Services PMI. Exp. 44.5 points. Actual 49.3. – Positive surprise for a change.

- 8:00 French Flash Manufacturing PMI. Exp. 47.7. Actual 47.6.

- 8:30 German Flash Services PMI. Exp. 50.1 – a fall under 50 will weigh on the euro. Actual 51.4 points.

- 8:30 German Flash Manufacturing PMI. Exp. 48.4. Actual 47.9 points – German numbers are mixed.

- 9:00 Euro-zone Flash Services PMI. Exp. 46.1. Actual 47.8 points.

- 9:00 Euro-zone Flash Manufacturing PMI. Exp. 46.6 points. Actual 46.4 – overall, European PMIs came out a bit above expectations.

- 10:00 Euro-zone Industrial New Orders. Exp. -2.4%.

- 13:30 US Unemployment Claims. Exp. 389K.

- 13:30 US Durable Goods Orders. Exp. -1.1%. Core exp. +0.1%.

- 13:30 US Personal Spending. Exp. +0.4%.

- 13:30 US Personal Income. Exp. +0.3%.

- 113:30 US Core PCE Price Index. Exp. +0.1%.

- 14:55 US Revised Consumer Sentiment. Exp. 64.6 points.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Pressure on Spain and Italy: The center-right PP party won a landslide victory in Spain’s general elections but bond yields put pressure on the government already before it was sworn in – 6.6% on 10 year bonds. Yesterday, an auction for 3-month bonds resulted in a yield of 5.11% – sky high. There are reports that Spain’s designated prime minister, Mariano Rajoy, has negotiated €100 billion of aid with Angela Merkel. 10 year yields remain high after last week’s bad bond auction. Italian bond yields are touching 7% once again.

- Dexia problems: The Franco-Belgian bank was split up a few month ago but it now seems that the deal is not done yet. Problems in Dexia come as other European banks struggle to get cash, especially in US dollars, and as Austria shuts its lending opportunities to Eastern Europe.

- China contracts: After one month above the critical 50 point level, the independent HSBC Manufacturing PMI fell into contraction zone, at 48 points. This is lower than the shallower drops seen earlier and casts a shadow all over the world. The dollar is stronger across the board and the euro suffers.

- Greece still awaits aid: The new technocrat Prime Minister Papademos, flew to Brussels in order to secure the long awaited 8 billion euros. The country will run out of money in mid December, according to the latest calculations, but these are doubted. The country will soon run out of money and the bank run can intensify.

- Wolves closing in on Germany: Only German bonds are really “safe” in Europe as the bond rout is spreading. But also Germany cannot stay immune and they are also ticking up. When the benchmark breaks, this will trigger a much bigger euro-crash. When will the ECB act and print euros?

- Euro/dollar swap like in 2008: The cost of swapping euros to dollar’s continues rising, and shows that banks continue paying a dear price for dollars. This is a reminder of 2008 and very worrying for the whole system.

- No debt reduction deal in the US: The US Supercommittee failed to reach an agreement regarding a long term debt reduction deal. The discussions and the announcement of the failure came with relative calm. As mentioned in the quarterly outlook, everything depends on the level of noise and not the actual result. Only Fitch is awaited and they might downgrade in the upcoming days, although this isn’t certain.

- Doubts about US Strength and QE3: After a big bunch of positive figures, the downgrade of Q3 GDP to 2% and also the Chinese slowdown make future US growth very uncertain. The meeting minutes revealed that some members still want to embark on QE3, although there’s no majority at the moment, especially as inflation remains elevated. The big bulk of US data will provide more insights.