Euro dollar is holding above the round 1.30 line after the two-step downfall yesterday – a fall that started with no new money from Germany and continued with no new money from the US. The debt crisis will be felt today with a longer-term Italian auction, a vote of confidence in Finland and some fresh indicators. Will 1.30 be broken as well ?

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

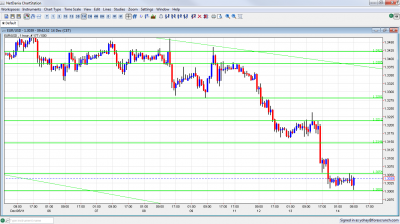

EUR/USD Technicals

- Asian session: Quiet session after the second downfall caused by Bernanke. The wake of the European session saw a new attempt on 1.30..

- Current range: 1.30 – 1.3060

- Further levels in both directions: Below 1.30, 1.2920, 1.2873 , 1.2720 and 1.2580.

- Above: 1.3060, 1.3145, 1.3212, 1.3280, 1.3380, 1.3420, 1.3480 and 1.3550.

- The round number of 1.30 was also tested as support. A fall opesn the door to more significant drops, with the YTD low of 1.2873 being the most important one.

- 1.3145 turns into critical resistance now.

Euro/Dollar holding to 1.30- click on the graph to enlarge.

EUR/USD Fundamentals

- During the day – Finnish vote of confidence.

- 10:00 Italian 5 year bond auction results.

- 10:00 Euro-zone Industrial Production. Exp. +0.1%.

- 13:30 US Import Prices. Exp. +1%.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Bernanke doesn’t change policy: The only change seen in the FOMC Statement was a more optimistic view of the labor market. Other than that, the same policy remains unchanged, low interest rate pledge, Operation Twist, etc. The same dissenter, Evans remained. Though this was widely expected, it sent the dollar higher and EUR/USD to 1.30.

- Italy under the spotlight: Italy will try to sell 3 billion euros in 5 year bonds. Spain had a relatively successful bond auction, but Italian yields are rising once again before the auction.

- Commerzbank on the edge: Germany’s second largest bank is in intense talks with the government regarding emergency aid. A fall of this bank could trigger a domino effect via Credit Default Swaps. This is one of the 7 reasons for the recent downfall.

- Will S&P downgrade France and Germany?: In a move that shocked markets, credit rating agency Standard and Poor’s warned all euro-zone countries, apart from Greece, that their rating is endangered. Some countries, such as Germany, got a warning about a one-notch downgrade, while France, Italy, Spain and others received a two-notch warning. In what seemed like a political move, S&P said that the action will depend on the EU Summit results and that it will publish its decision “as soon as possible”. Markets remain tense. Moody’s and Fitch also added their warnings.

- Draghi drags markets down: In one of the busiest rate decisions seen for quite some time, the ECB lowered the interest rate to 1% as expected, eased collateral rules for banks and offered 3 years loans. But on the other hand, ECB president made it clear that the ECB would not scale up its bond buying. So, Italy and Spain continue struggling and the euro falls. One ECB member said the central bank could scale up bond buying, but reality remains different: the ECB scaled down bond buying to less than one billion euros last week. Looks like a lose-lose situation for the euro.

- Greek deficit missed once again: Yet again, the deficit figures for 2011 were revised for the worse. In addition, the pace of withdrawals from Greek banks intensified recently, as the chances of leaving the euro-zone rose. This Greek bank run could bring down the system.