The New Zealand dollar reached new highs, but couldn’t hold on to them. Greece will continue influencing the kiwi also now. NBNZ Business Confidence is the highlight of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week RBNZ inflation expectations survey revealed a decline to 2.5% for the first quarter after 2.8% in the previous quarter suggesting inflation is not perceived as a problem for NZ in 2012. Growth outlook remained 2.1% as in the previous survey. All in all New Zealand economy is believed to be in a good position for now.

Updates: New Zealand trade balance dropped by -199M in January, shocking the markets which had expected a healthy surplus. For now, the kiwi remains unaffected by the news, and range trading continues at the 0.8370 level. NZD/USD couldn’t hold on to higher ground and is drifting towards 0.8340 as new European fears rise. Building consents were outstanding, at 8.3%. As well, business confidence was up sharply, with highest reading since September 2011. The pair continues to hold steady, trading at 0.8350.

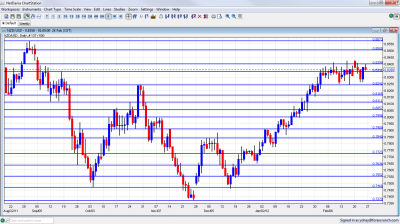

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Trade Balance: Sunday, 21:45.New Zealand trade balanced unexpectedly turned to surplus in December after five months of deficits. Surplus reached $338 million compared to a deficit of NZ$307 million in November. Exports soared 12.8% year-on-year. Economists expected a deficit of NZ$74 million. Dairy products made the biggest change climbing 32.1% to a record value of NZ$1.35 billion. A smaller surplus balance of $169 million is predicted.

- Building Consents: Tuesday, 21:45. New Zealand New residential consents increased 2.1% in December, Consents for apartments increased to 148. Earthquake-related consents in Canterbury reached $29 million below the $47 million in November.

- NBNZ Business Confidence: Wednesday, 0:00.New Zealand business confidence declined in December to 16.9 from18.3 in November, but profit expectations increased, giving hope for a good start to 2012. Since New Zealand is heavily dependent on exports, global slowdown and the European debt crisis could pose a downward risk to NZ economy.

- Overseas Trade Index: Wednesday, 21:45.New Zealand’s terms of fell 0.7% in the third quarter, driven by lower export prices and a strong local currency after increasing 2.4% in the third quarter. Analysts expected 1.5% gain in the fourth quarter. Another decline of 1.7% is expected.

- ANZ Commodity Prices: Friday, 0:00. New Zealand commodity prices climbed 1.2% in January, the first increase in eight months led by aluminium and dairy products following 0.8% drop in the previous month.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar had a nice Sunday gap higher and made another failed attempt to settle above the 0.84 line. It later returned to range. 0.84 capped the pair towards the end of the week once again, and it closed at 0.8358.

Technical lines, from top to bottom:

The lines haven’t changed since last week 0.8765 was a high line during August and is close to the all time high. It’s followed by 0.8680 which was support on high ground and is minor now.

0.8620 is close by and also was support on high ground during the summer. 0.8573 was a stubborn line of resistance during August 2011 and remains of high importance.

0.8505 was a peak on the way up during July. The 0.84 line separated ranges in August 2011, and earlier served as support when the kiwi traded higher. A move higher in February 2012 eventually resulted in a significant drop.

0.8340 was a peak in September and now switches to stronger resistance after being a point of struggle in February 2012. It is weaker now after serving as a battleground. 0.8240 was a peak in October and also back in May 2011. It proved its strength in January 2012 and will be tested again.

Moving lower, we find 0.8165. It provided support for the pair at several occasions, last seen in October. After being crossed on the way up, its strength is lower. 0.8110 switched positions from support in August to resistance later on and is a minor line, now on the way down.

0.8070 was resistance in October and support beforehand.. It was also tested in January. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is now stronger resistance after capping a rise at the beginning of 2012. 0.7840 worked as cap for a range and earlier stopped the pair in October. It then became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and is now minor support. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January.

I am neutral on NZD/USD

Stronger commodity prices support the kiwi. On the other hand, a potential crash in Greece will weaken the appetite for risk, and the New Zealand dollar is certainly a risk asset.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.