The Canadian dollar had a rough week, and surrendered to the greenback’s superiority. BOC Business Outlook Survey and Building Permits are the main events this week. Here’s an outlook for the Canadian events and an updated technical analysis for the Canadian dollar.

Last week, Ivey PMI figures increased unexpectedly to 63.5 from 59.9 in the previous month suggesting expansion in the industrial sector. However employment data disappointed with higher unemployment rate of 7.5% from 7.4% in the prior month and a bit lower than expected job increase of 17,500 while 17,800 was predicted. Let’s see what this week has in store for us.

Updates: The Canadian dollar jumped over 1.03 on global fear at the beginning of the new week, but then recovered on European strength. See how to trade the Canadian building permits. The Canadian dollar strengthened on the general calm, and USD/CAD reached 1.0140 before Fitch had worrying things to say about Europe.

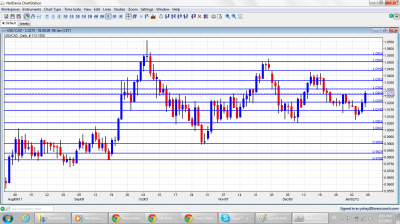

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Building Permits: Monday, 13:30. The value of Canadian building permits edged up 11.9% in October after a drop of4.15 in September amid strong building activity inOntario. The reading was much higher than the 2.3% increase predicted by analysts. Non residential construction soared 32.8% inOntariowhile residential permits dropped 0.1%. A drop of -3.1% is forecasted.

- BOC Business Outlook Survey: Monday, 15:30. The last survey of businesses conducted in October revealed a slight decline in the overall economic outlook. While a pick up in sales was reported in autumn, the outlook for the next 12 months showed a decline in sales which consequently lowered investments. Labor market outlook remained the same while inflation predictions weakened.

- Housing Starts: Tuesday, 13:15. The annual rate of housing starts in November was lower than the preceding month and below expectations with 181,100 units. October reading reached 208,800 units while Analysts expected a smaller decline to 203,000. However this drop can be associated with the moderation in the multiples segment. A rise of 187,000 is predicted.

- NHPI: Thursday, 13:30.Canada’s new home price index gained 0.2% in October amid price increase inEdmonton andToronto. September reading also showed an increase of 0.2% while analysts expected a higher rise of 0.3%. A further gain of 0.3% is predicted.

- Trade Balance: Friday, 13:30. Merchandise exports decreased by 3% while imports edged up 1.9% in October resulting in $885 million deficit from a$1 billion in September. The only increase occurred in the automobile sector while energy and Industrial products led the drop. Another decrease to $400 million is expected now.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD kicked off the year with a drop, It managed to go as low as 1.0076, before changing course. After a struggle with the the 1.02 line (discussed last week)

Technical lines, from top to bottom:

1.0677 is a long standing resistance line, tested several times in the past. 1.0550 is a minor line on the way up – a line which can slow the pair. 1.0500 is another minor line of resistance. It was a pivotal around the same time and was a point of resistance before the pair fell.

1.0430 provided support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November and has found new strength after working as a distinct line separating ranges. It is key resistance now. 1.0263 is the peak of surges during October, November and December, but was shattered after the move higher. The break above this line still needs to be confirmed.

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker now but remains pivotal. 1.0143 was a swing low in September and worked as resistance in the past. It capped a small recovery attempt in November.

1.0050 worked as support in November, was a swing low in December and had the opposite role back in 2010. It worked as a great cushion for the pair in November.

The very round number of USD/CAD parity is a clear line of course, and it will be closely watched on a potential downfall. Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June.

0.9830 provided support for the pair during September. 0.9780, where the current run began is the next and important support line.

I am neutral on USD/CAD.

Higher oil prices certainly help the loonie, and so does the ongoing US growth, seen also in jobs. On the other hand, the worries about a housing bubble in Canada, and the rise in the unemployment rate, cast a shadow over Canada’s strength.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.